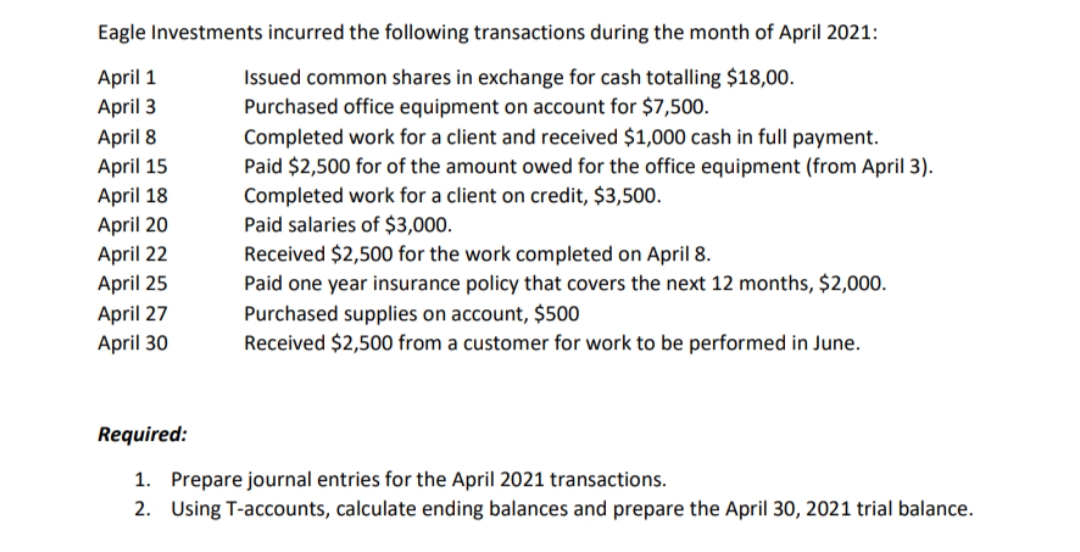

Eagle Investments incurred the following transactions during the month of April 2021: Issued common shares in exchange for cash totalling $18,00. Purchased office equipment on account for $7,500. Completed work for a client and received $1,000 cash in full payment. Paid $2,500 for of the amount owed for the office equipment (from April 3). Completed work for a client on credit, $3,500. Paid salaries of $3,000. Received $2,500 for the work completed on April 8. Paid one year insurance policy that covers the next 12 months, $2,000. Purchased supplies on account, $500 Received $2,500 from a customer for work to be performed in June. April 1 April 3 April 8 April 15 April 18 April 20 April 22 April 25 April 27 April 30 Required: 1. 2. Prepare journal entries for the April 2021 transactions. Using T-accounts, calculate ending balances and prepare the April 30, 2021 trial balance.

Eagle Investments incurred the following transactions during the month of April 2021: Issued common shares in exchange for cash totalling $18,00. Purchased office equipment on account for $7,500. Completed work for a client and received $1,000 cash in full payment. Paid $2,500 for of the amount owed for the office equipment (from April 3). Completed work for a client on credit, $3,500. Paid salaries of $3,000. Received $2,500 for the work completed on April 8. Paid one year insurance policy that covers the next 12 months, $2,000. Purchased supplies on account, $500 Received $2,500 from a customer for work to be performed in June. April 1 April 3 April 8 April 15 April 18 April 20 April 22 April 25 April 27 April 30 Required: 1. 2. Prepare journal entries for the April 2021 transactions. Using T-accounts, calculate ending balances and prepare the April 30, 2021 trial balance.

Chapter16: Statement Of Cash Flows

Section: Chapter Questions

Problem 1EB: Provide journal entries to record each of the following transactions. For each, identify whether the...

Related questions

Topic Video

Question

Please help me

Transcribed Image Text:Eagle Investments incurred the following transactions during the month of April 2021:

April 1

Issued common shares in exchange for cash totalling $18,00.

Purchased office equipment on account for $7,500.

April 3

April 8

Completed work for a client and received $1,000 cash in full payment.

April 15

Paid $2,500 for of the amount owed for the office equipment (from April 3).

Completed work for a client on credit, $3,500.

April 18

Paid salaries of $3,000.

April 20

April 22

April 25

April 27

April 30

Required:

1.

2.

Received $2,500 for the work completed on April 8.

Paid one year insurance policy that covers the next 12 months, $2,000.

Purchased supplies on account, $500

Received $2,500 from a customer for work to be performed in June.

Prepare journal entries for the April 2021 transactions.

Using T-accounts, calculate ending balances and prepare the April 30, 2021 trial balance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning