Exercise 13-11 Your answer is partially correct. Try again. The following stockholders' equity accounts, arranged alphabetically, are in the ledger of Martinez Corporation at December 31, 2020. Common Stock ($4 stated value) $1,344,000 Paid-in Capital in Excess of Par-Preferred Stock 275,000 Paid-in Capital in Excess of Stated Value-Common Stock 895,000 Preferred Stock (8%, $100 par) 535,000 Retained Earnings 1,150,000 Treasury Stock (10,500 common shares) 126,000 Prepare the stockholders' equity section of the balance sheet at December 31, 2020. (Enter the account name only and do not provide question.) MARTINEZ CORPORATION Partial Balance Sheet December 31, 2020 Stockholders' Equity Paid-in Capital Capital Stock Common Stock 1,344,000 Paid-in Capital in Excess of Stated Value-Common 895000 Total Capital Stock 2,239,000 Additional Paid-in Capital Paid-in Capital in Excess of Par-Common Stock 535000 Paid-in Capital in Excess of Par-Preferred Stock 275000 Total Additional Paid-in Capital 810000 Total Paid-in Capital 3049000 Retained Earnings 1150000 Total Paid-in Capital and Retained Earnings 4199000 Less v -126000 Treasury Stock Total Stockholders' Equity 4073000 Click if you would like to Show Work for this question: Open Show Work ১ Problem 14-04A (Video) Your answer is partially correct. Try again. On January 1, 2020, Sheridan Inc. had the following stockholders' equity balances. Common Stock (595,000 shares issued) $1,190,000 Paid-in Capital in Excess of Par-Common Stock 540,000 Common Stock Dividends Distributable 210,000 Retained Earnings 620,000 During 2020, the following transactions and events occurred. 1. Issued 105,000 shares of $2 par value common stock as a result of 15% stock dividend declared on December 15, 2021. 2. Issued 52,500 shares of common stock for cash at $4 per share. 3. Purchased 29,000 shares of common stock for the treasury at $5 per share. 4. Declared and paid a cash dividend of $111,000. 5. Sold 5,000 shares of treasury stock for cash at $5 per share. 6. Earned net income of $320,000. Prepare a stockholders' equity statement for the year. (If an amount reduces the account balance then enter with negative sign pr or parentheses e.g. (45).) Stockholders' Equity Statement For the Year Ending December 31, 2020 Paid-in Capital in Excess of Common Stock Treasury Stock Common Par - Dividends Retained Stock Common Stock Distributable Earnings Total Balances, Jan. 1 1190000 540000 210000 620000 2560000 Issued 105,000 share for stock dividend 210000 -210000 Issued 52,500 shares for cash 105000 105000 210000 Purchased 29,000 shares of treasury stock 145000 -145000 Declared cash dividend -111000 -111000 Sold 5,000 shares of treasury stock -25000 25000 Net income for year 320000 320000 Balances, Dec. 31 1505000 645000 120000 829000 2859000 %24

Exercise 13-11 Your answer is partially correct. Try again. The following stockholders' equity accounts, arranged alphabetically, are in the ledger of Martinez Corporation at December 31, 2020. Common Stock ($4 stated value) $1,344,000 Paid-in Capital in Excess of Par-Preferred Stock 275,000 Paid-in Capital in Excess of Stated Value-Common Stock 895,000 Preferred Stock (8%, $100 par) 535,000 Retained Earnings 1,150,000 Treasury Stock (10,500 common shares) 126,000 Prepare the stockholders' equity section of the balance sheet at December 31, 2020. (Enter the account name only and do not provide question.) MARTINEZ CORPORATION Partial Balance Sheet December 31, 2020 Stockholders' Equity Paid-in Capital Capital Stock Common Stock 1,344,000 Paid-in Capital in Excess of Stated Value-Common 895000 Total Capital Stock 2,239,000 Additional Paid-in Capital Paid-in Capital in Excess of Par-Common Stock 535000 Paid-in Capital in Excess of Par-Preferred Stock 275000 Total Additional Paid-in Capital 810000 Total Paid-in Capital 3049000 Retained Earnings 1150000 Total Paid-in Capital and Retained Earnings 4199000 Less v -126000 Treasury Stock Total Stockholders' Equity 4073000 Click if you would like to Show Work for this question: Open Show Work ১ Problem 14-04A (Video) Your answer is partially correct. Try again. On January 1, 2020, Sheridan Inc. had the following stockholders' equity balances. Common Stock (595,000 shares issued) $1,190,000 Paid-in Capital in Excess of Par-Common Stock 540,000 Common Stock Dividends Distributable 210,000 Retained Earnings 620,000 During 2020, the following transactions and events occurred. 1. Issued 105,000 shares of $2 par value common stock as a result of 15% stock dividend declared on December 15, 2021. 2. Issued 52,500 shares of common stock for cash at $4 per share. 3. Purchased 29,000 shares of common stock for the treasury at $5 per share. 4. Declared and paid a cash dividend of $111,000. 5. Sold 5,000 shares of treasury stock for cash at $5 per share. 6. Earned net income of $320,000. Prepare a stockholders' equity statement for the year. (If an amount reduces the account balance then enter with negative sign pr or parentheses e.g. (45).) Stockholders' Equity Statement For the Year Ending December 31, 2020 Paid-in Capital in Excess of Common Stock Treasury Stock Common Par - Dividends Retained Stock Common Stock Distributable Earnings Total Balances, Jan. 1 1190000 540000 210000 620000 2560000 Issued 105,000 share for stock dividend 210000 -210000 Issued 52,500 shares for cash 105000 105000 210000 Purchased 29,000 shares of treasury stock 145000 -145000 Declared cash dividend -111000 -111000 Sold 5,000 shares of treasury stock -25000 25000 Net income for year 320000 320000 Balances, Dec. 31 1505000 645000 120000 829000 2859000 %24

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter12: Corporations: Organization, Stock Transactions, And Dividends

Section: Chapter Questions

Problem 12.3APR: Stock transactions for corporate expansion On December 1 of the current year, the following accounts...

Related questions

Question

100%

Need Help filling in the blanks that keep coming up incorrect on the two attached questions.

