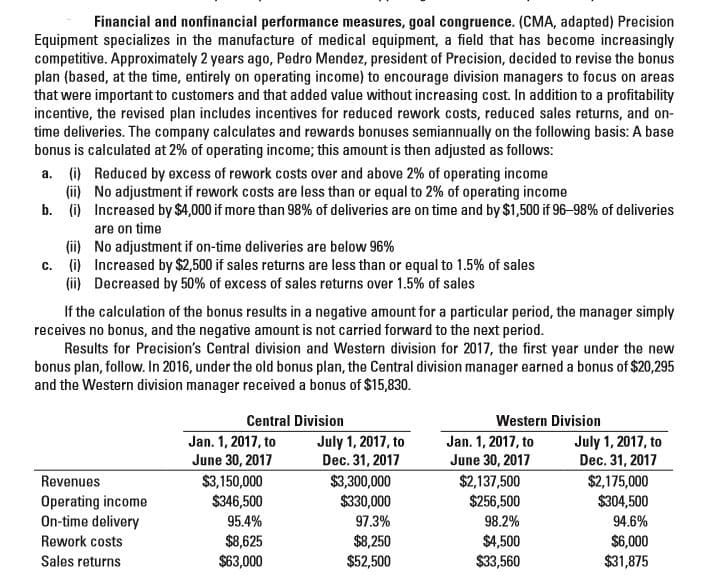

Financial and nonfinancial performance measures, goal congruence. (CMA, adapted) Precision Equipment specializes in the manufacture of medical equipment, a field that has become increasingly competitive. Approximately 2 years ago, Pedro Mendez, president of Precision, decided to revise the bonus plan (based, at the time, entirely on operating income) to encourage division managers to focus on areas that were important to customers and that added value without increasing cost. In addition to a profitability incentive, the revised plan includes incentives for reduced rework costs, reduced sales returns, and on- time deliveries. The company calculates and rewards bonuses semiannually on the following basis: A base bonus is calculated at 2% of operating income; this amount is then adjusted as follows: a. (i) Reduced by excess of rework costs over and above 2% of operating income (ii) No adjustment if rework costs are less than or equal to 2% of operating income b. (i) Increased by $4,000 if more than 98% of deliveries are on time and by $1,500 if 96–98% of deliveries are on time (ii) No adjustment if on-time deliveries are below 96% c. (i) Increased by $2,500 if sales returns are less than or equal to 1.5% of sales (ii) Decreased by 50% of excess of sales returns over 1.5% of sales If the calculation of the bonus results in a negative amount for a particular period, the manager simply receives no bonus, and the negative amount is not carried forward to the next period. Results for Precision's Central division and Western division for 2017, the first year under the new bonus plan, follow. In 2016, under the old bonus plan, the Central division manager earned a bonus of $20,295 and the Western division manager received a bonus of $15,830. Central Division Western Division Jan. 1, 2017, to June 30, 2017 July 1, 2017, to Dec. 31, 2017 Jan. 1, 2017, to June 30, 2017 July 1, 2017, to Dec. 31, 2017 $3,300,000 $330,000 $2,137,500 $256,500 98.2% $4,500 $33,560 Revenues $3,150,000 $2,175,000 Operating income On-time delivery Rework costs $346,500 95.4% $8,625 $63,000 $304,500 97.3% 94.6% $8,250 $52,500 $6,000 $31,875 Sales returns

Financial and nonfinancial performance measures, goal congruence. (CMA, adapted) Precision Equipment specializes in the manufacture of medical equipment, a field that has become increasingly competitive. Approximately 2 years ago, Pedro Mendez, president of Precision, decided to revise the bonus plan (based, at the time, entirely on operating income) to encourage division managers to focus on areas that were important to customers and that added value without increasing cost. In addition to a profitability incentive, the revised plan includes incentives for reduced rework costs, reduced sales returns, and on- time deliveries. The company calculates and rewards bonuses semiannually on the following basis: A base bonus is calculated at 2% of operating income; this amount is then adjusted as follows: a. (i) Reduced by excess of rework costs over and above 2% of operating income (ii) No adjustment if rework costs are less than or equal to 2% of operating income b. (i) Increased by $4,000 if more than 98% of deliveries are on time and by $1,500 if 96–98% of deliveries are on time (ii) No adjustment if on-time deliveries are below 96% c. (i) Increased by $2,500 if sales returns are less than or equal to 1.5% of sales (ii) Decreased by 50% of excess of sales returns over 1.5% of sales If the calculation of the bonus results in a negative amount for a particular period, the manager simply receives no bonus, and the negative amount is not carried forward to the next period. Results for Precision's Central division and Western division for 2017, the first year under the new bonus plan, follow. In 2016, under the old bonus plan, the Central division manager earned a bonus of $20,295 and the Western division manager received a bonus of $15,830. Central Division Western Division Jan. 1, 2017, to June 30, 2017 July 1, 2017, to Dec. 31, 2017 Jan. 1, 2017, to June 30, 2017 July 1, 2017, to Dec. 31, 2017 $3,300,000 $330,000 $2,137,500 $256,500 98.2% $4,500 $33,560 Revenues $3,150,000 $2,175,000 Operating income On-time delivery Rework costs $346,500 95.4% $8,625 $63,000 $304,500 97.3% 94.6% $8,250 $52,500 $6,000 $31,875 Sales returns

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter11: Strategic Cost Management

Section: Chapter Questions

Problem 9E

Related questions

Question

Why did Mendez need to introduce these new performance measures? That is, why does Mendez need to use these performance measures in addition to the operating-income numbers for the period?

Transcribed Image Text:Financial and nonfinancial performance measures, goal congruence. (CMA, adapted) Precision

Equipment specializes in the manufacture of medical equipment, a field that has become increasingly

competitive. Approximately 2 years ago, Pedro Mendez, president of Precision, decided to revise the bonus

plan (based, at the time, entirely on operating income) to encourage division managers to focus on areas

that were important to customers and that added value without increasing cost. In addition to a profitability

incentive, the revised plan includes incentives for reduced rework costs, reduced sales returns, and on-

time deliveries. The company calculates and rewards bonuses semiannually on the following basis: A base

bonus is calculated at 2% of operating income; this amount is then adjusted as follows:

a. (i) Reduced by excess of rework costs over and above 2% of operating income

(ii) No adjustment if rework costs are less than or equal to 2% of operating income

b. (i) Increased by $4,000 if more than 98% of deliveries are on time and by $1,500 if 96–98% of deliveries

are on time

(ii) No adjustment if on-time deliveries are below 96%

c. (i) Increased by $2,500 if sales returns are less than or equal to 1.5% of sales

(ii) Decreased by 50% of excess of sales returns over 1.5% of sales

If the calculation of the bonus results in a negative amount for a particular period, the manager simply

receives no bonus, and the negative amount is not carried forward to the next period.

Results for Precision's Central division and Western division for 2017, the first year under the new

bonus plan, follow. In 2016, under the old bonus plan, the Central division manager earned a bonus of $20,295

and the Western division manager received a bonus of $15,830.

Central Division

Western Division

Jan. 1, 2017, to

June 30, 2017

July 1, 2017, to

Dec. 31, 2017

Jan. 1, 2017, to

June 30, 2017

July 1, 2017, to

Dec. 31, 2017

$3,300,000

$330,000

$2,137,500

$256,500

98.2%

$4,500

$33,560

Revenues

$3,150,000

$2,175,000

Operating income

On-time delivery

Rework costs

$346,500

95.4%

$8,625

$63,000

$304,500

97.3%

94.6%

$8,250

$52,500

$6,000

$31,875

Sales returns

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,