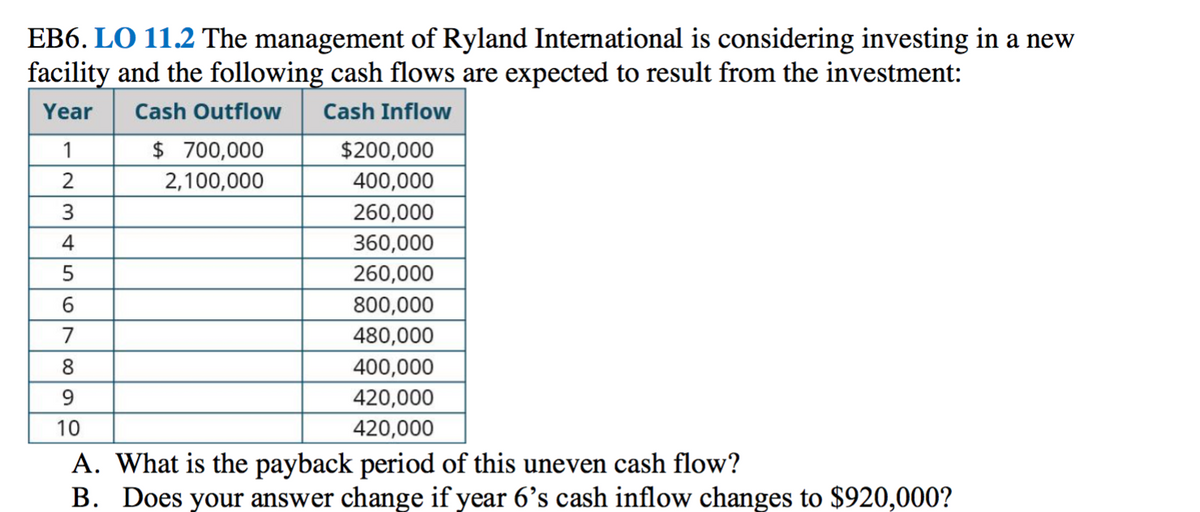

The management of Ryland International is considering investing in a new following cash flows are expected to result from the investment: Outflow Cash Inflow 00,000 00,000 $200,000 400,000 260,000 360,000 260,000 800,000 480,000 400,000 420,000 420,000 s the payback period of this uneven cash flow? our answer change if year 6's cash inflow changes to $920,000?

The management of Ryland International is considering investing in a new following cash flows are expected to result from the investment: Outflow Cash Inflow 00,000 00,000 $200,000 400,000 260,000 360,000 260,000 800,000 480,000 400,000 420,000 420,000 s the payback period of this uneven cash flow? our answer change if year 6's cash inflow changes to $920,000?

Chapter4: Time Value Of Money

Section4.12: Uneven, Or Irregular, Cash Flows

Problem 3ST

Related questions

Question

Transcribed Image Text:EB6. LO 11.2 The management of Ryland International is considering investing in a new

facility and the following cash flows are expected to result from the investment:

Year

Cash Outflow

Cash Inflow

1

$ 700,000

$200,000

2

2,100,000

400,000

3

260,000

360,000

4

260,000

800,000

7

480,000

400,000

420,000

8

9.

10

420,000

A. What is the payback period of this uneven cash flow?

B. Does your answer change if year 6's cash inflow changes to $920,000?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you