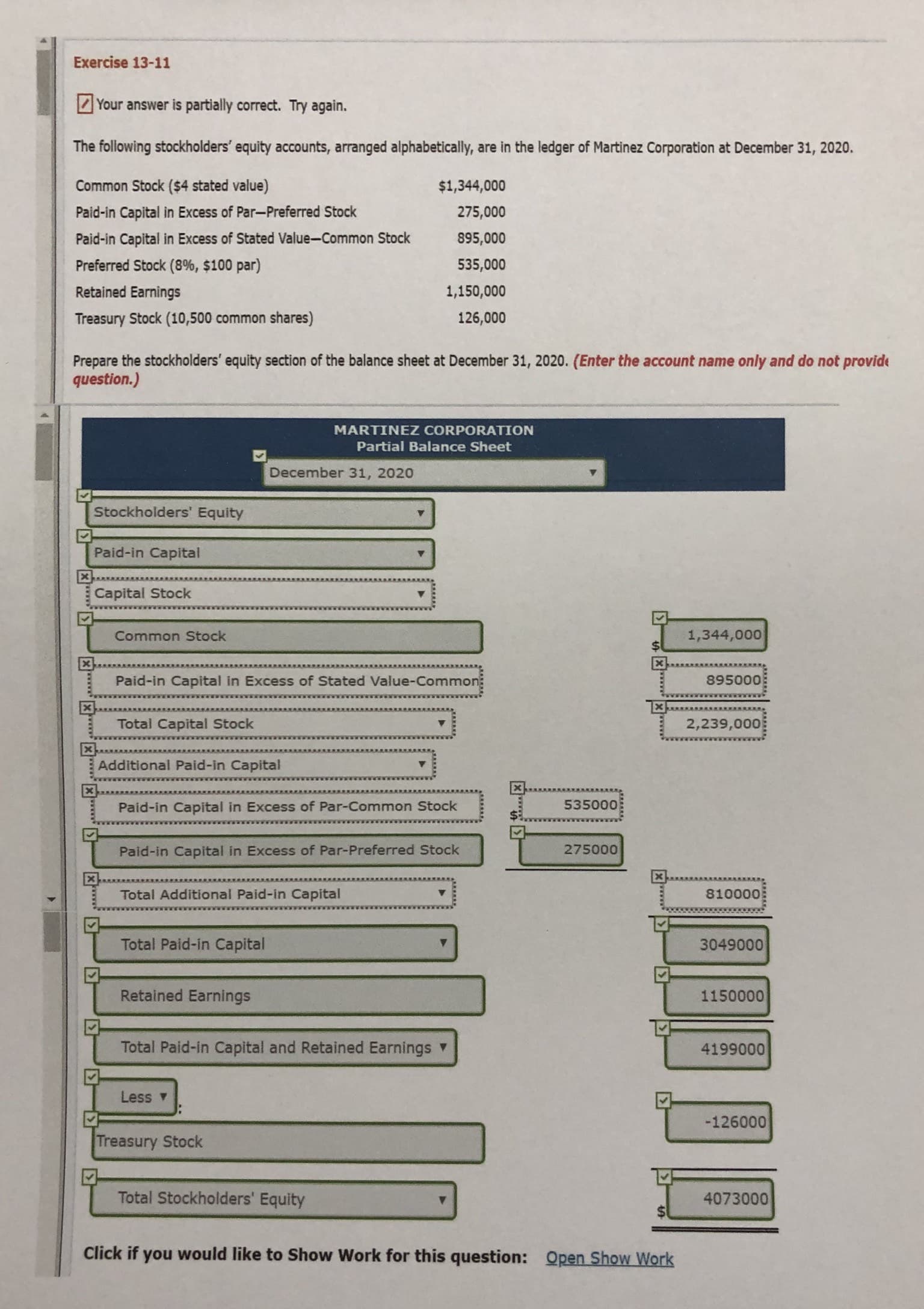

Transcribed Image Text:Exercise 13-11

Your answer is partially correct. Try again.

The following stockholders' equity accounts, arranged alphabetically, are in the ledger of Martinez Corporation at December 31, 2020.

Common Stock ($4 stated value)

$1,344,000

Paid-in Capital in Excess of Par-Preferred Stock

275,000

Paid-in Capital in Excess of Stated Value-Common Stock

895,000

Preferred Stock (8%, $100 par)

535,000

Retained Earnings

1,150,000

Treasury Stock (10,500 common shares)

126,000

Prepare the stockholders' equity section of the balance sheet at December 31, 2020. (Enter the account name only and do not provide

question.)

