estimated annual retum () which constrairts are binding? what is your interpretation of these constraints in terms of the problem? (Select all that apply) C Constraint 1. Al funds available are being utized. O Constraint 2 The maximum permissibie rkis being incured. O Constraint 3. All evalable shares of US. O are being purchased. ONone of the constraints are binding (a what are the dual values for the constraints? Interpret each. (Round your anwers te twe decimal places) constraint 1 Constraint 1 has a dual value of 0.09. r an adonal dollar isadded te the available funds, the total annual retum is predicted to inorease by sa.0n. O Constraint 1 has a dual value ofS.an additional dallar s added te the avalable funda, the total annual return is prodicted to increase by $5. CConstraint 1 has a dual value of 3. If an addtional dollar is added to the alatle fund. the total ann return is predicted to increese by $3. OConstreint I has a dual value of 1.33. an adstional dar is added to the avalable funds, the total anual retun a predicted to increase by $1.33. OConatraint 1 has a slack of s200. Addtional dolars added to the avaliabie fund wl net ingrove the tetal annual retum constraint 2

estimated annual retum () which constrairts are binding? what is your interpretation of these constraints in terms of the problem? (Select all that apply) C Constraint 1. Al funds available are being utized. O Constraint 2 The maximum permissibie rkis being incured. O Constraint 3. All evalable shares of US. O are being purchased. ONone of the constraints are binding (a what are the dual values for the constraints? Interpret each. (Round your anwers te twe decimal places) constraint 1 Constraint 1 has a dual value of 0.09. r an adonal dollar isadded te the available funds, the total annual retum is predicted to inorease by sa.0n. O Constraint 1 has a dual value ofS.an additional dallar s added te the avalable funda, the total annual return is prodicted to increase by $5. CConstraint 1 has a dual value of 3. If an addtional dollar is added to the alatle fund. the total ann return is predicted to increese by $3. OConstreint I has a dual value of 1.33. an adstional dar is added to the avalable funds, the total anual retun a predicted to increase by $1.33. OConatraint 1 has a slack of s200. Addtional dolars added to the avaliabie fund wl net ingrove the tetal annual retum constraint 2

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter4: Linear Programming Models

Section: Chapter Questions

Problem 82P

Related questions

Question

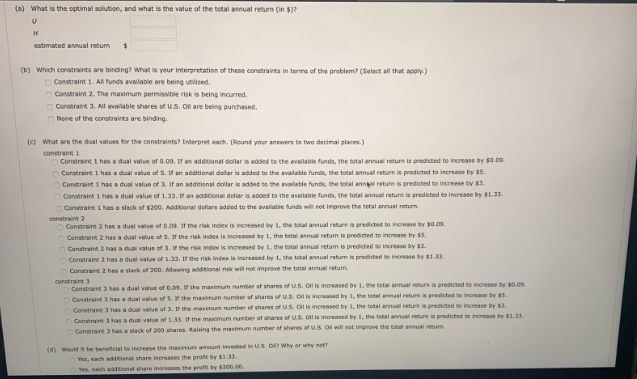

Transcribed Image Text:(a) What is the optimal solution, and what is the value of the total annual return (in $)?

estimated annual returm

(b) Which constraints are binding? What is your interpretation of these constraints in terms of the problem? (Select all that apply.)

O Constraint 1. All funds available are being utized.

O Constraint 2. The maximum permissible risk is being incurred.

O Constraint 3. All available shares of U.S. Ol are being purchased.

O None of the constraints are binding.

(e) What are the dual values for the constraints? Interpret each. (Round your answers to two decimal places. )

constraint 1

O Constraint 1 has a dual volue of 0.09. It an adational dollar is added to the avallable funds, the botal annual retum is predicted to increase by $0.09.

O Constraint 1 has a dual value of 5. If an additional dollar is added to the avalable funda, the total annual return is predicted to increase by $5.

O Constraint 1 has a dual value of 3. If an additional dolar is added to the avalatle funds, the total annl return is predicted to increase by $3.

O Constraint 1 has a duel value of 1.33. an additional dellar is added to the aveilable funds, the total annual retun a predicted to increase by 1.33.

O Constraint 1 has a slack of s200. Additional dollars added to the avalable funds will not improve the tetal annual return.

constraint 2

O Constraint 2 has a dual value of 0.09. It the risk index is increesed by 1, the tutal annual return is predicted to increase by s0.00.

Constreint 2 has a dusl velue of S. If the risk index is increased by 1, the total annual retum is predicted to increase by $5.

O Canstraint 2 has a dual value of 3. If the risk index is increased by 1. the total annual retum is predicted to increase by 53.

O Constraint 2 has a duel value of 1.33. the risk index la increased by 1, the total annual retum is predicted te increase by $1.33.

Coratraint 2 hes a slack of 200. Alowing additional risk wil not improve the total annual retum.

constraint 3

Constraint 3 has a dual value of 0.09. the maximum number of shares of U.S. O is increased by 1. the total annual return is predicted to increase by s0.09.

Constraint 3 has a dual value of 5. the maximum number of shares of u.S. Ol is increased by 1, the tetal annual return is predictod te increase by 5.

O Constraint 3 has a dual velue of 3. If the maimum number ef shares of US. Ol s increased by 1, the total annual return is predicted te increase by $3.

O Conatraint 3 has a dual value of 133. If the maximum number of shares of US. Ol is increased by 1, the total annual return ie predicted to increasey 1.33.

Constraint 3 has a slack of 200 shares. Raising the masimum number cf shares of US. Ol will net improve the total annual retum

(4) Would t be beneficial to increese the maxium amount invested in U.S O7 Why or why not?

Yos, each adtmonal chare increases the proft by $1.33

Yes, each addtional share inreases the profn by 200.00.

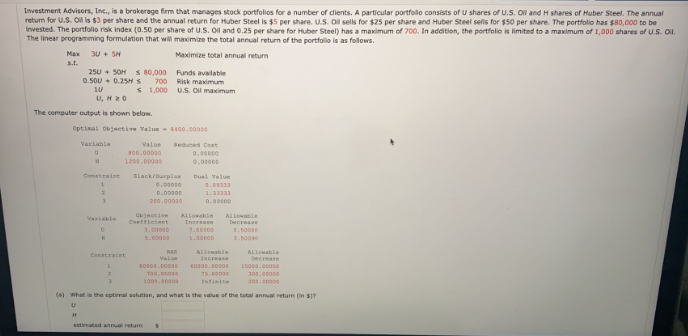

Transcribed Image Text:Investment Advisors, Inc., is a brokerage firm that manages stock portfolos for a number of dients. A particular portfollo consists of U shares of U.S. Ol and H shares of Huber Steel. The annual

Invested. The portfolio risk index (0.50 per share of U.S. Oil and 0.25 per share for Huber Steel) has a maximum of 700. In addition, the portfolio is limited to a maxcimum of 1,000 shares of U.S. Ol.

The linear programming formulation that will maximize the total annual return of the portfolo is as follows.

Max 30 + SH

Maximize total annual return

s.t.

250 + SOH S 80,000 Funds available

0.50U + 0.25H S

700 Risk maximum

S 1,000 U.S. Ol maximum

U, H20

The computer output is shown below.

Optimal objective Value - 00.0c000s

Variable

Value

Beduces Cent

0.00000

0.01000

00.00000

1200.00000

Constraint

Slack/barpius

Dual Velue

0.00oto

0.000

23.ב

200.c0030

0.00000

Cjeotive

Coeftielent

Allowable

Inerease

7.00000

ALjowale

Decrease

Varieble

3.00000

.5000

5.0000

3.5000

RAS

Value

Allewable

Iscrease

ALlewable

Constraint

Decrease

so0.co

75. coon0

301.c000

1000.0000

Intinite

201.coo00

(a) what in the eptimal selution, and what is the value of the total annual retum in $)7

estimated annuel retum

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,