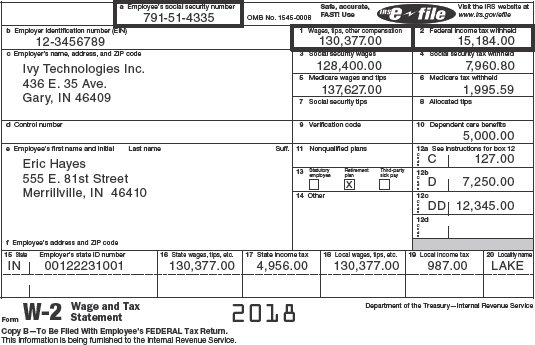

Eric, your friend, received his Form W-2 from his employer (below) and has asked for your help. Eric’s 2018 salary was $145,000 and he does not understand why the amounts in Boxes 1, 3 and 5 are not $145,000? His final paycheck for the year included the following information: – Eric contributed 5 percent of his salary to the company 401(k) plan on a pre-tax basis. – Eric is married with two children. He had $5,000 deducted from his wages for a Dependent Care Flexible Spending Account. – Eric is enrolled in the company-sponsored life insurance program. He has a policy that provides a benefit of $145,000. – Eric contributed $2,500 to the Health Care Flexible Spending Account (he keeps forgetting that the maximum deferral has increased over the years). Using the information and Eric’s Form W-2, prepare an email to Eric reconciling his salary of $145,000 to the amounts in Boxes 1, 3, and 5

Eric, your friend, received his Form W-2 from his employer (below) and has asked for your help. Eric’s 2018 salary was $145,000 and he does not understand why the amounts in Boxes 1, 3 and 5 are not $145,000? His final paycheck for the year included the following information: – Eric contributed 5 percent of his salary to the company 401(k) plan on a pre-tax basis. – Eric is married with two children. He had $5,000 deducted from his wages for a Dependent Care Flexible Spending Account. – Eric is enrolled in the company-sponsored life insurance program. He has a policy that provides a benefit of $145,000. – Eric contributed $2,500 to the Health Care Flexible Spending Account (he keeps forgetting that the maximum deferral has increased over the years). Using the information and Eric’s Form W-2, prepare an email to Eric reconciling his salary of $145,000 to the amounts in Boxes 1, 3, and 5

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter13: Accounting For Payroll And Payroll Taxes

Section13.3: Reporting Withholding And Payroll Taxes

Problem 1OYO

Related questions

Question

Eric, your friend, received his Form W-2 from his employer (below) and has asked for your help. Eric’s 2018 salary was $145,000 and he does not understand why the amounts in Boxes 1, 3 and 5 are not $145,000? His final paycheck for the year included the following information: – Eric contributed 5 percent of his salary to the company 401(k) plan on a pre-tax basis. – Eric is married with two children. He had $5,000 deducted from his wages for a Dependent Care Flexible Spending Account. – Eric is enrolled in the company-sponsored life insurance program. He has a policy that provides a benefit of $145,000. – Eric contributed $2,500 to the Health Care Flexible Spending Account (he keeps forgetting that the maximum deferral has increased over the years). Using the information and Eric’s Form W-2, prepare an email to Eric reconciling his salary of $145,000 to the amounts in Boxes 1, 3, and 5

Transcribed Image Text:a Employee's socalscully umber

791-51-4335

Sate, accurate,

OMB No. 1545-0008 FASTI Use

Vst the IRS wabelta at

efile

www.s.gowerte

b Employor Identification number EN

12-3456789

1 Wages, ips, cner oomperealon

130,377.00

2 Foderal ncome tax wihelG

15, 184.00

a Employer's nama, addross, and ZIP code

* Sucaluny wagur

128,400.00

Ivy Technologies Inc.

436 E. 35 Ave.

7,960.80

6 Modicare tax withheld

1,995.59

6 Medcare wages and tips

Gary, IN 46409

137,627.00

7 Socal necurtty tips

8 Allocated tips

d Control rumber

9 Vorication code

10 Depanderk cara bonefts

5,000.00

• Employae's firstname and Intial

Sur. 11 Nonqualned plans

Last name

12a Soo nstructions for box 12

Eric Hayes

127.00

12b

plan

sick p

555 E. 81st Street

7,250.00

Merrillville, IN 46410

14 Cther

120

| DD| 12,345.00

12d

f Employoe's addross and DP code

15 State Employer's state ID number

IN | 00122231001

16 Stata wagas, tips, ata.

17 State Income tax

18 Local wagus, 1ps, atc.

19 Local Income tax

20 Localtty name

130,377.00

4,956.00

130,377.00

987.00

LAKE

Form W-2 Wage and Tax

Statement

Department of the Treaury-Internal Roverue Service

2018

Copy B-To Be FIlled With Employee's FEDERAL Tax Return.

This Information Is belng fumished to the Intemal Revenue Service.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you