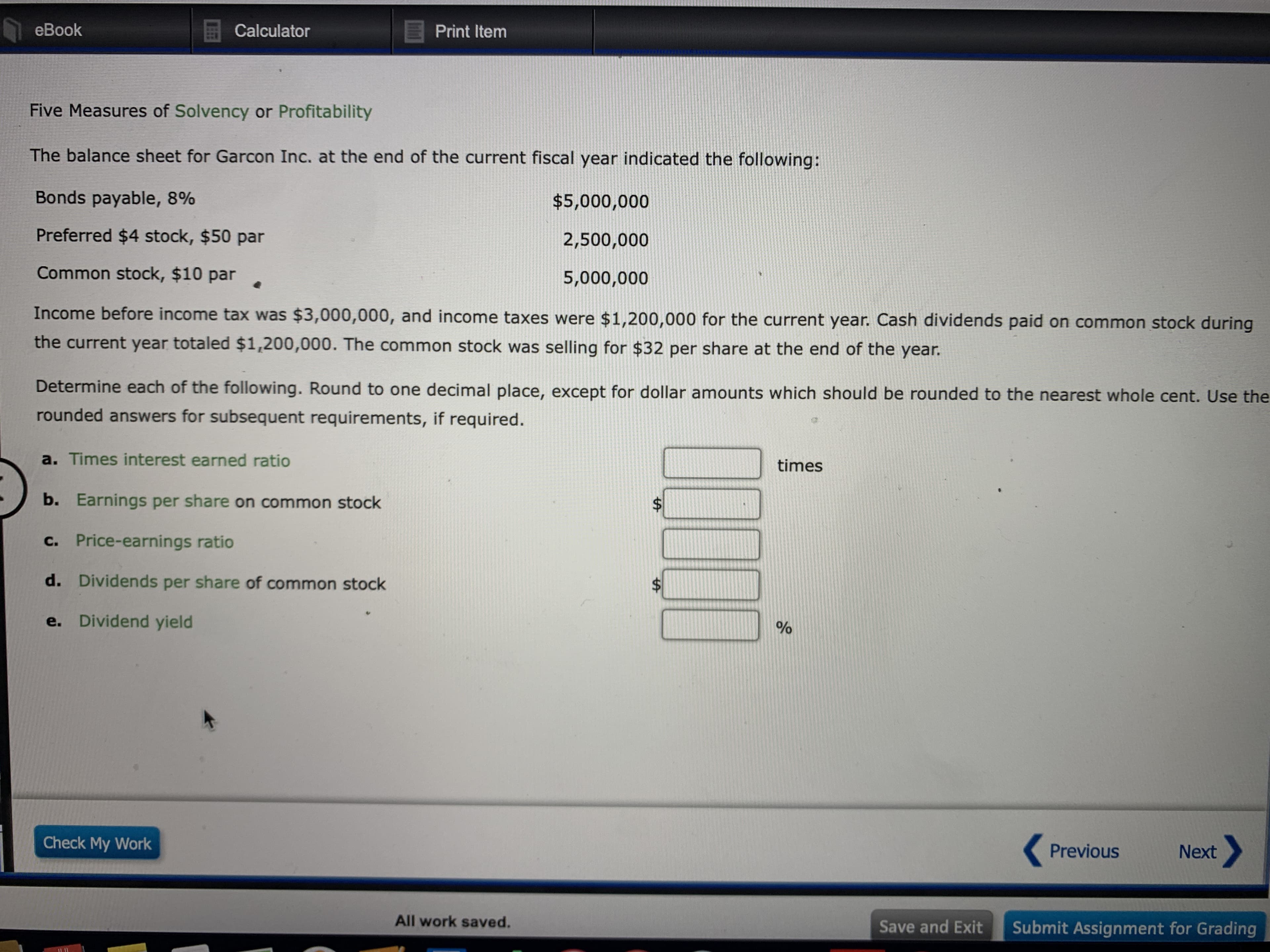

eBook Calculator Print Item Five Measures of Solvency or Profitability The balance sheet for Garcon Inc. at the end of the current fiscal year indicated the following: Bonds payable, 8% $5,000,000 Preferred $4 stock, $50 par 2,500,000 Common stock, $10 par 5,000,000 Income before income tax was $3,000,000, and income taxes were $1,200,000 for the current year. Cash dividends paid on common stock during the current year totaled $1,200,000. The common stock was selling for $32 per share at the end of the year. Determine each of the following. Round to one decimal place, except for dollar amounts which should be rounded to the nearest whole cent. Use the rounded answers for subsequent requirements, if required. a. Times interest earned ratio times b. Earnings per share on common stock c. Price-earnings ratio d. Dividends per share of common stock e. Dividend yield % Check My Work Previous Next All work saved. Save and Exit Submit Assignment for Grading

eBook Calculator Print Item Five Measures of Solvency or Profitability The balance sheet for Garcon Inc. at the end of the current fiscal year indicated the following: Bonds payable, 8% $5,000,000 Preferred $4 stock, $50 par 2,500,000 Common stock, $10 par 5,000,000 Income before income tax was $3,000,000, and income taxes were $1,200,000 for the current year. Cash dividends paid on common stock during the current year totaled $1,200,000. The common stock was selling for $32 per share at the end of the year. Determine each of the following. Round to one decimal place, except for dollar amounts which should be rounded to the nearest whole cent. Use the rounded answers for subsequent requirements, if required. a. Times interest earned ratio times b. Earnings per share on common stock c. Price-earnings ratio d. Dividends per share of common stock e. Dividend yield % Check My Work Previous Next All work saved. Save and Exit Submit Assignment for Grading

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter17: Financial Statement Analysis

Section: Chapter Questions

Problem 20E: Five measures of solvency or profitability The balance sheet for Garcon Inc. at the end of the...

Related questions

Question

Transcribed Image Text:eBook

Calculator

Print Item

Five Measures of Solvency or Profitability

The balance sheet for Garcon Inc. at the end of the current fiscal year indicated the following:

Bonds payable, 8%

$5,000,000

Preferred $4 stock, $50 par

2,500,000

Common stock, $10 par

5,000,000

Income before income tax was $3,000,000, and income taxes were $1,200,000 for the current year. Cash dividends paid on common stock during

the current year totaled $1,200,000. The common stock was selling for $32 per share at the end of the year.

Determine each of the following. Round to one decimal place, except for dollar amounts which should be rounded to the nearest whole cent. Use the

rounded answers for subsequent requirements, if required.

a. Times interest earned ratio

times

b. Earnings per share on common stock

c. Price-earnings ratio

d. Dividends per share of common stock

e. Dividend yield

%

Check My Work

Previous

Next

All work saved.

Save and Exit

Submit Assignment for Grading

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 8 steps with 6 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,