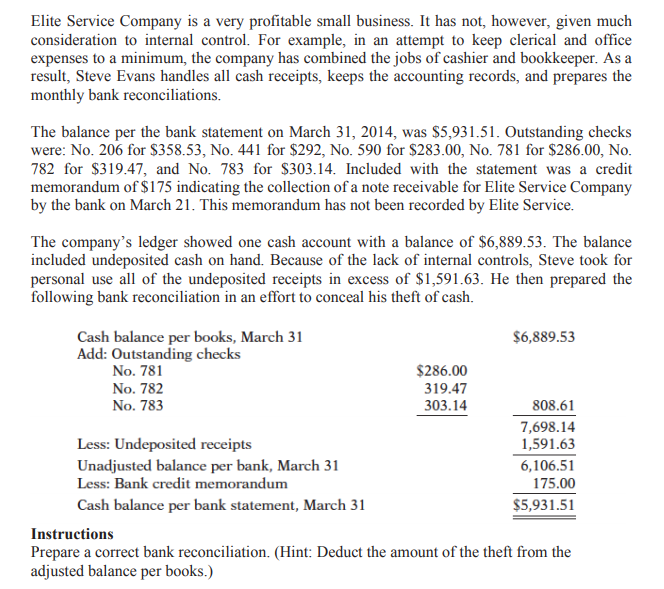

Elite Service Company is a very profitable small business. It has not, however, given much consideration to internal control. For example, in an attempt to keep clerical and office expenses to a minimum, the company has combined the jobs of cashier and bookkeeper. As a result, Steve Evans handles all cash receipts, keeps the accounting records, and prepares the monthly bank reconciliations. The balance per the bank statement on March 31, 2014, was $5,931.51. Outstanding checks were: No. 206 for $358.53, No. 441 for $292, No. 590 for $283.00, No. 781 for $286.00, No. 782 for $319.47, and No. 783 for $303.14. Included with the statement was a credit memorandum of $175 indicating the collection of a note receivable for Elite Service Company by the bank on March 21. This memorandum has not been recorded by Elite Service. The company's ledger showed one cash account with a balance of $6,889.53. The balance included undeposited cash on hand. Because of the lack of internal controls, Steve took for personal use all of the undeposited receipts in excess of $1,591.63. He then prepared the following bank reconciliation in an effort to conceal his theft of cash.

Elite Service Company is a very profitable small business. It has not, however, given much consideration to internal control. For example, in an attempt to keep clerical and office expenses to a minimum, the company has combined the jobs of cashier and bookkeeper. As a result, Steve Evans handles all cash receipts, keeps the accounting records, and prepares the monthly bank reconciliations. The balance per the bank statement on March 31, 2014, was $5,931.51. Outstanding checks were: No. 206 for $358.53, No. 441 for $292, No. 590 for $283.00, No. 781 for $286.00, No. 782 for $319.47, and No. 783 for $303.14. Included with the statement was a credit memorandum of $175 indicating the collection of a note receivable for Elite Service Company by the bank on March 21. This memorandum has not been recorded by Elite Service. The company's ledger showed one cash account with a balance of $6,889.53. The balance included undeposited cash on hand. Because of the lack of internal controls, Steve took for personal use all of the undeposited receipts in excess of $1,591.63. He then prepared the following bank reconciliation in an effort to conceal his theft of cash.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter8: Sarbanes-oxley, Internal Control, And Cash

Section: Chapter Questions

Problem 18E

Related questions

Question

Hello, Please if you can solve this problem. Thank you.

Transcribed Image Text:Elite Service Company is a very profitable small business. It has not, however, given much

consideration to internal control. For example, in an attempt to keep clerical and office

expenses to a minimum, the company has combined the jobs of cashier and bookkeeper. As a

result, Steve Evans handles all cash receipts, keeps the accounting records, and prepares the

monthly bank reconciliations.

The balance per the bank statement on March 31, 2014, was $5,931.51. Outstanding checks

were: No. 206 for $358.53, No. 441 for $292, No. 590 for $283.00, No. 781 for $286.00, No.

782 for $319.47, and No. 783 for $303.14. Included with the statement was a credit

memorandum of $175 indicating the collection of a note receivable for Elite Service Company

by the bank on March 21. This memorandum has not been recorded by Elite Service.

The company's ledger showed one cash account with a balance of $6,889.53. The balance

included undeposited cash on hand. Because of the lack of internal controls, Steve took for

personal use all of the undeposited receipts in excess of $1,591.63. He then prepared the

following bank reconciliation in an effort to conceal his theft of cash.

Cash balance per books, March 31

Add: Outstanding checks

No. 781

$6,889.53

$286.00

No. 782

319.47

No. 783

303.14

808.61

7,698.14

1,591.63

Less: Undeposited receipts

Unadjusted balance per bank, March 31

Less: Bank credit memorandum

6,106.51

175.00

Cash balance per bank statement, March 31

$5,931.51

Instructions

Prepare a correct bank reconciliation. (Hint: Deduct the amount of the theft from the

adjusted balance per books.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,