Financial statements for Rundle Company follow. RUNDLE COMPANY Balance Sheets As of December 31 Year 4 Year 3 Assets Current assets Cash $ 22,000 $ 18,000 Marketable securities 21,200 7,200 Accounts receivable (net) 53,000 45,000 Inventories 138,000 146,000 Prepaid items 27,000 12,000 Total current assets 261,200 228,200 Investments 27,000 20,000 Plant (net) 270,000 255,000 Land 30,000 25,000 Total assets $ 588,200 $ 528,200 Liabilities and Stockholders’ Equity Liabilities Current liabilities Notes payable $ 31,800 $ 13,500 Accounts payable 133,800 120,000 Salaries payable 21,000 15,000 Total current liabilities 186,600 148,500 Noncurrent liabilities Bonds payable 100,000 100,000 Other 27,000 22,000 Total noncurrent liabilities 127,000 122,000 Total liabilities 313,600 270,500 Stockholders’ equity Preferred stock, (par value $10, 4% cumulative, non-participating; 7,000 shares authorized and issued) 70,000 70,000 Common stock (no par; 50,000 shares authorized; 10,000 shares issued) 70,000 70,000 Retained earnings 134,600 117,700 Total stockholders’ equity 274,600 257,700 Total liabilities and stockholders’ equity $ 588,200 $ 528,200 n. Return on investment (average total assets in Year 3 is $528,200). (Round your answers to 2 decimal places.) o. Return on equity (average stockholders' equity in Year 3 is $257,700). (Round your answers to 2 decimal places.) p. Earnings per share (total shares outstanding is unchanged). (Round your answers to 2 decimal places.) q. Book value per share of common stock. (Round your answers to 2 decimal places.) r. Price-earnings ratio (market price per share: Year 3, $12.35; Year 4, $13.70). (Round your intermediate calculations and final answer to 2 decimal places.) s. Dividend yield on common stock. (Round your answers to 2 decimal places.)

Financial statements for Rundle Company follow. RUNDLE COMPANY Balance Sheets As of December 31 Year 4 Year 3 Assets Current assets Cash $ 22,000 $ 18,000 Marketable securities 21,200 7,200 Accounts receivable (net) 53,000 45,000 Inventories 138,000 146,000 Prepaid items 27,000 12,000 Total current assets 261,200 228,200 Investments 27,000 20,000 Plant (net) 270,000 255,000 Land 30,000 25,000 Total assets $ 588,200 $ 528,200 Liabilities and Stockholders’ Equity Liabilities Current liabilities Notes payable $ 31,800 $ 13,500 Accounts payable 133,800 120,000 Salaries payable 21,000 15,000 Total current liabilities 186,600 148,500 Noncurrent liabilities Bonds payable 100,000 100,000 Other 27,000 22,000 Total noncurrent liabilities 127,000 122,000 Total liabilities 313,600 270,500 Stockholders’ equity Preferred stock, (par value $10, 4% cumulative, non-participating; 7,000 shares authorized and issued) 70,000 70,000 Common stock (no par; 50,000 shares authorized; 10,000 shares issued) 70,000 70,000 Retained earnings 134,600 117,700 Total stockholders’ equity 274,600 257,700 Total liabilities and stockholders’ equity $ 588,200 $ 528,200 n. Return on investment (average total assets in Year 3 is $528,200). (Round your answers to 2 decimal places.) o. Return on equity (average stockholders' equity in Year 3 is $257,700). (Round your answers to 2 decimal places.) p. Earnings per share (total shares outstanding is unchanged). (Round your answers to 2 decimal places.) q. Book value per share of common stock. (Round your answers to 2 decimal places.) r. Price-earnings ratio (market price per share: Year 3, $12.35; Year 4, $13.70). (Round your intermediate calculations and final answer to 2 decimal places.) s. Dividend yield on common stock. (Round your answers to 2 decimal places.)

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 21BEA: The income statement, statement of retained earnings, and balance sheet for Somerville Company are...

