Entries for Installment Note Transactions On January 1, Year 1, Bryson Company obtained a $33,000, four-year, 8% installment note from Campbell Bank. The note requires annual payments of $9,963, beginning on December 31, Year 1. a. Prepare an amortization table for this installment note, similar to the one presented in Exhibit 4 Note: Round the computation of the interest expense to the nearest whole dollar. Enter all amounts as positive numbers. In Year 4, round the amount in the Decrease in Notes Payable column either up or down to ensure that the Carrying Amount zeroes out. Amortization of Installment Notes Year Ending December 31 Year 1 Year 2 Year 3 Interest Expense (800 of January 1 Note Carrying Amount) December 31 Carrying Amount Decrease in January 1 Carrying Amount Note Payment (Cash Paid) Notes Payable 9,963 9,963 9,963 9,963 39,852 2,640 2,054 1,421 738 6,853 33,000 25,677 17,768 9,226 7,323 7,909 8,542 9,925 33,699 25,677 17,768 9,226 Year 4 0

Entries for Installment Note Transactions On January 1, Year 1, Bryson Company obtained a $33,000, four-year, 8% installment note from Campbell Bank. The note requires annual payments of $9,963, beginning on December 31, Year 1. a. Prepare an amortization table for this installment note, similar to the one presented in Exhibit 4 Note: Round the computation of the interest expense to the nearest whole dollar. Enter all amounts as positive numbers. In Year 4, round the amount in the Decrease in Notes Payable column either up or down to ensure that the Carrying Amount zeroes out. Amortization of Installment Notes Year Ending December 31 Year 1 Year 2 Year 3 Interest Expense (800 of January 1 Note Carrying Amount) December 31 Carrying Amount Decrease in January 1 Carrying Amount Note Payment (Cash Paid) Notes Payable 9,963 9,963 9,963 9,963 39,852 2,640 2,054 1,421 738 6,853 33,000 25,677 17,768 9,226 7,323 7,909 8,542 9,925 33,699 25,677 17,768 9,226 Year 4 0

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter14: Long-term Liabilities: Bonds And Notes

Section: Chapter Questions

Problem 11E

Related questions

Question

Hi I'm stuck on this problem. My numbers aren't adding up and I'm completely lost because I have redone it and still running into the same issue. Can you please help? Thanks!

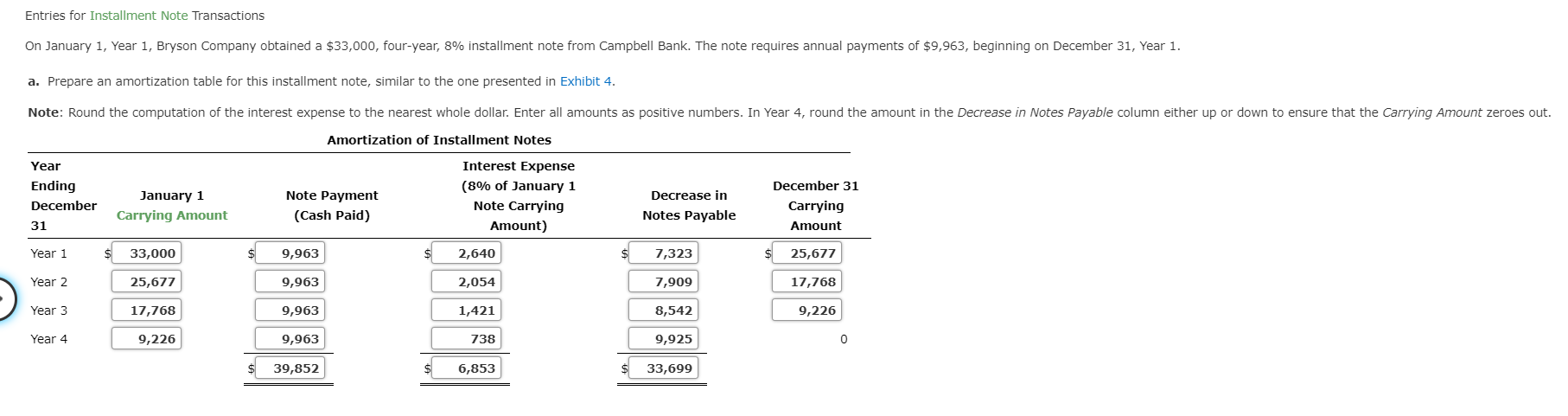

Transcribed Image Text:Entries for Installment Note Transactions

On January 1, Year 1, Bryson Company obtained a $33,000, four-year, 8% installment note from Campbell Bank. The note requires annual payments of $9,963, beginning on December 31, Year 1.

a. Prepare an amortization table for this installment note, similar to the one presented in Exhibit 4

Note: Round the computation of the interest expense to the nearest whole dollar. Enter all amounts as positive numbers. In Year 4, round the amount in the Decrease in Notes Payable column either up or down to ensure that the Carrying Amount zeroes out.

Amortization of Installment Notes

Year

Ending

December

31

Year 1

Year 2

Year 3

Interest Expense

(800 of January 1

Note Carrying

Amount)

December 31

Carrying

Amount

Decrease in

January 1

Carrying Amount

Note Payment

(Cash Paid)

Notes Payable

9,963

9,963

9,963

9,963

39,852

2,640

2,054

1,421

738

6,853

33,000

25,677

17,768

9,226

7,323

7,909

8,542

9,925

33,699

25,677

17,768

9,226

Year 4

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College