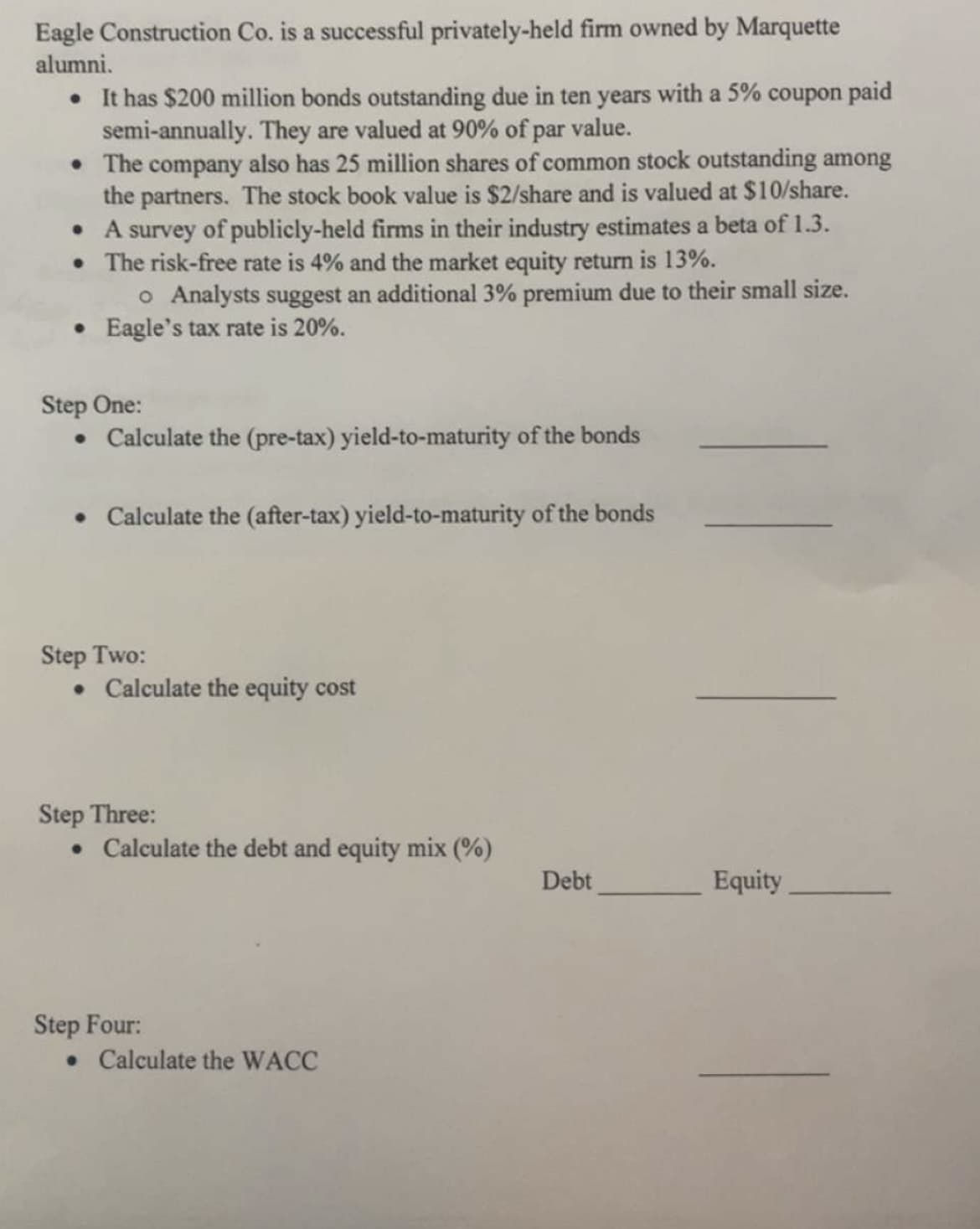

Eagle Construction Co. is a successful privately-held firm owned by Marquette alumni. • It has $200 million bonds outstanding due in ten years with a 5% coupon paid semi-annually. They are valued at 90% of par value.

Q: 12-12. Using the following information for Handy Hardware, determine the capital structure that…

A: As per the given information: Proportion of debt Earnings per share (EPS)Stock price…

Q: Suppose that someone has a salary of $201.150 in 2019. What would the equivalent salary be in 1979?…

A: The time value states that what cash purchases today cannot be purchased in the future using the…

Q: The current zero-coupon yield curve for risk-free bonds is as follows: What is the price per $100…

A: Information Provided: Face value = $100 Period of bond = 2 years YTM for 2 year = 5.47%

Q: oyce has never invested in shares before. She has come to you, as a prospective finance graduate,…

A: The dividend discount model (DDM) is a quantitative method used for predicting the worth} of a…

Q: Your bank is offering you an account that will pay 25% interest (an effective two-year rate) in…

A:

Q: Your client Ben is in his late 30s (married, with two kids) and working as a full-time doctor in ZZ…

A: Investment are important for better life but doing investment involves risk also so there should be…

Q: Based on the Capital Asset Pricing Model (CAPM) and the diagram below, what is the return of the…

A: Risk-Free Return = 3.5% Return on market = 12% Beta = 1.2 or 0.8

Q: Assume that a company is considering purchasing a machine for $100,000 that will have a seven-year…

A: Year Cash inflow PV factor PV of Cash Inflow 1 21,000 0.8547 17,948.72 2…

Q: Consider the following security: Brous Metalworks Earnings Per Share,…

A: Select financials are available about a stock. We have to calculate several parameters sequentially,…

Q: 12-12. Using the following information for Handy Hardware, determine the capital structure that…

A: To achieve optimal capital structure, the share price should be at its highest and WACC should be at…

Q: Suppose Jack, president of Heart Limited has hired you to advise on the firm’s cost of capital. (a)…

A: Heart’s total liabilities = $8 million Total interest expense = $1 million Cost of debt = 1/8= 12.5%…

Q: Farley Inc. has perpetual preferred stock outstanding that sells for $40 a share and pays a dividend…

A: Preferred stock carry the fixed dividend to be paid each period and they are paid before the common…

Q: Tresnan Brothers is expected to pay a $3.60 per share dividend at the end of the year (i.e., D1 =…

A: Given, Dividend D1=$3.60 Growth rate is 9% required rate is 12%

Q: Based on the growth rate determined in part a, project earnings for next year (E1). (Do not round…

A: Price of stock can be determined by the constant growth of dividend and required rate and the…

Q: Meadow Dew Corporation currently has an EPS of $3.80, and the benchmark PE for the company is 37.…

A: The Earnings per share is used to measure the performance of a company by finding out how much…

Q: 1. Write the Ratio/ Equation to be used, IF REQUIRED 2. Substitute the given 3. Solution (Solve for…

A: Dividend is the distribution of the company’s earnings to the shareholders of the company. A…

Q: Jason Momoa put up $18,000 to take a long position in XYZ stock with a price of $30. a) If the…

A: Borrowing The act of receiving funds from a lender is called borrowing. The person who borrows money…

Q: An executive has two application options to follow. What's the best? a) 150% p.a. capitalized…

A: Interest Rate = 150% p.a. capitalized monthly Interest Rate = 200% p.a. compounded semiannually

Q: Other things equal, return on equity (ROE) is higher using leverage than it is without leverage.…

A: Solution - Return on Equity can be defined as the profit of a business with respect to equity…

Q: 12-22. Besrand Boats (BB) expects this year's sales to be $150,000. BB's fixed operating costs equal…

A: As per the given information: Expected sales - $150,000Fixed operating costs - $18,000Variable…

Q: 12. Nonannual compounding period The number of compounding periods in one year is called compounding…

A: 1) Nominal rate is stated interest rate which is given in the question = 4.4% 2) Periodic rate =…

Q: answer using TVM calculations and formulas Today Dante and Sharon had their first child. All of the…

A: Initial deposit (I) = $23,000 Monthly interest rate (r) = 0.00266666666666667 (i.e. 0.032 / 12)…

Q: What exactly are the effects of choosing the wrong indexing strategy?

A: Index-It is a yardstick that used to measure the performance of a stock or portfolio against certain…

Q: Consider a European put with an exercise (strike) price of 5.00 and with 6 months to maturity. The…

A: Put options: Put options are derivative instruments that give their holders the right, but not the…

Q: engineer wishes to set up a special fund by making uniform semiannual and end-of-period deposits for…

A: The compounding has impact on the long period and due to compounding more interest is being…

Q: Consider the following security, which you expect will grow rapidly for three years followed by a…

A: We have select financials available for a company. We have to prepare the projected cash flow and…

Q: a. Compute the bond's yield to maturity. b. Determine the value of the bond to you given the…

A: Information Provided: Bond maturity = 13 years Par value = $1000 Coupon rate = 12% Market price =…

Q: If a one year treasury bill you can buy today for $909.09 has a face value of $1000. Its yield to…

A: The treasury is the debt instrument issued by the government. The treasury bill is issued at…

Q: Type only your answer in the space provided below with the $ and no spaces, rounding the answer to…

A: The closing costs of a loan are the amount of upfront payment that a borrower needs to provide to…

Q: You buy a share of The Ludwig Corporation stock for $22.90. You expect it to pay dividends of $1.05,…

A: 1). The growth rate in dividend is calculated using following compounded average growth rate…

Q: Julianne Zaslow just inherited $100,000 from her great aunt Abigail. Julianne and her partner are…

A: Given, Mortgage loan amount is $275000 APR is 4.25% Term is 30 years

Q: Find the numerical value of the factor (A/P, 30%,22).

A: We have; Capital Recovery function (A/P,30%,22) To Find: Numerical Value of the Function

Q: a) Find the exponential function that describes the amount in the account after time t, in years. b)…

A: Information Provided: Principal = $18,982 Interest rate = 5.6% compounded continuously

Q: Draw the payoff diagram for Valero, the long side of the contract. Then draw the payoff diagram for…

A: A forward contract is a derivative that locks in the price of a future transaction. In this case, at…

Q: Can you please do a step by step calculation on the standard deviation please? My calculation isn't…

A: In finance we use standard deviation often to determine the risk associated with an investment, risk…

Q: Refer to the chart: Which of the following would you recommend an investor do? The stock is…

A: Resistance price is 1.60 Support -1 is 1.46 Support -2 is 1.08 To Find: Where to buy

Q: A bond sells for $866.09 and has a coupon rate of 6.40 percent. If the bond has 14 years until…

A: Bond price = $866.09 Semiannual coupon amount = $1000 * 0.064 / 2 = $32 Semiannual maturity period =…

Q: (Related to Checkpoint 9.3) (Bond valuation) Pybus, Inc. is considering issuing bonds that will…

A: Information Provided: Bond maturity = 24 years Annual coupon rate = 6% Par value = $1000 Yield to…

Q: Complete the following, using ordinary interest. (Use Days in a year table.) Note: Do not round…

A: The borrower is the one who borrows money from the lender and the lender charges interest for the…

Q: our grandfather wants to establish a scholarship in his father's name at a local university and has…

A: Perpetuity type of annuity pay the money forever and the present value of perpetuity depends on the…

Q: Burt's TVs has current liabilities of $24.8 million. Cash makes up 39 percent of the current assets…

A: Current assets refer to those assets that are expected to be converted to cash in less than 12…

Q: Chandrika deposits $500 in an account paying an effective quarterly interest rate 2.01875%. Muhammad…

A: Present Value: The present value (PV) is the present sum of the future payments. The future…

Q: wilma just sold all the shares of international inns stock that she owned for $156 per share. she…

A: Yield The return an investor gets from an investment is called the yield. Investors can earn returns…

Q: Fegley, Incorporated, has an issue of preferred stock outstanding that pays a dividend of $6.95…

A: Preferred Stock refers to that type of stock which possess the features of both equities and debt.…

Q: Your company wants to raise $8.5 million by issuing 10-year zero-coupon bonds. If the yield to…

A: Information Provided: Bond current value = $8,500,000 Yield to maturity = 5% Period of bond = 10…

Q: You deposit $1.2 million into your account to cover expenses in the next 12 years. The account earns…

A: We have an initial balance to support the living expenses of next two year. We have to find the…

Q: How can you know whether a project will be profitable? What purpose does TCO serve?

A: The management evaluates the project before accepting the project, the management has to decide…

Q: The Campbell Company is considering adding a robotic paint sprayer to its production line. The…

A: The NPV of a project is used to measure its profitability into account. It takes the concept of TVM…

Q: B eBook The J.R. Ryland Computer Company considering a plant expansion to enable the company to…

A: a) i) Expected Value of Medium scale = (50 * 0.20) +(150 * 0.20) + (200 * 0.6) = 10 + 30 + 120 = 160…

Q: On January 1, the Wiek Company contracted with its president, T. Mae, to make a single deposit…

A: As per the given information: Pension amount paid to Mae for each of the three years following…

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

- Market Basket, Inc., has 125,000 shares of common stock outstanding at a price of $43 a share. They also have 25,000 shares of preferred stock outstanding at a price of $55 a share. There are 10,000, 8 percent bonds outstanding that are priced at $990. The bonds mature in 16 years and pay interest semiannually. What is the capital structure weight of the preferredstock?Hotel Cortez is an all-equity firm that has 11,200 shares of stock outstanding at a market price of $35 per share. The firm's management has decided to issue $68,000 worth of debt and use the funds to repurchase shares of the outstanding stock. The interest rate on the debt will be 9 percent. What is the break-even EBIT?Masterson, Inc., has 8 million shares of common stock outstanding. The current share price is $82, and the book value per share is $6. The company also has two bond issues outstanding. The first bond issue has a face value of $135 million, has a coupon rate of 7 percent, and sells for 93 percent of par. The second issue has a face value of $120 million, has a coupon rate of 6 percent, and sells for 102 percent of par. The first issue matures in 25 years, the second in 9 years. Both bonds make semiannual coupon payments. What are the company's capital structure weights on a book value basis? Equity/Value ___________ Debt/Value ____________ What are the company's capital structure weights on a market value basis? Equity/Value __________ Debt/Value ___________

- Dineage Corporation has 5 million shares of common stock outstanding. The current share price is $84, and the book value per share is $7. The company also has two bond issues outstanding. The first bond issue has a face value of $60 million, has a 7 percent coupon, and sells for 94 percent of par. The second issue has a face value of $35 million, has a 8 percent coupon, and sells for 107 percent of par. The first issue matures in 22 years, the second in 4 years. The most recent dividend was $5.6 and the dividend growth rate is 8 percent. Assume that the overall cost of debt is the weighted average of that implied by the two outstanding debt issues. Both bonds make semiannual payments. The tax rate is 35 percent. What is the company's WACC?Barret Industries is a publicly listed company in London. The company has equity claims of £100 million (book value), and it is currently issuing 10 million shares in the financial market. The company has just paid a 40% of its earnings as dividends to the shareholders, and the company has showed earings of £2 per share. The stock of Barret is currently trading in the market at £17 per share. In addition, as Barret Industries is a geared company, it also issues corporate bonds in the financial market. The company now has 50 million units of 5% redeemable bonds which has a nominal value of £2. The bonds are currently traded in the market at £1.36 per unit. The interest is about to be paid and a premium of 3.5% is redeemable at the maturity of the bonds in 8 years' time. The corporate tax for the company is 45%. Ignore personal tax. Required: a) Calculate the cost of equity using the dividend growth model (DGM) b) calculate the after tax cost of debt c) calculate the WACCMasterson, Inc., has 8 million shares of common stock outstanding. The current share price is $74, and the book value per share is $7. The company also has two bond issues outstanding. The first bond issue has a face value of $95 million, has a coupon rate of 7 percent, and sells for 97 percent of par. The second issue has a face value of $80 million, has a coupon rate of 6 percent, and sells for 109 percent of par. The first issue matures in 23 years, the second in 6 years. Both bonds make semiannual coupon payments. a. What are the company's capital structure weights on a book value basis? (Do not round intermediate calculations and round your answers to 4 decimal places, e.g., .1616.) b. What are the company’s capital structure weights on a market value basis? (Do not round intermediate calculations and round your answers to 4 decimal places, e.g., .1616.) c. Which are more relevant, the book or market value weights?

