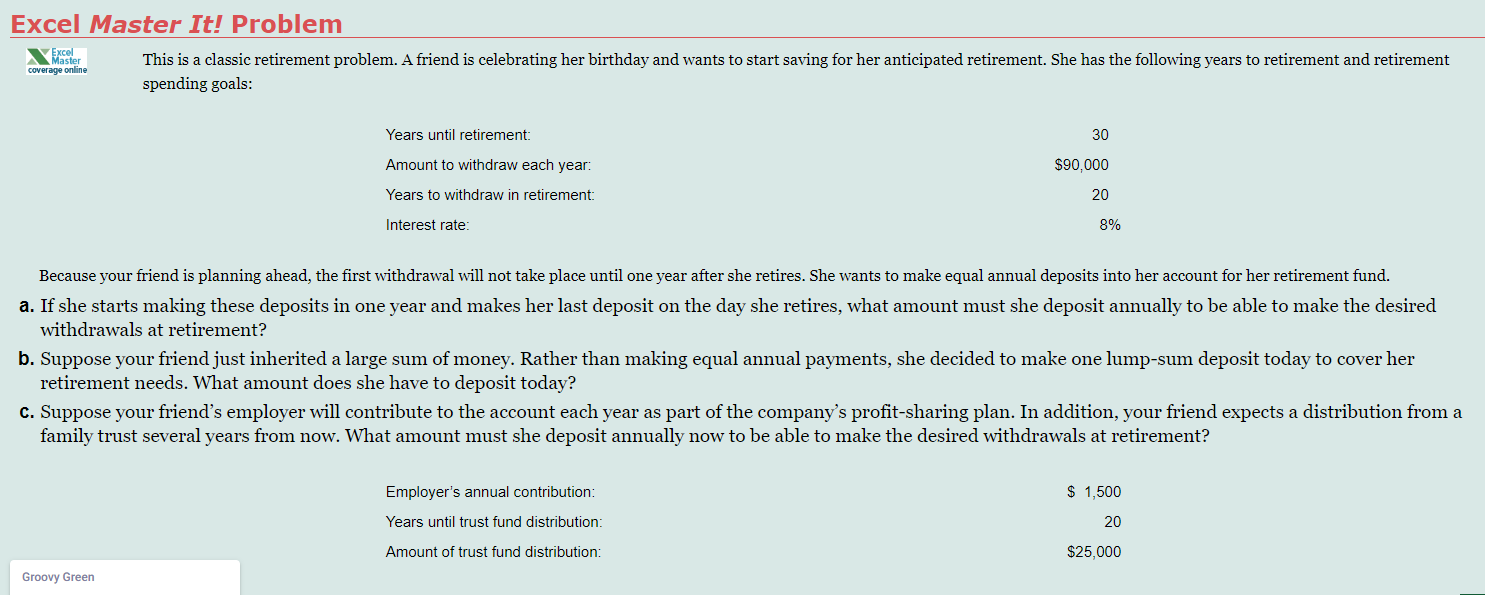

This is a classic retirement problem. A friend is celebrating her birthday and wants to start saving for her anticipated retirement. She has the following years to retirement and retirement spending goals: Years until retirement: Amount to withdraw each year: Years to withdraw in retirement: Interest rate: 30 $90,000 20 8% r friend is planning ahead, the first withdrawal will not take place until one year after she retires. She wants to make equal annual deposits into her account for her retirement fund. ts making these deposits in one year and makes her last deposit on the day she retires, what amount must she deposit annually to be able to make the desired als at retirement? Employer's annual contribution: Years until trust fund distribution: Amount of trust fund distribution: our friend just inherited a large sum of money. Rather than making equal annual payments, she decided to make one lump-sum deposit today to cover her t needs. What amount does she have to deposit today? our friend's employer will contribute to the account each year as part of the company's profit-sharing plan. In addition, your friend expects a distribution from a st several years from now. What amount must she deposit annually now to be able to make the desired withdrawals at retirement? $ 1,500 20 $25,000

This is a classic retirement problem. A friend is celebrating her birthday and wants to start saving for her anticipated retirement. She has the following years to retirement and retirement spending goals: Years until retirement: Amount to withdraw each year: Years to withdraw in retirement: Interest rate: 30 $90,000 20 8% r friend is planning ahead, the first withdrawal will not take place until one year after she retires. She wants to make equal annual deposits into her account for her retirement fund. ts making these deposits in one year and makes her last deposit on the day she retires, what amount must she deposit annually to be able to make the desired als at retirement? Employer's annual contribution: Years until trust fund distribution: Amount of trust fund distribution: our friend just inherited a large sum of money. Rather than making equal annual payments, she decided to make one lump-sum deposit today to cover her t needs. What amount does she have to deposit today? our friend's employer will contribute to the account each year as part of the company's profit-sharing plan. In addition, your friend expects a distribution from a st several years from now. What amount must she deposit annually now to be able to make the desired withdrawals at retirement? $ 1,500 20 $25,000

Chapter17: Retirement And Estate Planning

Section: Chapter Questions

Problem 4FPC

Related questions

Question

Here is my question attched in excel spreadsheet

Transcribed Image Text:Excel Master It! Problem

Ercel

Master

This is a classic retirement problem. A friend is celebrating her birthday and wants to start saving for her anticipated retirement. She has the following years to retirement and retirement

spending goals:

coverage online

Years until retirement:

30

Amount to withdraw each year:

$90,000

Years to withdraw in retirement:

20

Interest rate:

8%

Because your friend is planning ahead, the first withdrawal will not take place until one year after she retires. She wants to make equal annual deposits into her account for her retirement fund.

a. If she starts making these deposits in one year and makes her last deposit on the day she retires, what amount must she deposit annually to be able to make the desired

withdrawals at retirement?

b. Suppose your friend just inherited a large sum of money. Rather than making equal annual payments, she decided to make one lump-sum deposit today to cover her

retirement needs. What amount does she have to deposit today?

c. Suppose your friend's employer will contribute to the account each year as part of the company's profit-sharing plan. In addition, your friend expects a distribution from a

family trust several years from now. What amount must she deposit annually now to be able to make the desired withdrawals at retirement?

Employer's annual contribution:

$ 1,500

Years until trust fund distribution:

20

Amount of trust fund distribution:

$25,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning