FA 3 Set Exercises 1. What are some comparative advantages of investing in the following? a) Unit investment trusts. b) Open-end mutual funds. c) Individual stocks and bonds that you choose for yourself.

FA 3 Set Exercises 1. What are some comparative advantages of investing in the following? a) Unit investment trusts. b) Open-end mutual funds. c) Individual stocks and bonds that you choose for yourself.

Chapter7: Types And Costs Of Financial Capital

Section: Chapter Questions

Problem 6EP

Related questions

Question

Transcribed Image Text:FA 3 Set Exercises

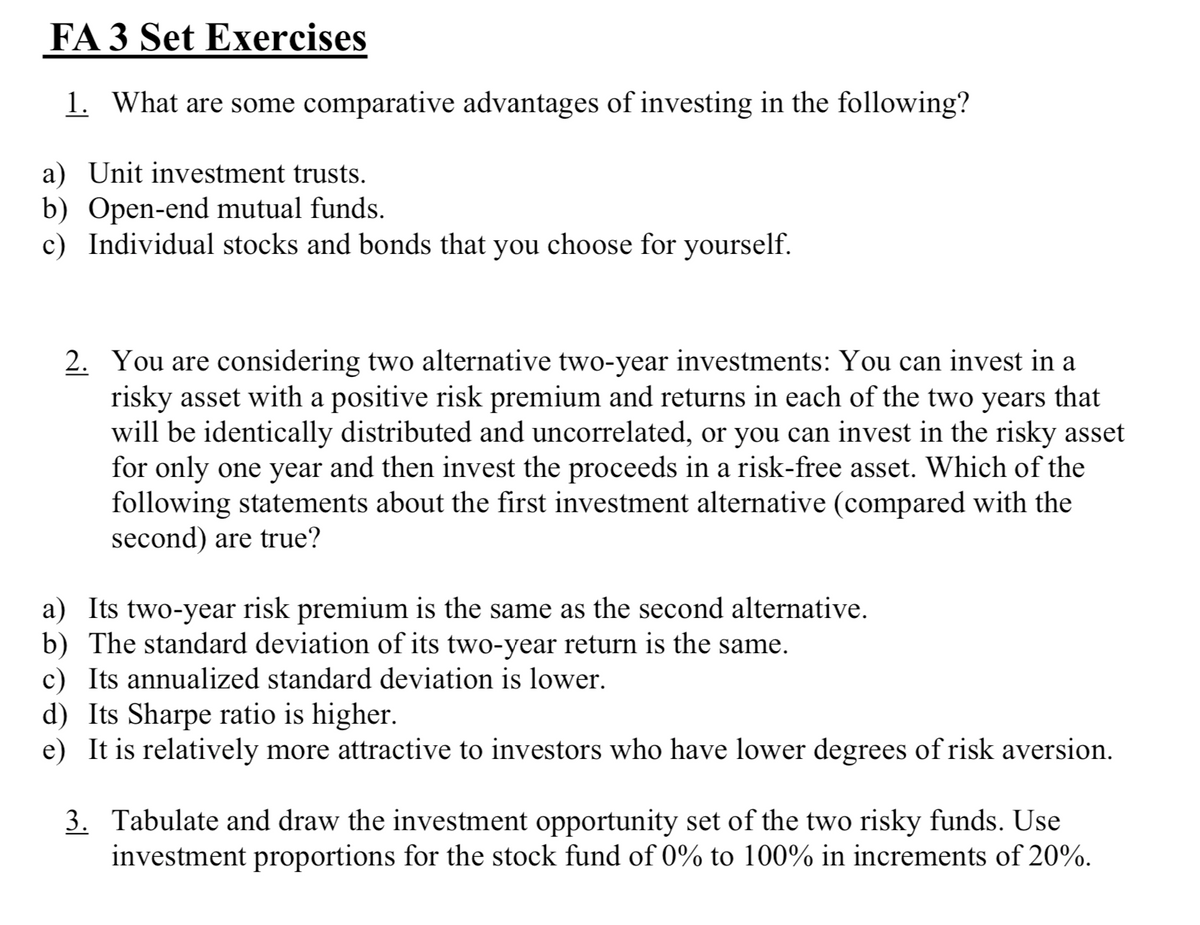

1. What are some comparative advantages of investing in the following?

a) Unit investment trusts.

b) Open-end mutual funds.

c) Individual stocks and bonds that you choose for yourself.

2. You are considering two alternative two-year investments: You can invest in a

risky asset with a positive risk premium and returns in each of the two years that

will be identically distributed and uncorrelated, or you can invest in the risky asset

for only one year and then invest the proceeds in a risk-free asset. Which of the

following statements about the first investment alternative (compared with the

second) are true?

a) Its two-year risk premium is the same as the second alternative.

b) The standard deviation of its two-year return is the same.

c) Its annualized standard deviation is lower.

d) Its Sharpe ratio is higher.

e) It is relatively more attractive to investors who have lower degrees of risk aversion.

3.

Tabulate and draw the investment opportunity set of the two risky funds. Use

investment proportions for the stock fund of 0% to 100% in increments of 20%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning