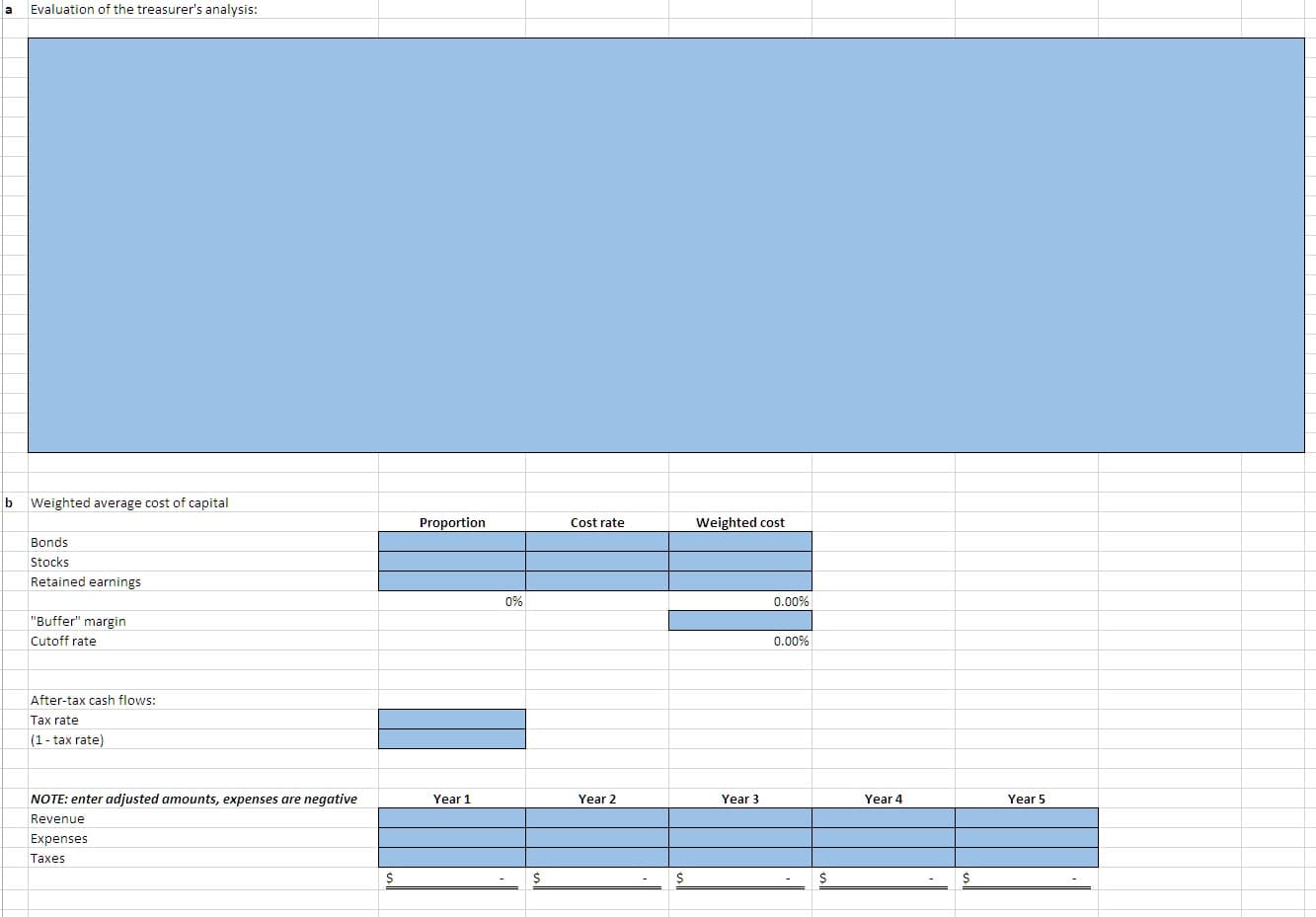

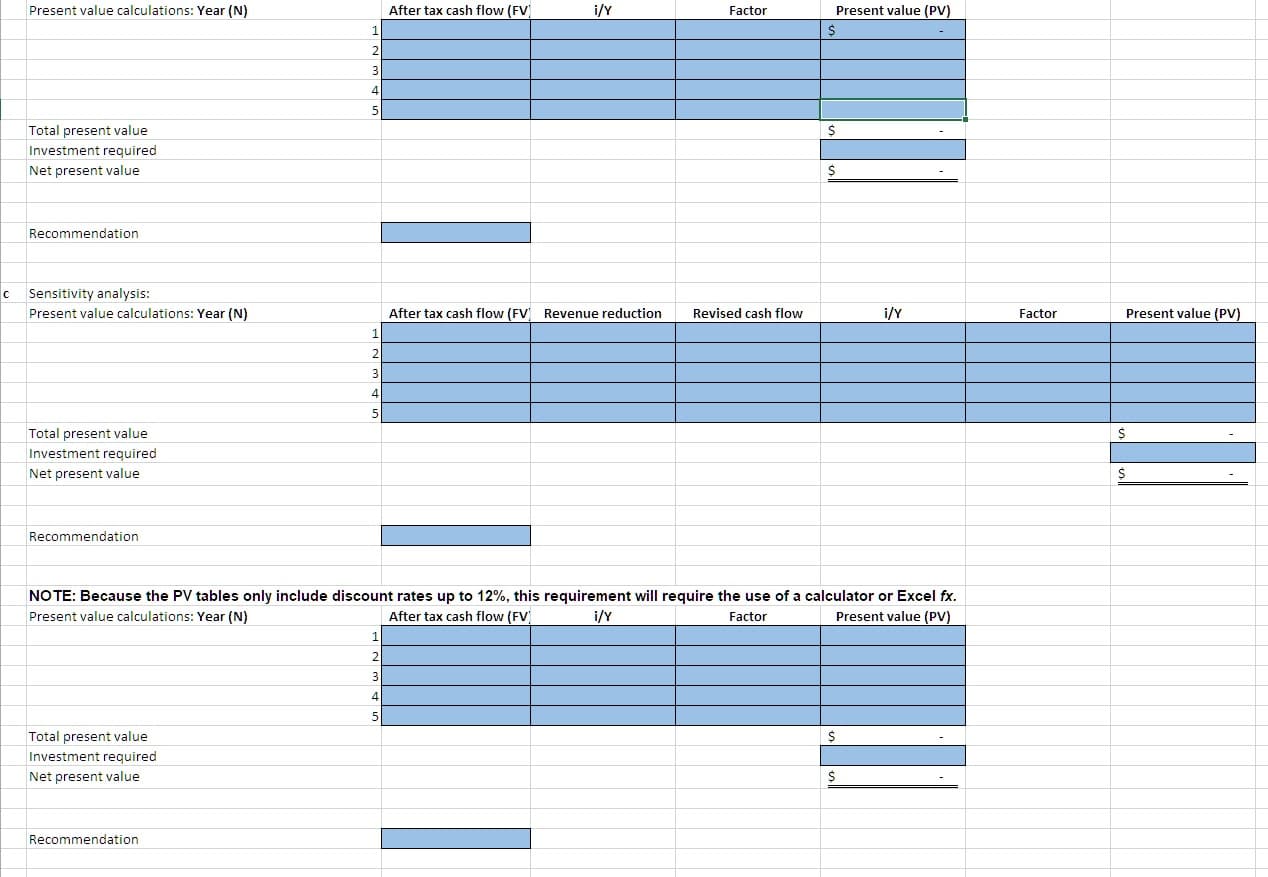

Evaluation of the treasurer's analysis: b Weighted average cost of capital Proportion Weighted cost Cost rate Bonds Stocks Retained earnings 0% 0.00% "Buffer" margin Cutoff rate 0.00% After-tax cash flows: Tax rate (1-tax rate) NOTE: enter adjusted amounts, expenses are negative Year 3 Year 1 Year 2 Year 4 Year 5 Revenue Expenses Taxes $ After tax cash flow (FV i/Y Present value calculations: Year (N) Present value (PV) Factor S 2 5 Total present value S Investment required Net present value Recommendation c Sensitivity analysis: After tax cash flow (FV Present value (PV) i/Y Present value calculations: Year (N) Revenue reduction Revised cash flow Factor 2 5 Total present value Investment required Net present value Recommendation NOTE: Because the PV tables only include discount rates up to 12%, this requirement will require the use of a calculator or Excel fx. After tax cash flow (FV i/Y Present value (PV) Present value calculations: Year (N) Factor 5 Total present value Investment required S Net present value Recommendation

I need help with this:

New Haven Corporation recently identified an investment opportunity invovling the purchase of a patent that will permit the company to modify its line of CD recorders. The patent's purchase price is $720,000 and the legal protection it provides will last for five more years; there is no salvage value. However, after preparing the capital expenditure analysis below, New Haven's treasurer has recommended to the company's captial budgeting committee that the investment be rejected. Brad Decker, chairperson of the capital budgeting committee, find it diffult to accept the treasurer's analysis because he "feels intuitively" that the investment is attractive. For this reason, he has retained you to review the treasurer's analysis and recommendation. You are provided with the following data and summary of the treasurer's analysis:

1. Required investmnet: $720,000 cash for the patent to be amortized on a straight-line basis, five-year useful life, with zero salvage value.

2. Project cash revenue and operating expenses:

| Year | Cash Revenue | Cash Expenses |

| 1 | $620,000 | $240,000 |

| 2 | 560,000 | 200,000 |

| 3 | 400,000 | 170,000 |

| 4 | 250,000 | 80,000 |

| 5 | 200,000 | 50,000 |

| $2,030,000 | $740,000 |

4. Income taxes: New Haven has an overall income tax rate of 30%.

5. Treasurers analysis:

|

Average cost of captial (8% + 9% + 10%)/3 = 9% |

||

| Total cash revenue | $2,030,000 | |

| Total cash expenses | $740,000 | |

| Total amortization | 720,000 | |

| Total operating expenses | 1,460,000 | |

| Projected net income over five years | 570,000 | |

| Average annual income | 114,000 | |

| Present value of future returns | 443,420 | |

| Required investment | 720,000 | |

| Negative |

(276,580) |

Recommendation: Reject investment because of insufficient net present value.

Required:

a) Review the treasurer's anlysis, identifying any questionable aspects and beiefly comment on the apparent effect of each such item on the treasurer's analysis.

b) Prepare your own analysis of the investment, including a calculation of the proper cost of capital and hurdle rates, a net present value analysis of the project, and a brief recommendation to Decker regarding the investment (round amounts to nearest dollar).

c) Because of his concern for the uncertainties of the CD recorder business, Decker also has asked you to provied analyses supporting whether or not your recommendation would change

1. If estimates of projected cash revenue were reduced by 10%.

2. If the "buffer margin" were tripled from 2.5% to 7.5%

Refer to the two screenshots of the spreadsheets. below

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images