Explain how the possible profit and loss possibilities arise for an individual who invests in a: a. A Call Option i. Be sure to explain what a Call Option is. ii. Be sure to incorporate the cost of the Call Option in your analysis. b. A Put Option i. Be sure to explain what a Put Option is. ii. Be sure to incorporate the cost of the Put Option in your analysis.

(a)

(i)

The stock option may be of two types: a call option and a put option. Call option gives a right to the buyer to purchase the shares at current market price on pre-determined date.

The buyer has an option not the liability to purchase the shares for which option premium is paid.

(ii)

The option contract is created when both buyer and seller agree. The owner of the option call (i.e. buyer) may purchase shares till the expiration date at pre-decided option premium. By paying this premium, owner of the call option may exercise the option. The call option owner may evaluate its profit or loss based on current market price of the share.

For instance:

If Person A owns the call option of S company’s share of $250 at premium of $10. If the current market price increased to $320 before expiration date of call option. Then the buyer may exercise the call option and purchase the shares at $250 as per call option contract.

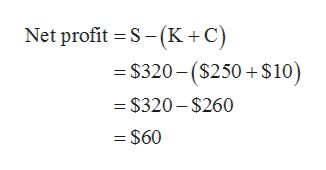

The net profit will be as follows:

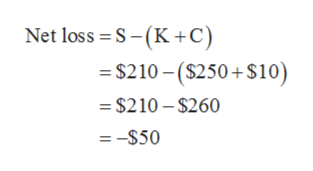

Where, K is the exercise price, S is the current market price and C is the option premium.

If the current market price declines to $210 then the net loss will be as follows:

Step by step

Solved in 8 steps with 4 images