- Taunton's is an all-equity firm that has 150,000 shares of stock outstanding. The CFO is considering borrowing $215,000 at 7 percent interest to repurchase 17,000 shares. Ignoring taxes, what is the value of the firm? Round to the nearest dollar and format as "X,XXX,XXX"Dinklage Corp. has 5 million shares of common stock outstanding. The current share price is $77, and the book value per share is $8. The company also has two bond issues outstanding. The first bond issue has a face value of $60 million, a coupon rate of 6 percent, and sells for 97 percent of par. The second issue has a face value of $30 million, a coupon rate of 7 percent, and sells for 105 percent of par. The first issue matures in 21 years, the second in 4 years. Suppose the most recent dividend was $4.90 and the dividend growth rate is 6 percent. Assume that the overall cost of debt is the weighted average of that implied by the two outstanding debt issues. Both bonds make semiannual payments. The tax rate is 40 percent. What is the company's WACC? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) WACC _________%A corporation has 7 million shares of common stock outstanding. The current share price is $68, and the book value per share is $8. The company also has two bond issues outstanding. The first bond issue has a face value of $70 million, a coupon rate of 6 percent, and sells for 97 percent of par. The second issue has a face value of $40 million, a coupon rate of 6.5 percent, and sells for 108 percent of par. The first issue matures in 21 years, the second in 6 years. Assume the most recent dividend was $3.25 and the dividend growth rate is 5 percent. Assume that the overall cost of debt is the weighted average of that implied by the two outstanding debt issues. Both bonds make semiannual payments. The tax rate is 21 percent. What is the company’s WACC?

- Kim's Bridal Shoppe has 12,400 shares of common stock outstanding at a price of $58 per share. It also has 325 shares of preferred stock outstanding at a price of $88 per share. There are 400 bonds outstanding that have a coupon rate of 7.7 percent paid semiannually. The bonds mature in 39 years, have a face value of $2,000, and sell at 113 percent of par. What is the capital structure weight of the common stock?Dinklage Corporation has 9 million shares of common stock outstanding. The current share price is $88, and the book value per share is $7. The company also has two bond issues outstanding. The first bond issue has a face value of $80 million, has a 5 percent coupon, and sells for 98 percent of par. The second issue has a face value of $55 million, has a 6 percent coupon, and sells for 106 percent of par. The first issue matures in 20 years, the second in 8 years. The most recent dividend was $6 and the dividend growth rate is 8 percent. Assume that the overall cost of debt is the weighted average of that implied by the two outstanding debt issues. Both bonds make semiannual payments. The tax rate is 38 percent. What is the company's WACC?Titan Mining Corporation has 9 million shares of common stock outstanding, 250,000 shares of preferred stock with 6% return, and 105,000 7.5% semiannual bonds outstanding. The common stock currently sells for $34 per share and has a beta of 1.25, the preferred stock currently sells for $91 per share, and bonds have 15 years to maturity and sell for $930. The market risk premium is 8.5%, T-bills are yielding 5%, and Titan Mining’s tax rate is 35%. The firm is considering acquiring a new machine that costs $100,000 and the expected cash flows are $31,000 per year for the next 4 years. Based on the IRR, should you accept or reject the project?