Related questions

Question

Financial statements for Rundle Company follow.

| RUNDLE COMPANY | |||||||

| Balance Sheets As of December 31 |

|||||||

| Year 4 | Year 3 | ||||||

| Assets | |||||||

| Current assets | |||||||

| Cash | $ | 22,000 | $ | 18,000 | |||

| Marketable securities | 21,200 | 7,200 | |||||

| Accounts receivable (net) | 53,000 | 45,000 | |||||

| Inventories | 138,000 | 146,000 | |||||

| Prepaid items | 27,000 | 12,000 | |||||

| Total current assets | 261,200 | 228,200 | |||||

| Investments | 27,000 | 20,000 | |||||

| Plant (net) | 270,000 | 255,000 | |||||

| Land | 30,000 | 25,000 | |||||

| Total assets | $ | 588,200 | $ | 528,200 | |||

| Liabilities and |

|||||||

| Liabilities | |||||||

| Current liabilities | |||||||

| Notes payable | $ | 31,800 | $ | 13,500 | |||

| Accounts payable | 133,800 | 120,000 | |||||

| Salaries payable | 21,000 | 15,000 | |||||

| Total current liabilities | 186,600 | 148,500 | |||||

| Noncurrent liabilities | |||||||

| Bonds payable | 100,000 | 100,000 | |||||

| Other | 27,000 | 22,000 | |||||

| Total noncurrent liabilities | 127,000 | 122,000 | |||||

| Total liabilities | 313,600 | 270,500 | |||||

| Stockholders’ equity | |||||||

shares authorized and issued) |

70,000 | 70,000 | |||||

| Common stock (no par; 50,000 shares authorized; 10,000 shares issued) | 70,000 | 70,000 | |||||

| 134,600 | 117,700 | ||||||

| Total stockholders’ equity | 274,600 | 257,700 | |||||

| Total liabilities and stockholders’ equity | $ | 588,200 | $ | 528,200 | |||

n. Return on investment (average total assets in Year 3 is $528,200). (Round your answers to 2 decimal places.)

o. Return on equity (average stockholders' equity in Year 3 is $257,700). (Round your answers to 2 decimal places.)

p. Earnings per share (total shares outstanding is unchanged). (Round your answers to 2 decimal places.)

q. Book value per share of common stock. (Round your answers to 2 decimal places.)

r. Price-earnings ratio (market price per share: Year 3, $12.35; Year 4, $13.70). (Round your intermediate calculations and final answer to 2 decimal places.)

s. Dividend yield on common stock. (Round your answers to 2 decimal places.)

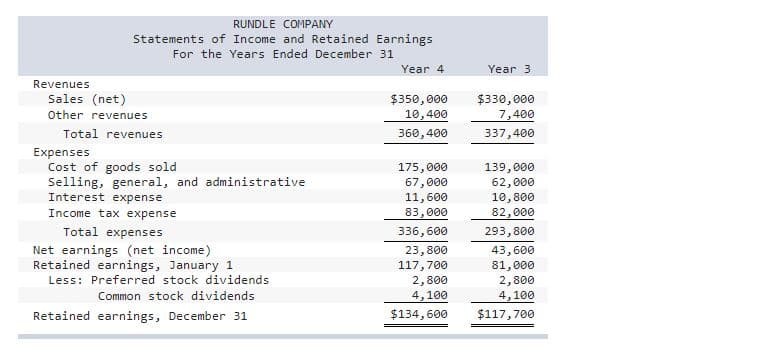

Transcribed Image Text:Revenues

RUNDLE COMPANY

Statements of Income and Retained Earnings

For the Years Ended December 31

Sales (net)

Other revenues

Total revenues

Expenses

Cost of goods sold

Selling, general, and administrative

Interest expense

Income tax expense

Total expenses

Net earnings (net income)

Retained earnings, January 1

Less: Preferred stock dividends

Common stock dividends

Retained earnings, December 31

Year 4

$350,000

10,400

360,400

175,000

67,000

11,600

83,000

336,600

23,800

117,700

2,800

4,100

$134,600

Year 3

$330,000

7,400

337,400

139,000

62,000

10,800

82,000

293,800

43,600

81,000

2,800

4,100

$117,700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 7 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,