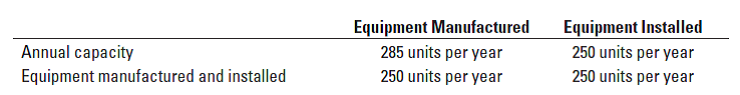

Equipment Manufactured 285 units per year 250 units per year Equipment Installed 250 units per year 250 units per year Annual capacity Equipment manufactured and installed 1. Washington's engineers have found a way to reduce equipment manufacturing time. The new method would cost an additional $500 per unit and would allow Washington to manufacture 30 additional units a year. Should Washington implement the new method? Show your calculations. 2. Washington's designers have proposed a change in direct materials that would increase direct mate- rial costs by $2,000 per unit. This change would enable Washington to install 285 units of equipment each year. If Washington makes the change, it will implement the new design on all equipment sold. Should Washington use the new design? Show your calculations. 3. A new installation technique has been developed that will enable Washington's engineers to install 7 additional units of equipment a year. The new method will increase installation costs by $145,000 each year. Should Washington implement the new technique? Show your calculations. 4. Washington is considering how to motivate workers to improve their productivity (output per hour). One proposal is to evaluate and compensate workers in the manufacturing and installation depart- ments on the basis of their productivities. Do you think the new proposal is a good idea? Explain briefly. Required

Theory of constraints, throughput margin, and relevant costs. Washington Industries manufactures electronic testing equipment. Washington also installs the equipment at customers’ sites and ensures that it functions smoothly. Additional information on the manufacturing and installation departments is as follows (capacities are expressed in terms of the number of units of electronic testing equipment):

Washington manufactures only 250 units per year because the installation department has only enough capacity to install 250 units. The equipment sells for $55,000 per unit (installed) and has direct material costs of $30,000. All costs other than direct material costs are fixed. The following requirements refer only to the preceding data. There is no connection between the requirements.

Trending now

This is a popular solution!

Step by step

Solved in 7 steps with 3 images