MARTINEZ CORPORATION

Partial Balance Sheet

December 31, 2020

Stockholders' Equity

Paid-in Capital

Capital Stock

Common Stock

1,344,000

Paid-in Capital in Excess of Stated Value-Common

895000

Total Capital Stock

2,239,000

Additional Paid-in Capital

Paid-in Capital in Excess of Par-Common Stock

535000

Paid-in Capital in Excess of Par-Preferred Stock

275000

Total Additional Paid-in Capital

810000

Total Paid-in Capital

3049000

Retained Earnings

1150000

Total Paid-in Capital and Retained Earnings

4199000

Less v

-126000

Treasury Stock

Total Stockholders' Equity

4073000

Click if you would like to Show Work for this question: Open Show Work

১

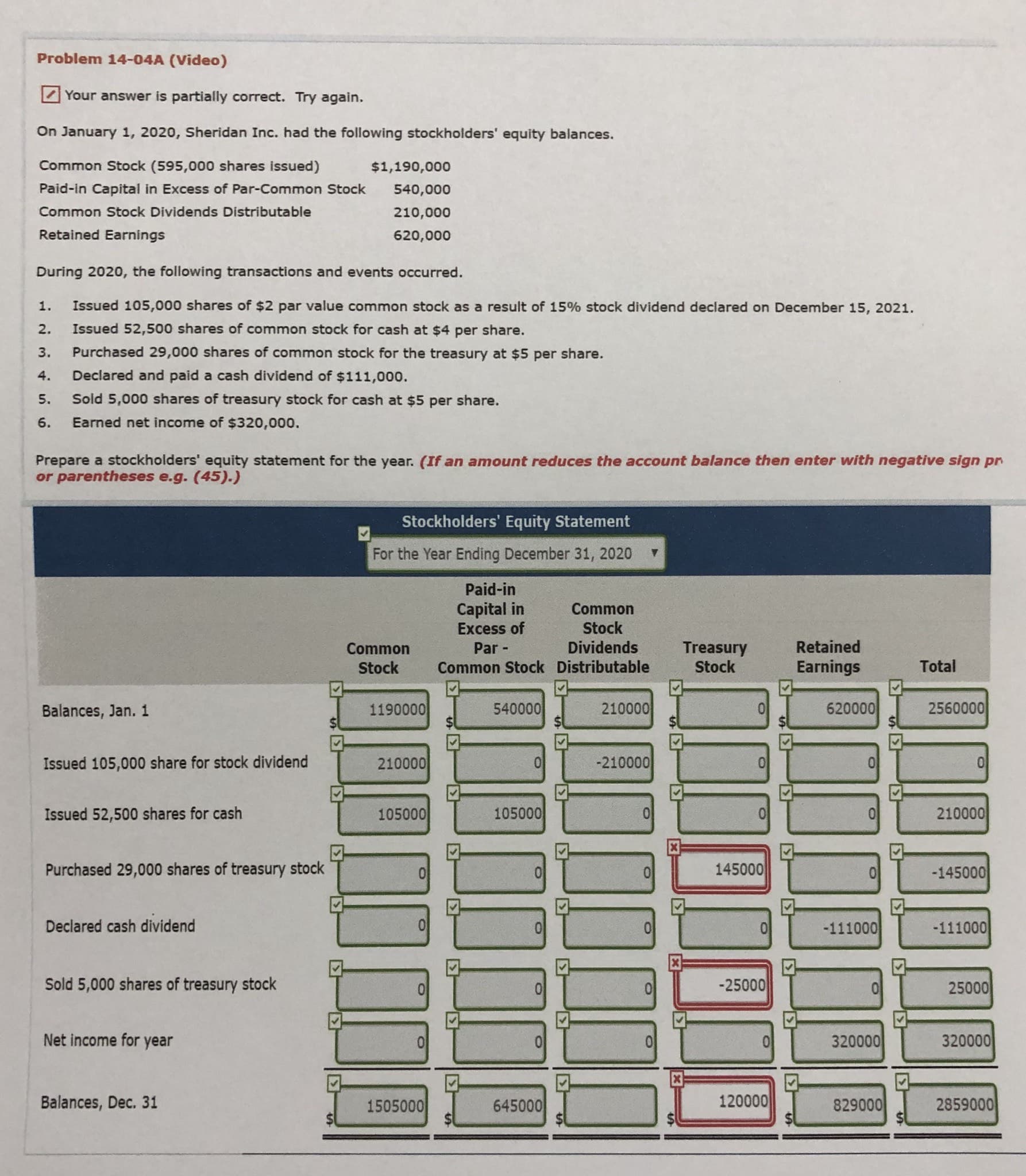

Transcribed Image Text:Problem 14-04A (Video)

Your answer is partially correct. Try again.

On January 1, 2020, Sheridan Inc. had the following stockholders' equity balances.

Common Stock (595,000 shares issued)

$1,190,000

Paid-in Capital in Excess of Par-Common Stock

540,000

Common Stock Dividends Distributable

210,000

Retained Earnings

620,000

During 2020, the following transactions and events occurred.

1.

Issued 105,000 shares of $2 par value common stock as a result of 15% stock dividend declared on December 15, 2021.

2.

Issued 52,500 shares of common stock for cash at $4 per share.

3.

Purchased 29,000 shares of common stock for the treasury at $5 per share.

4.

Declared and paid a cash dividend of $111,000.

5.

Sold 5,000 shares of treasury stock for cash at $5 per share.

6.

Earned net income of $320,000.

Prepare a stockholders' equity statement for the year. (If an amount reduces the account balance then enter with negative sign pr

or parentheses e.g. (45).)

Stockholders' Equity Statement

For the Year Ending December 31, 2020

Paid-in

Capital in

Excess of

Common

Stock

Treasury

Stock

Common

Par -

Dividends

Retained

Stock

Common Stock Distributable

Earnings

Total

Balances, Jan. 1

1190000

540000

210000

620000

2560000

Issued 105,000 share for stock dividend

210000

-210000

Issued 52,500 shares for cash

105000

105000

210000

Purchased 29,000 shares of treasury stock

145000

-145000

Declared cash dividend

-111000

-111000

Sold 5,000 shares of treasury stock

-25000

25000

Net income for year

320000

320000

Balances, Dec. 31

1505000

645000

120000

829000

2859000

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning