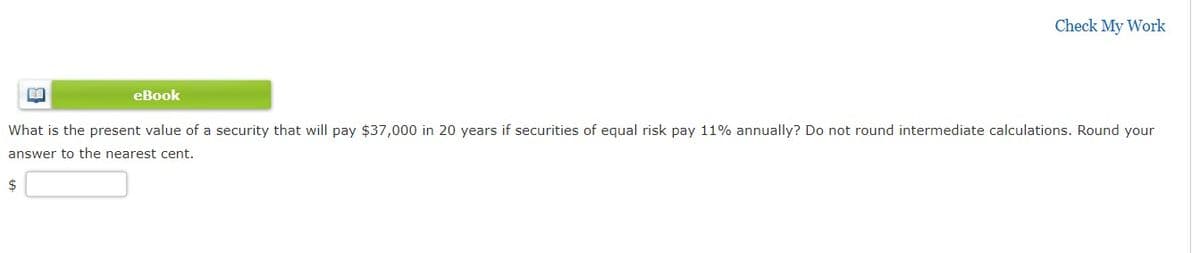

eBook What is the present value of a security that will pay $37,000 in 20 years if securities of equal risk pay 11% annually? Do not round intermediate calculations. Round your answer to the nearest cent.

Q: What is the present value of a security that will pay $14,000 in 20 years if securities of equal…

A: Present value is the value of the amount in current times that is expected to be received in future…

Q: Suppose you purchase a zero coupon bond with face value $1,000, maturing in 25 years, for $180. What…

A: Yield to maturity can be calculated by following function in excel =RATE (nper, pmt, pv, [fv],…

Q: What is the present value of a security that will pay the amount shown below in 20 years? Securities…

A: Present value refers to the current valuation for a future sum. Investors determine the present…

Q: You are considering an investment in a 40-year security. The security will pay $25 a…

A: Annuities are insurance contracts that promise to pay you regular income either immediately or in…

Q: What is the present value of a security that will pay $7,000 in 20 years if securities of equal risk…

A: Given: Future value (FV) = 7000 Number of years (n) = 20 Interest rate (r) = 7% = 0.07

Q: Consider three securities that will pay risk-free cash flows over the next three years and that have…

A: For $ 100 cash flow received in one year, the price is $ 92.42 For $500 Cash flow, the price…

Q: 1. An engineer purchased a bond for P1M. This pays an interest of P50,000.00 each year for 20 years,…

A: The real rate of return(post-inflation adjustment)-It is the rate of interest that an investor or…

Q: A personal account earmarked as a retirement supplement contains $242,300. Suppose $200,000 is u…

A: Present Value: The present value is the value of cash flow stream or the fixed lump sum amount at…

Q: What would you pay for a $110,000 debenture bond that matures in 15 years and pays $5,500 a year in…

A: Given Information Amount of Debenture Bond = $110,000 Maturity = 15 years Interest earned per year…

Q: You attempt to finance a 10-year guaranteed investment contract (GIC). The payment made by…

A: given GIC is 5%. The bond you want to use is a 15-year, 5% annual coupon rate bond (semiannually…

Q: What is the present value of a security that will pay $40,000 in 20 years if securities of equal…

A: Calculate the present value as follows: Present value = Future value / (1+rate)^years

Q: a coupon of 6.6 percent, a YTM of 8.35 percent, and also has 15 years to maturity. If interest rates…

A: Bond Price: It is computed by discounting all the coupon payments and the par value of the bond by…

Q: What would you pay for a $205,000 debenture bond that matures in 15 years and pays $10,250 a year in…

A: Issue price of the bonds = Present value of principal + Present value of interest payments where,…

Q: What is the present value of a security that will pay $5000 in 20 years if securities of equal risk…

A: Calculation of Present Value:The present value is $1,292.10. Excel Spreadsheet:

Q: What would you pay for a $205,000 debenture bond that matures in 15 years and pays $10,250 a year in…

A: Issue price of the bonds = Present value of principal + Present value of interest payments where,…

Q: What is the present value of a security that will pay $2,000 at the end of each year for 6 years if…

A: The present value can be calculated as follows if the payments are made at the end : Calculations…

Q: a. What is the present value of a security that will pay $4,000 in 20 years if securities of equal…

A: a) Present value = Future value /(1+rate)^years

Q: 3. What is the present value of a security that will pay $15,000 in 15 ye securities of equal risk…

A: Using PV in excel

Q: What is the present value of a security that will pay $11200 in 16 years if securities of equal risk…

A: We need to use the concept of time value of money to solve the question. According to the concept of…

Q: What is the present value of a security that will pay 5, 000 in 20 years if securities of equal risk…

A: solution given Future value 5000 Number of years 20 Interest rate 7% Present…

Q: What would you pay for a $205,000 debenture bond that matures in 15 years and pays $10,250 a year in…

A: Issue price of the bonds = Present value of principal + Present value of interest payments where,…

Q: What is the present value of a security that will pay $29,000 in 20 yearsif securities of equal risk…

A: Present Value is a current value of a future payment. Future cash flows are discounted at the…

Q: What is the present value of a security that will pay $5000 in 20 years if the securities of equal…

A: The present value of the cash flow is the current worth of a cash flow at a certain rate of interest…

Q: b. John needs to pay $55,000, $60,000 and $65,000 at the end of next 3 years respectively. The…

A: i) Duration of the obligation will be, = Σ( PV of CF*n) / Σ PV of CF ; PV of CF = Present…

Q: A $1,000 par value bond with an annual 14% coupon rate will mature in 20 years. Coupon payments are…

A: Bonds: Bonds are a debt instrument on which interest is paid. They can be issued at a discount/par…

Q: present value of a security

A: The present value is the computations used under the concept of the time value of money, where the…

Q: 20 Toy World bonds have a face value of $1,000, mature in 12 years, pay interest semiannually, and…

A: Given: Particulars Amount Face value (FV) $1,000 Years 12 Coupon rate 7.20% Rate 7%

Q: At what annual interest rate would the following have to be invested? i) $500 to grow to $1,948.00…

A: Note: We’ll answer the first question since the exact one wasn’t specified. Please submit a new…

Q: What is the present value of a security that will pay $10,000 in 20 years if securities of equal…

A: The formula used as follows: Present value=Future value1+rt

Q: What is the present value of a security that will pay $32,000 in 20 years if securities of equal…

A: We need to use the concept of time value of money to solve the question. According to the concept of…

Q: an investor buy a 10,000 par, 4.25 percent annual coupon TIPS security with three years to maturity.…

A: TIPS refers to Treasury Inflation-Protected Securities. These are treasury bonds that protect…

Q: You intend to purchase a 10-year, $1,000 face value bond that pays interest of $60 every 6 months.…

A: The price of the bond shall be the present value of face value of the bond and semi annual coupons…

Q: What is the present value of a security that will pay $18,000 in 20 years if securities of equal…

A: Present value is the value of the money in current time that is expected to be received in future…

Q: 4) A zero-coupon bond matures in 10 years and will be worth $1000.00 to the holder. If the bond was…

A: Given data; price of bond = $1000 yield to maturity = 5% number of years to maturity when bond is…

Q: Suppose on can invest in a money market instrument that matures in 70 days that offers 8% nominal…

A: Nominal rate (r) = 8% Period = 70 Days Number of days in a year = 365 days Number of compounding per…

Q: What is the present value of a security that will pay $3,000 in 20 years if securities of equal risk…

A: Present Value: It is the present worth of the future amount and is estimated by discounting the…

Q: Kas a $1,000 par value, 12 years to maturity, and an 8% annual coupon and sells for $980. ed What is…

A: (a) Given: Face value =$1000 Present value =$980 Time =12 years Coupon rate =8% So, coupon payment…

Q: How much should an investor be willing to pay now for 10%, P 50, 000.00 bond that will mature in 25…

A: Given: Face Value of bond = 50,000 N = 50 semi annual periods (25 years) Interest rate = 12%/2 = 6%…

Q: What is the present value of a security that will pay $17,000 in 20 years if securities of equal…

A: Present value of a single sum can be calculated by using this equation Present value =Future…

Q: f one would want to invest savings of $29,000 in government securities for the next 2 years.…

A: Investment refers to an form of an asset or an item which is purchased with the main motive of…

Discount Factor:

Discount Factor is a determinant that finds out the present value of future cash flows. Discounting is the main factor that is used in discounting the flow cash. Discount Factor is computed by aggregating the discount rates to one and raising the rate to present value compounded for the number of periods.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- What is the present value of a security that will pay $32,000 in 20 years if securities of equal risk pay 5% annually? Do not round intermediate calculations. Round your answer to the nearest centWhat is the present value of a security that will pay $40,000 in 20 years if securities of equal risk pay 6% annually? Round your answer to the nearest cent.Please show working. Please answer a, b and c a. What is the present value of a security that will pay $4,000 in 20 years if securities of equal risk pay 5% annually? Do not round intermediate calculations. Round your answer to the nearest cent. ______ b. You have $45,312.74 in a brokerage account, and you plan to deposit an additional $3,000 at the end of every future year until your account totals $230,000. You expect to earn 10% annually on the account. How many years will it take to reach your goal? Round your answer to the nearest whole number. _________ c. If you deposit money today in an account that pays 3.5% annual interest, how long will it take to double your money? Round your answer to two decimal places. ___________ years

- What is the present value of a security that will pay $29,000 in 20 yearsif securities of equal risk pay 5% annually?What is the present value of a security that promises to pay you $15,000 in 10 years? Assume that you earn 5% compounded quarterly if you were to invest in other securities of equal risk.What is the present value of a security that will pay $5,000 in 20 years if securities of equal risk pay 7%?

- you are considering investing in a four year security which pays 6,000 in one year. 6,000 in two years, 6,000 in 3 years and 17,500 in 4 years. the security currently trades at a price of of 18,483.77. What is the yield to maturity of the security? What is duration?An investor buys a ($1000 FV) Treasury Strip security with 11 years to maturity at a yield of 5.1%. Two years later the yield to maturity on the strip is 4.0% and the investor decides to sell. What is the compounded annual rate of return on the investment over the investment horizon? For simplicity assume all yields in the question are quoted with annual compounding. Enter your answer as percent to two decimal places, but do not include the % sign.What is the present value of a security that will pay $5000 in 20 years if securities of equal risk pay 7 percent annually?