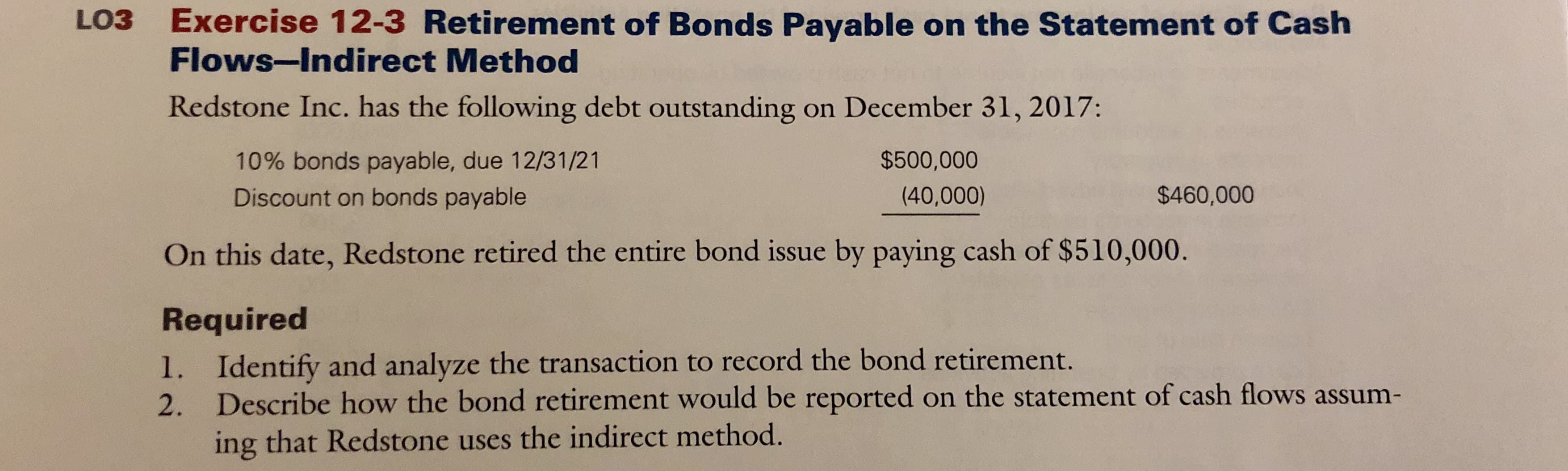

Exercise 12-3 Retirement of Bonds Payable on the Statement of Cash Flows-Indirect Method LO3 Redstone Inc. has the following debt outstanding on December 31, 2017: 10% bonds payable, due 12/31/21 Discount on bonds payable $500,000 (40,000) $460,000 On this date, Redstone retired the entire bond issue by paying cash of $510,000. Required 1. Identify and analyze the transaction to record the bond retirement. 2. Describe how the bond retirement would be reported on the statement of cash flows assum- ing that Redstone uses the indirect method.

Exercise 12-3 Retirement of Bonds Payable on the Statement of Cash Flows-Indirect Method LO3 Redstone Inc. has the following debt outstanding on December 31, 2017: 10% bonds payable, due 12/31/21 Discount on bonds payable $500,000 (40,000) $460,000 On this date, Redstone retired the entire bond issue by paying cash of $510,000. Required 1. Identify and analyze the transaction to record the bond retirement. 2. Describe how the bond retirement would be reported on the statement of cash flows assum- ing that Redstone uses the indirect method.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter12: The Statement Of Cash Flows

Section: Chapter Questions

Problem 12.3E

Related questions

Question

Transcribed Image Text:Exercise 12-3 Retirement of Bonds Payable on the Statement of Cash

Flows-Indirect Method

LO3

Redstone Inc. has the following debt outstanding on December 31, 2017:

10% bonds payable, due 12/31/21

Discount on bonds payable

$500,000

(40,000)

$460,000

On this date, Redstone retired the entire bond issue by paying cash of $510,000.

Required

1. Identify and analyze the transaction to record the bond retirement.

2. Describe how the bond retirement would be reported on the statement of cash flows assum-

ing that Redstone uses the indirect method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,