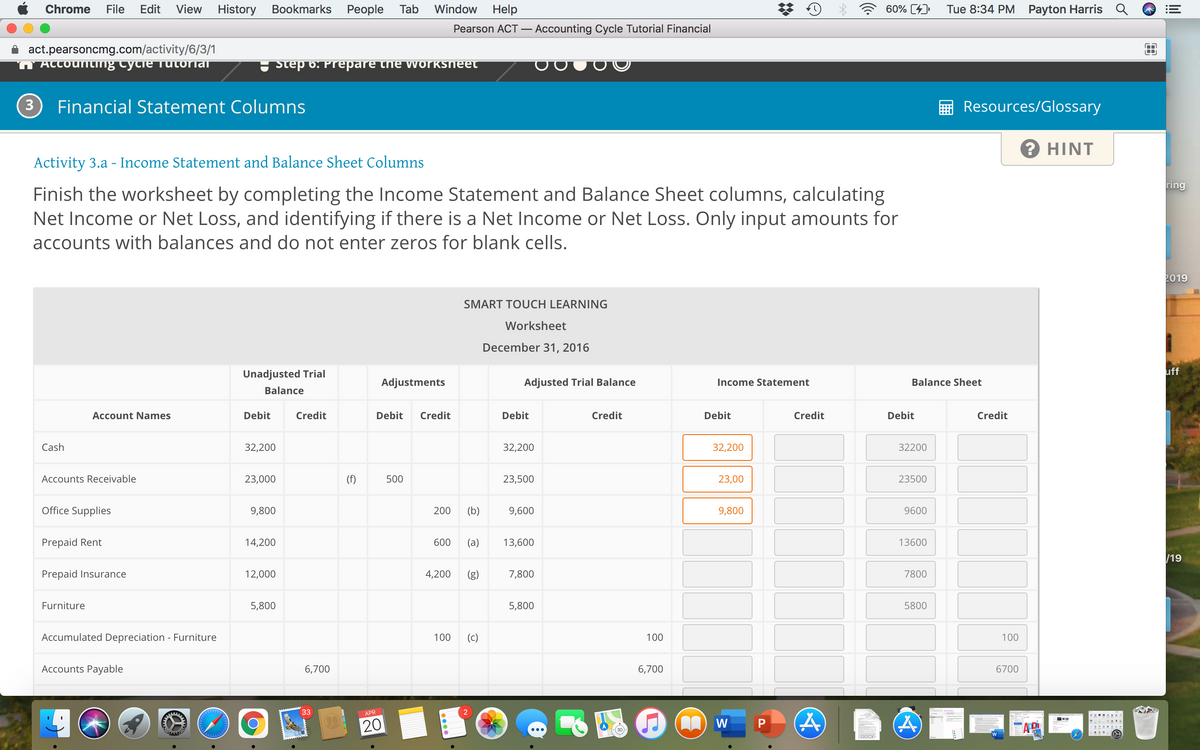

Finish the worksheet by completing the Income Statement and Balance Sheet columns, calculating Net Income or Net Loss, and identifying if there is a Net Income or Net Loss. Only input amounts for accounts with balances and do not enter zeros for blank cells. SMART TOUCH LEARNING Worksheet December 31, 2016 Unadjusted Trial Adjustments Adjusted Trial Balance Income Statement Balance Sheet Balance Account Names Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit Cash 32,200 32,200 32,200 32200

Finish the worksheet by completing the Income Statement and Balance Sheet columns, calculating Net Income or Net Loss, and identifying if there is a Net Income or Net Loss. Only input amounts for accounts with balances and do not enter zeros for blank cells. SMART TOUCH LEARNING Worksheet December 31, 2016 Unadjusted Trial Adjustments Adjusted Trial Balance Income Statement Balance Sheet Balance Account Names Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit Cash 32,200 32,200 32,200 32200

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter22: Master Budget (master)

Section: Chapter Questions

Problem 2R: Open the file MASTER from the website for this book at cengagebrain.com. Enter all the formulas...

Related questions

Question

100%

in this problem i need help figuring out the ones in red.

Transcribed Image Text:Chrome

File

Edit

View

History Bookmarks

Реople

Tab

Window

Help

60% [4)

Tue 8:34 PM

Payton Harris Q

Pearson ACT – Accounting Cycle Tutorial Financial

act.pearsoncmg.com/activity/6/3/1

Accounting Cycle Tutorial

Step 6. Prepare the worksneet

3

Financial Statement Columns

Resources/Glossary

? HINT

Activity 3.a - Income Statement and Balance Sheet Columns

ring

Finish the worksheet by completing the Income Statement and Balance Sheet columns, calculating

Net Income or Net Loss, and identifying if there is a Net Income or Net Loss. Only input amounts for

accounts with balances and do not enter zeros for blank cells.

2019

SMART TOUCH LEARNING

Worksheet

December 31, 2016

Unadjusted Trial

uff

Adjustments

Adjusted Trial Balance

Income Statement

Balance Sheet

Balance

Account Names

Debit

Credit

Debit

Credit

Debit

Credit

Debit

Credit

Debit

Credit

Cash

32,200

32,200

32,200

32200

Accounts Receivable

23,000

(f)

500

23,500

23,00

23500

Office Supplies

9,800

200

(b)

9,600

9,800

9600

Prepaid Rent

14,200

600

(a)

13,600

13600

/19

Prepaid Insurance

12,000

4,200

(g)

7,800

7800

Furniture

5,800

5,800

5800

Accumulated Depreciation - Furniture

100

(c)

100

100

Accounts Payable

6,700

6,700

6700

33

APR

20

DOCX

Transcribed Image Text:Chrome

File

Edit

View

History

Bookmarks

Реople

Tab

Window

Help

60% [4)

Tue 8:35 PM

Payton Harris Q

Pearson ACT – Accounting Cycle Tutorial Financial

act.pearsoncmg.com/activity/6/3/1

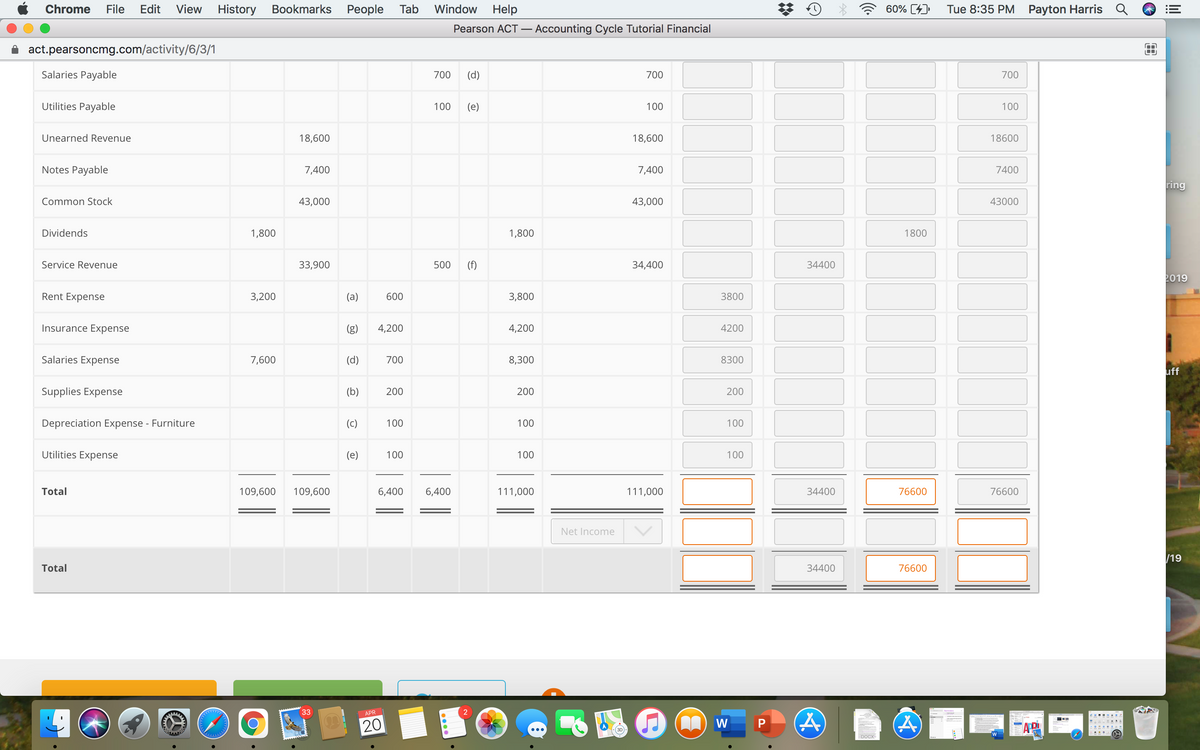

Salaries Payable

700

(d)

700

700

Utilities Payable

100

(e)

100

100

Unearned Revenue

18,600

18,600

18600

Notes Payable

7,400

7,400

7400

ring

Common Stock

43,000

43,000

43000

Dividends

1,800

1,800

1800

Service Revenue

33,900

500

(f)

34,400

34400

2019

Rent Expense

3,200

(a)

600

3,800

3800

Insurance Expense

(g)

4,200

4,200

4200

Salaries Expense

7,600

(d)

700

8,300

8300

uff

Supplies Expense

(b)

200

200

200

Depreciation Expense - Furniture

(c)

100

100

100

Utilities Expense

(e)

100

100

100

Total

109,600

109,600

6,400

6,400

111,000

111,000

34400

76600

76600

Net Income

/19

Total

34400

76600

33

APR

20

DOCX

|

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning