Ellie is 15 and claimed as a dependent by her parents. She has $1,325 in dividends $ а. income and $3,680 in wages from a part-time job. Ruby and Woody are married and file a joint tax return. Ruby is age 66, and Woody $ is 69. Their taxable retirement income is $13,340. b. C. Shonda is age 68 and single. She is claimed by her daughter as a dependent. Her earned income is $270, and her interest income $605. d. Frazier, age 40, is married but is filing a separate return. His wife itemizes her deductions.

Ellie is 15 and claimed as a dependent by her parents. She has $1,325 in dividends $ а. income and $3,680 in wages from a part-time job. Ruby and Woody are married and file a joint tax return. Ruby is age 66, and Woody $ is 69. Their taxable retirement income is $13,340. b. C. Shonda is age 68 and single. She is claimed by her daughter as a dependent. Her earned income is $270, and her interest income $605. d. Frazier, age 40, is married but is filing a separate return. His wife itemizes her deductions.

Chapter3: Tax Formula And Tax Determination; An Overview Of property Transactions

Section: Chapter Questions

Problem 21CE

Related questions

Question

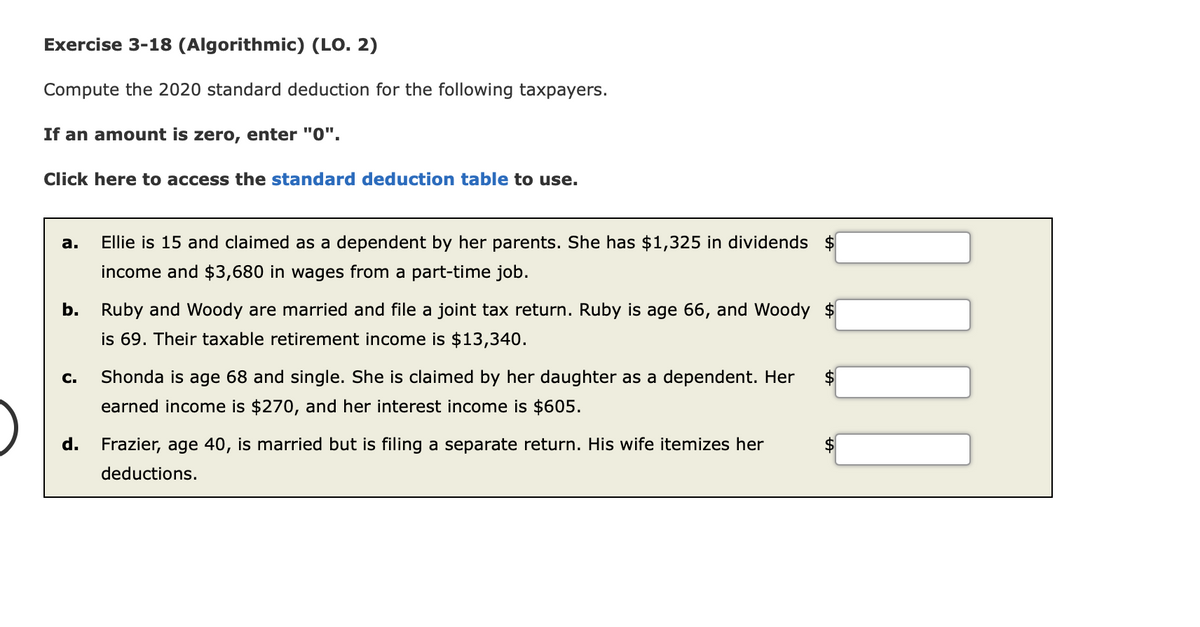

Transcribed Image Text:Exercise 3-18 (Algorithmic) (LO. 2)

Compute the 2020 standard deduction for the following taxpayers.

If an amount is zero, enter "0".

Click here to access the standard deduction table to use.

а.

Ellie is 15 and claimed as a dependent by her parents. She has $1,325 in dividends

income and $3,680 in wages from a part-time job.

b.

Ruby and Woody are married and file a joint tax return. Ruby is age 66, and Woody

is 69. Their taxable retirement income is $13,340.

С.

Shonda is age 68 and single. She is claimed by her daughter as a dependent. Her

2$

earned income is $270, and her interest income is $605.

d.

Frazier, age 40, is married but is filing a separate return. His wife itemizes her

deductions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning