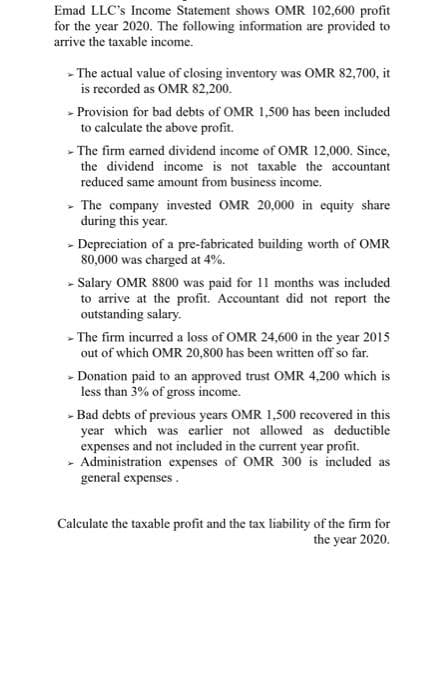

Emad LLC's Income Statement shows OMR 102,600 profit for the year 2020. The following information are provided to arrive the taxable income. - The actual value of closing inventory was OMR 82,700, it is recorded as OMR 82,200. - Provision for bad debts of OMR 1,500 has been included to calculate the above profit. - The firm earned dividend income of OMR 12,000. Since, the dividend income is not taxable the accountant reduced same amount from business income. - The company invested OMR 20,000 in equity share during this year. - Depreciation of a pre-fabricated building worth of OMR 80,000 was charged at 4%. - Salary OMR 8800 was paid for 11 months was included to arrive at the profit. Accountant did not report the outstanding salary. - The firm incurred a loss of OMR 24,600 in the year 2015 out of which OMR 20,800 has been written off so far. - Donation paid to an approved trust OMR 4,200 which is less than 3% of gross income. - Bad debts of previous years OMR 1,500 recovered in this year which was earlier not allowed as deductible expenses and not included in the current year profit. Administration expenses of OMR 300 is included as general expenses. Calculate the taxable profit and the tax liability of the firm for the year 2020.

Emad LLC's Income Statement shows OMR 102,600 profit for the year 2020. The following information are provided to arrive the taxable income. - The actual value of closing inventory was OMR 82,700, it is recorded as OMR 82,200. - Provision for bad debts of OMR 1,500 has been included to calculate the above profit. - The firm earned dividend income of OMR 12,000. Since, the dividend income is not taxable the accountant reduced same amount from business income. - The company invested OMR 20,000 in equity share during this year. - Depreciation of a pre-fabricated building worth of OMR 80,000 was charged at 4%. - Salary OMR 8800 was paid for 11 months was included to arrive at the profit. Accountant did not report the outstanding salary. - The firm incurred a loss of OMR 24,600 in the year 2015 out of which OMR 20,800 has been written off so far. - Donation paid to an approved trust OMR 4,200 which is less than 3% of gross income. - Bad debts of previous years OMR 1,500 recovered in this year which was earlier not allowed as deductible expenses and not included in the current year profit. Administration expenses of OMR 300 is included as general expenses. Calculate the taxable profit and the tax liability of the firm for the year 2020.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 9MC: Brooks Company reported a prior period adjustment of 512,000 in pretax financial "income" and...

Related questions

Question

100%

Transcribed Image Text:Emad LLC's Income Statement shows OMR 102,600 profit

for the year 2020. The following information are provided to

arrive the taxable income.

- The actual value of closing inventory was OMR 82,700, it

is recorded as OMR 82,200.

- Provision for bad debts of OMR 1,500 has been included

to calculate the above profit.

- The firm earned dividend income of OMR 12,000. Since,

the dividend income is not taxable the accountant

reduced same amount from business income.

- The company invested OMR 20,000 in equity share

during this year.

- Depreciation of a pre-fabricated building worth of OMR

80,000 was charged at 4%.

- Salary OMR 8800 was paid for 11 months was included

to arrive at the profit. Accountant did not report the

outstanding salary.

- The firm incurred a loss of OMR 24,600 in the year 2015

out of which OMR 20,800 has been written off so far.

- Donation paid to an approved trust OMR 4,200 which is

less than 3% of gross income.

- Bad debts of previous years OMR 1,500 recovered in this

year which was earlier not allowed as deductible

expenses and not included in the current year profit.

- Administration expenses of OMR 300 is included as

general expenses.

Calculate the taxable profit and the tax liability of the firm for

the year 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning