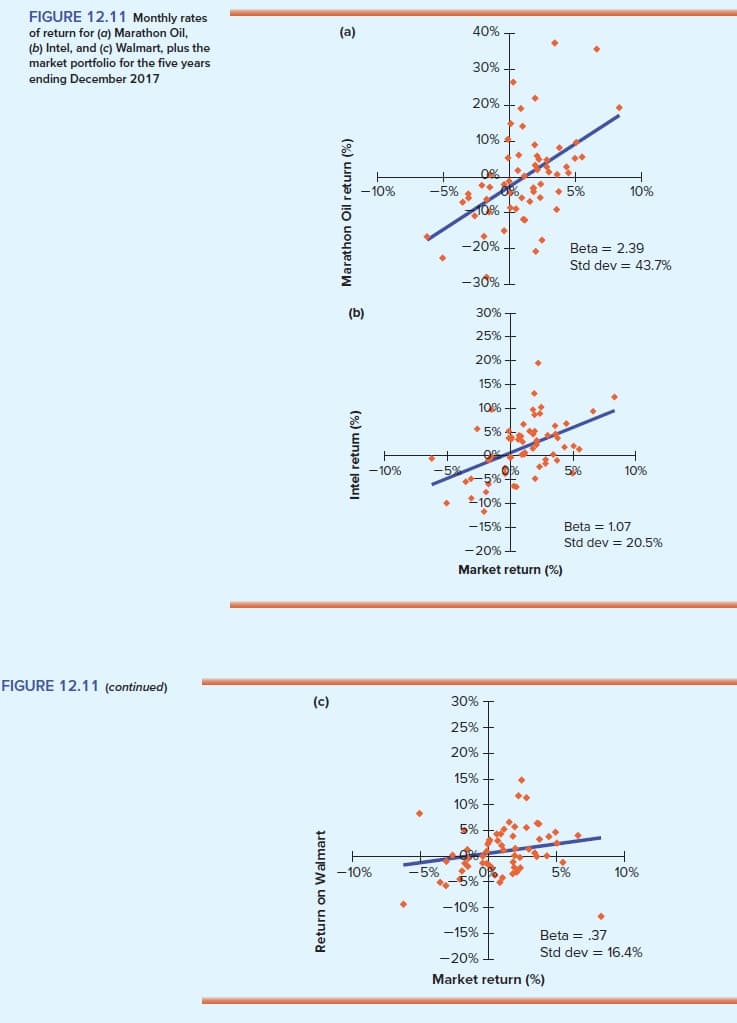

FIGURE 12.11 Monthly rates 40% of return for (a) Marathon Oil, (b) Intel, and (c) Walmart, plus the market portfolio for the five years (a) 30% ending December 2017 20% 10% 10% -10% -5% 5% -20% Beta 2.39 Std dev 43.7 % -30 % 30%-T (b) 25%+ 20%+ 15%- 10% 5% 506 -10% 10% -5% 5% 10% Beta 1.07 -15% Std dev 20.5% -20% Market return (%) FIGURE 12.11 (continued) 30% (c) 25% 20% 15% 10% 5% t. -5% Op 5% 5% -10% 10% -10% -15% Beta = 37 Std dev 16.4% -20 % Market return (%) Return on Walmart Marathon Oil return (%) Intel retum (%)

FIGURE 12.11 Monthly rates 40% of return for (a) Marathon Oil, (b) Intel, and (c) Walmart, plus the market portfolio for the five years (a) 30% ending December 2017 20% 10% 10% -10% -5% 5% -20% Beta 2.39 Std dev 43.7 % -30 % 30%-T (b) 25%+ 20%+ 15%- 10% 5% 506 -10% 10% -5% 5% 10% Beta 1.07 -15% Std dev 20.5% -20% Market return (%) FIGURE 12.11 (continued) 30% (c) 25% 20% 15% 10% 5% t. -5% Op 5% 5% -10% 10% -10% -15% Beta = 37 Std dev 16.4% -20 % Market return (%) Return on Walmart Marathon Oil return (%) Intel retum (%)

Chapter10: Project Cash Flows And Risk

Section: Chapter Questions

Problem 15PROB

Related questions

Question

Figure 12.11 shows plots of monthly

d. Consider a well-diversified portfolio made up of stocks with the same beta as Intel. What are the beta and standard deviation of this portfolio’s return? The standard deviation of the market portfolio’s return is 20%.

e. What is the expected rate of return on each stock? Use the

Transcribed Image Text:FIGURE 12.11 Monthly rates

40%

of return for (a) Marathon Oil,

(b) Intel, and (c) Walmart, plus the

market portfolio for the five years

(a)

30%

ending December 2017

20%

10%

10%

-10%

-5%

5%

-20%

Beta 2.39

Std dev 43.7 %

-30 %

30%-T

(b)

25%+

20%+

15%-

10%

5%

506

-10%

10%

-5%

5%

10%

Beta 1.07

-15%

Std dev 20.5%

-20%

Market return (%)

FIGURE 12.11 (continued)

30%

(c)

25%

20%

15%

10%

5% t.

-5%

Op

5%

5%

-10%

10%

-10%

-15%

Beta = 37

Std dev 16.4%

-20 %

Market return (%)

Return on Walmart

Marathon Oil return (%)

Intel retum (%)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you