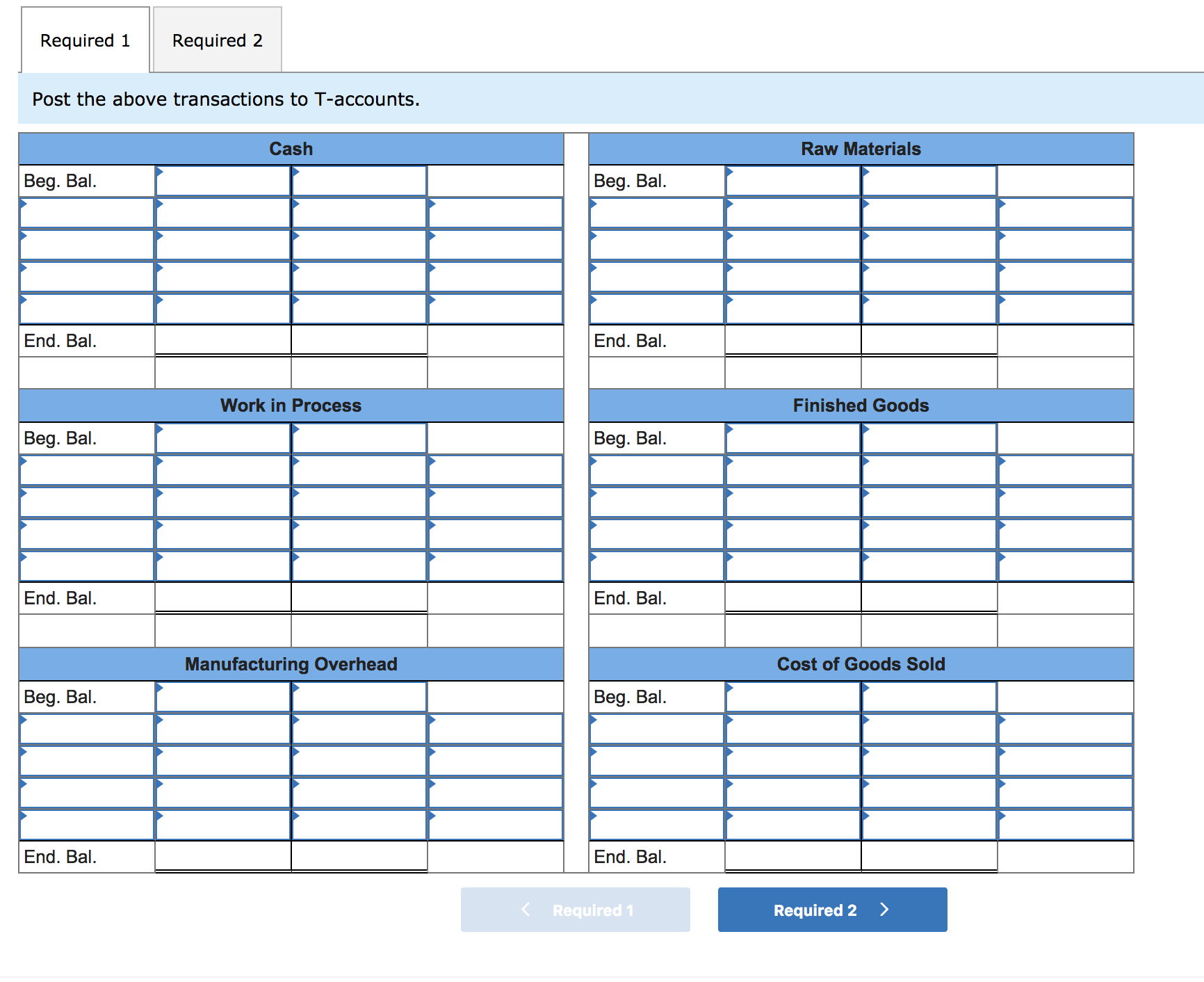

Exercise 3-2 Prepare T-Accounts [LO3-2, LO3-4] Jurvin Enterprises is a manufacturing company that had no beginning inventories. A subset of the transactions that it recorded during a recent month is shown below. a. $94,000 in raw materials were purchased for cash. b. $89,000 in raw materials were used in production. Of this amount, $78,000 was for direct materials and the remainder was for indirect materials.. c. Total labor wages of $132,000 were incurred and paid. Of this amount, $112,000 was for direct labor and the remainder was for indirect labor. d. Additional manufacturing overhead costs of $143,000 were incurred and paid. e. Manufacturing overhead of $152,000 was applied to production using the company's predetermined overhead rate. f. All of the jobs in process at the end of the month were completed. g. All of the completed jobs were shipped to customers. h. Any underapplied or overapplied overhead for the period was closed to Cost of Goods Sold. Required: 1. Post the above transactions to T-accounts. 2. Determine the adjusted cost of goods sold for the period. Required 1 Required 2 Post the above transactions to T-accounts. Cash Raw Materials Beg. Bal. Beg. Bal. End. Bal. End. Bal. Work in Process Finished Goods Beg. Bal. Beg. Bal. End. Bal. End. Bal. Manufacturing Overhead Cost of Goods Sold Beg. Bal. Beg. Bal. End. Bal. End. Bal. Required 1 Required 2

Exercise 3-2 Prepare T-Accounts [LO3-2, LO3-4] Jurvin Enterprises is a manufacturing company that had no beginning inventories. A subset of the transactions that it recorded during a recent month is shown below. a. $94,000 in raw materials were purchased for cash. b. $89,000 in raw materials were used in production. Of this amount, $78,000 was for direct materials and the remainder was for indirect materials.. c. Total labor wages of $132,000 were incurred and paid. Of this amount, $112,000 was for direct labor and the remainder was for indirect labor. d. Additional manufacturing overhead costs of $143,000 were incurred and paid. e. Manufacturing overhead of $152,000 was applied to production using the company's predetermined overhead rate. f. All of the jobs in process at the end of the month were completed. g. All of the completed jobs were shipped to customers. h. Any underapplied or overapplied overhead for the period was closed to Cost of Goods Sold. Required: 1. Post the above transactions to T-accounts. 2. Determine the adjusted cost of goods sold for the period. Required 1 Required 2 Post the above transactions to T-accounts. Cash Raw Materials Beg. Bal. Beg. Bal. End. Bal. End. Bal. Work in Process Finished Goods Beg. Bal. Beg. Bal. End. Bal. End. Bal. Manufacturing Overhead Cost of Goods Sold Beg. Bal. Beg. Bal. End. Bal. End. Bal. Required 1 Required 2

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter2: The Accounting Information System

Section: Chapter Questions

Problem 62APSA: Problem 2-62B Comprehensive Problem Mulberry Services sells electronic data processing services to...

Related questions

Question

Help

![Exercise 3-2 Prepare T-Accounts [LO3-2, LO3-4]

Jurvin Enterprises is a manufacturing company that had no beginning inventories. A subset of the transactions that it recorded during a

recent month is shown below.

a. $94,000 in raw materials were purchased for cash.

b. $89,000 in raw materials were used in production. Of this amount, $78,000 was for direct materials and the remainder was for

indirect materials..

c. Total labor wages of $132,000 were incurred and paid. Of this amount, $112,000 was for direct labor and the remainder was for

indirect labor.

d. Additional manufacturing overhead costs of $143,000 were incurred and paid.

e. Manufacturing overhead of $152,000 was applied to production using the company's predetermined overhead rate.

f. All of the jobs in process at the end of the month were completed.

g. All of the completed jobs were shipped to customers.

h. Any underapplied or overapplied overhead for the period was closed to Cost of Goods Sold.

Required:

1. Post the above transactions to T-accounts.

2. Determine the adjusted cost of goods sold for the period.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F8aeb4c9c-8d33-4b47-954d-a4d3ce02aa40%2F075505ea-d89b-458b-977f-c43e2454e10e%2Ffe4x9n.png&w=3840&q=75)

Transcribed Image Text:Exercise 3-2 Prepare T-Accounts [LO3-2, LO3-4]

Jurvin Enterprises is a manufacturing company that had no beginning inventories. A subset of the transactions that it recorded during a

recent month is shown below.

a. $94,000 in raw materials were purchased for cash.

b. $89,000 in raw materials were used in production. Of this amount, $78,000 was for direct materials and the remainder was for

indirect materials..

c. Total labor wages of $132,000 were incurred and paid. Of this amount, $112,000 was for direct labor and the remainder was for

indirect labor.

d. Additional manufacturing overhead costs of $143,000 were incurred and paid.

e. Manufacturing overhead of $152,000 was applied to production using the company's predetermined overhead rate.

f. All of the jobs in process at the end of the month were completed.

g. All of the completed jobs were shipped to customers.

h. Any underapplied or overapplied overhead for the period was closed to Cost of Goods Sold.

Required:

1. Post the above transactions to T-accounts.

2. Determine the adjusted cost of goods sold for the period.

Transcribed Image Text:Required 1

Required 2

Post the above transactions to T-accounts.

Cash

Raw Materials

Beg. Bal.

Beg. Bal.

End. Bal.

End. Bal.

Work in Process

Finished Goods

Beg. Bal.

Beg. Bal.

End. Bal.

End. Bal.

Manufacturing Overhead

Cost of Goods Sold

Beg. Bal.

Beg. Bal.

End. Bal.

End. Bal.

Required 1

Required 2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning