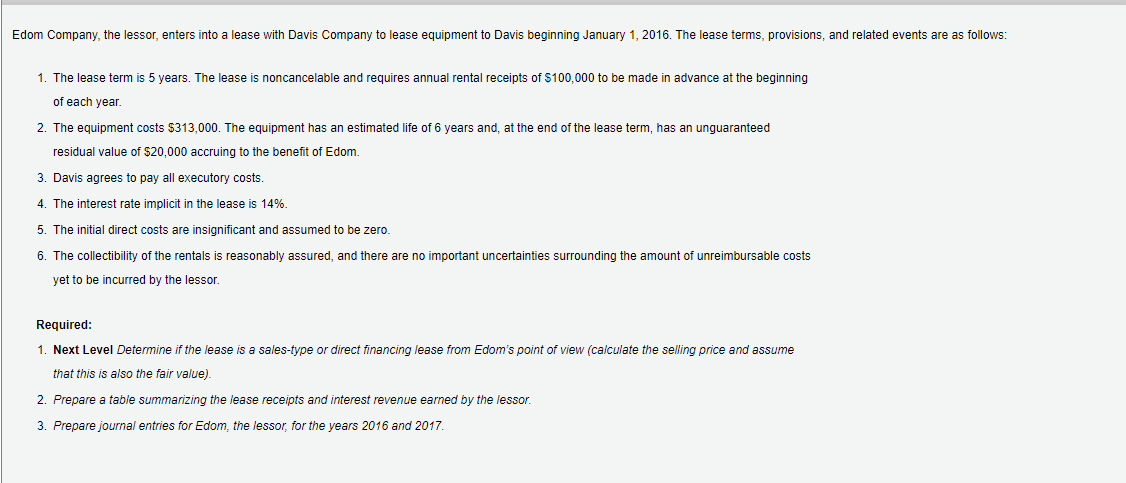

Edom Company, the lessor, enters into a lease with Davis Company to lease equipment to Davis beginning January 1, 2016. The lease terms, provisions, and related events are as follows: 1. The lease term is 5 years. The lease is noncancelable and requires annual rental receipts of $100,000 to be made in advance at the beginning of each year. 2. The equipment costs $313,000. The equipment has an estimated life of 6 years and, at the end of the lease term, has an unguaranteed residual value of $20,000 accruing to the benefit e Edom. 3. Davis agrees to pay all executory costs. 4. The interest rate implicit in the lease is 14%. 5. The initial direct costs are insignificant and assumed to be zero. 6. The collectibility of the rentals is reasonably assured, and there are no important uncertainties surrounding the amount of unreimbursable costs yet to be incurred by the lessor. Required: 1. Next Level Determine if the lease is a sales-type or direct financing lease from Edom's point of view (calculate the selling price and assume that this is also the fair value). 2. Prepare a table summarizing the lease receipts and interest revenue earned by the lessor. 3. Prepare journal entries for Edom, the lessor, for the years 2016 and 2017.

Edom Company, the lessor, enters into a lease with Davis Company to lease equipment to Davis beginning January 1, 2016. The lease terms, provisions, and related events are as follows: 1. The lease term is 5 years. The lease is noncancelable and requires annual rental receipts of $100,000 to be made in advance at the beginning of each year. 2. The equipment costs $313,000. The equipment has an estimated life of 6 years and, at the end of the lease term, has an unguaranteed residual value of $20,000 accruing to the benefit e Edom. 3. Davis agrees to pay all executory costs. 4. The interest rate implicit in the lease is 14%. 5. The initial direct costs are insignificant and assumed to be zero. 6. The collectibility of the rentals is reasonably assured, and there are no important uncertainties surrounding the amount of unreimbursable costs yet to be incurred by the lessor. Required: 1. Next Level Determine if the lease is a sales-type or direct financing lease from Edom's point of view (calculate the selling price and assume that this is also the fair value). 2. Prepare a table summarizing the lease receipts and interest revenue earned by the lessor. 3. Prepare journal entries for Edom, the lessor, for the years 2016 and 2017.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 2E: Lessee Accounting with Payments Made at Beginning of Year Adden Company signs a lease agreement...

Related questions

Question

Transcribed Image Text:Edom Company, the lessor, enters into

lease with Davis Company to lease equipment to Davis beginning January 1, 2016. The lease terms, provisions, and related events are as follows:

1. The lease term is 5 years. The lease is noncancelable and requires annual rental receipts of $100,000 to be made in advance at the beginning

of each year.

2. The equipment costs $313,000. The equipment has an estimated life of 6 years and, at the end of the lease term, has an unguaranteed

residual value of $20,000 accruing to the benefit of Edom.

3. Davis agrees to pay all executory costs.

4. The interest rate implicit in the lease is 14%.

5. The initial direct costs are insignificant and assumed to be zero.

6. The collectibility of the rentals is reasonably assured, and there are no important uncertainties surrounding the amount of unreimbursable costs

yet to be incurred by the lessor.

Required:

1. Next Level Determine if the lease is a sales-type or direct financing lease from Edom's point of view (calculate the selling price and assume

that this is also the fair value).

2. Prepare a table summarizing the lease receipts and interest revenue earned by the lessor.

3. Prepare journal entries for Edom, the lessor, for the years 2016 and 2017.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 5 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning