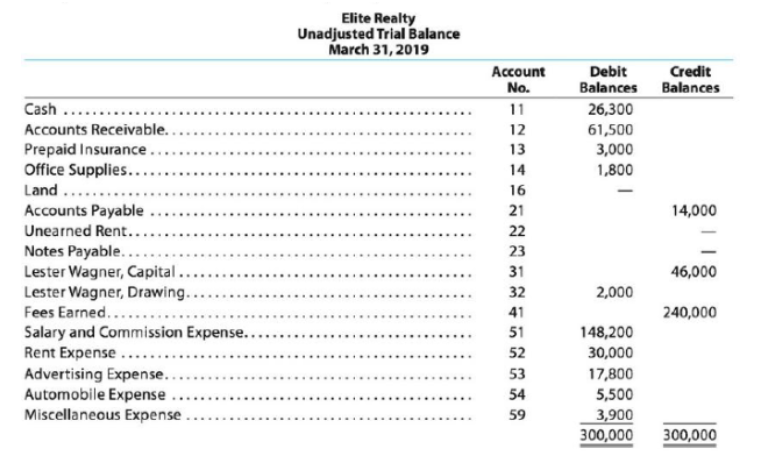

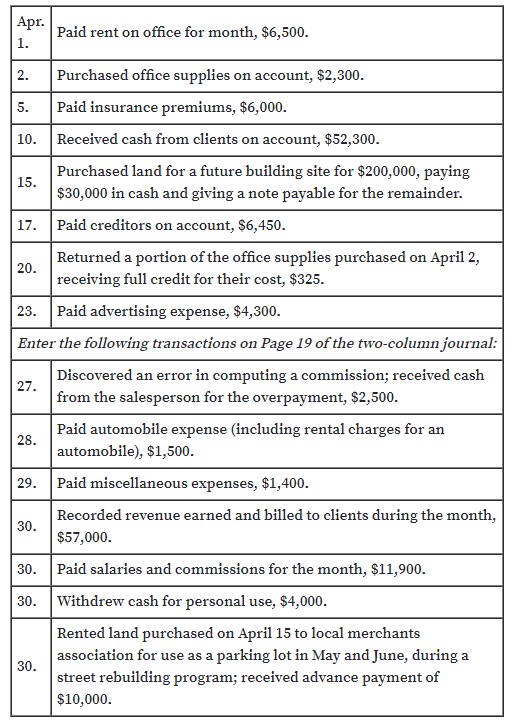

Elite Realty Unadjusted Trial Balance March 31, 2019 Debit Balances Credit Balances Account No. Cash ...... 11 26,300 Accounts Receivable. 61,500 3,000 1,800 12 Prepaid Insurance. Office Supplies... 13 14 Land ..... 16 Accounts Payable 21 14,000 Unearned Rent.... 22 Notes Payable..... Lester Wagner, Capital.. Lester Wagner, Drawing... Fees Earned... Salary and Commission Expense.. Rent Expense ... Advertising Expense. Automobile Expense Miscellaneous Expense . 23 31 46,000 32 2,000 41 240,000 148,200 30,000 51 52 53 17,800 5,500 54 59 3,900 300,000 300,000 Apr. Paid rent on office for month, $6,500. 1. 2. Purchased office supplies on account, $2,300. 5. Paid insurance premiums, $6,000. 10. Received cash from clients on account, $52,300. Purchased land for a future building site for $200,000, paying 15. $30,000 in cash and giving a note payable for the remainder. 17. Paid creditors on account, $6,450. Returned a portion of the office supplies purchased on April 2, 20. receiving full credit for their cost, $325. 23. Paid advertising expense, $4,300. Enter the following transactions on Page 19 of the two-column journal: Discovered an error in computing a commission; received cash 27. from the salesperson for the overpayment, $2,500. Paid automobile expense (including rental charges for an 28. automobile), $1,500. 29. Paid miscellaneous expenses, $1,400. Recorded revenue earned and billed to clients during the month, 30. $57,000. 30. Paid salaries and commissions for the month, $11,900. 30. Withdrew cash for personal use, $4,000. Rented land purchased on April 15 to local merchants association for use as a parking lot in May and June, during a street rebuilding program; received advance payment of 30. $10,000.

Journal entries and

Elite Realty acts as an agent in buying, selling, renting, and managing

real estate. The unadjusted trial balance on March 31, 2019, follows: (attached)

The attached business transactions were completed by Elite Realty

during April 2019:

Instructions

1. Record the April 1, 2019, balance of each account in the appropriate

balance column of a four-column account, write Balance in the item

section, and place a check mark () in the Posting Reference column.

2. Journalize the transactions for April in a two-column journal

beginning on Page 18.

3. Post to the ledger, extending the account balance to the appropriate

balance column after each posting.

4. Prepare an unadjusted trial balance of the ledger as of April 30, 2019.

5. Assume that the April 30 transaction for salaries and commissions

should have been $19,100. (a) Why did the unadjusted trial balance in (4)

balance? (b) Journalize the correcting entry. (c) Is this error a

transposition or slide?

Trending now

This is a popular solution!

Step by step

Solved in 5 steps