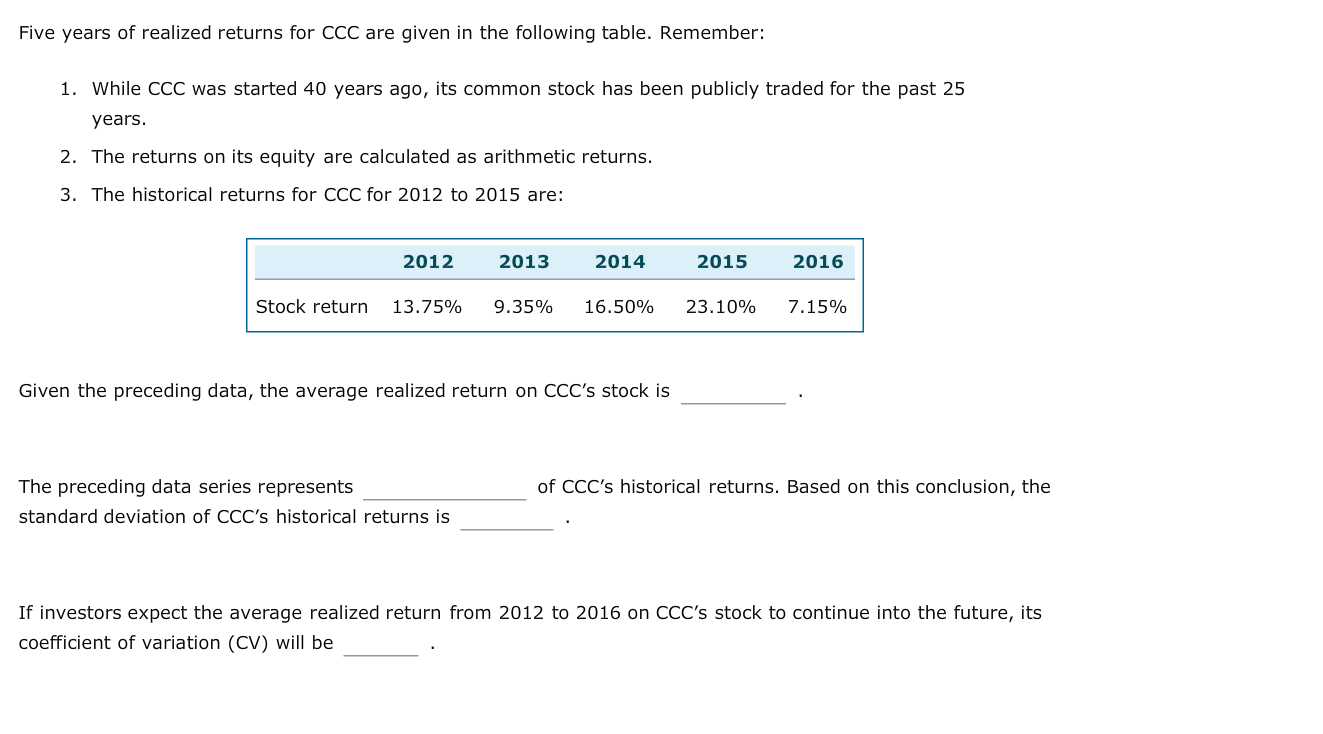

Five years of realized returns for CCC are given in the following table. Remember: 1. While CCC was started 40 years ago, its common stock has been publicly traded for the past 25 years 2. The returns on its equity are calculated as arithmetic returns. 3. The historical returns for CCC for 2012 to 2015 are: 2016 2012 2013 2014 2015 Stock return 13.75% 16.50% 7.15% 9.35% 23.10% Given the preceding data, the average realized return on CCC's stock is The preceding data series represents of CCC's historical returns. Based on this conclusion, the standard deviation of CCC's historical returns is If investors expect the average realized return from 2012 to 2016 on CCC's stock to continue into the future, its coefficient of variation (CV) will be

Five years of realized returns for CCC are given in the following table. Remember: 1. While CCC was started 40 years ago, its common stock has been publicly traded for the past 25 years 2. The returns on its equity are calculated as arithmetic returns. 3. The historical returns for CCC for 2012 to 2015 are: 2016 2012 2013 2014 2015 Stock return 13.75% 16.50% 7.15% 9.35% 23.10% Given the preceding data, the average realized return on CCC's stock is The preceding data series represents of CCC's historical returns. Based on this conclusion, the standard deviation of CCC's historical returns is If investors expect the average realized return from 2012 to 2016 on CCC's stock to continue into the future, its coefficient of variation (CV) will be

Chapter7: Common Stock: Characteristics, Valuation, And Issuance

Section: Chapter Questions

Problem 8P

Related questions

Question

Transcribed Image Text:Five years of realized returns for CCC are given in the following table. Remember:

1. While CCC was started 40 years ago, its common stock has been publicly traded for the past 25

years

2. The returns on its equity are calculated as arithmetic returns.

3. The historical returns for CCC for 2012 to 2015 are:

2016

2012

2013

2014

2015

Stock return

13.75%

16.50%

7.15%

9.35%

23.10%

Given the preceding data, the average realized return on CCC's stock is

The preceding data series represents

of CCC's historical returns. Based on this conclusion, the

standard deviation of CCC's historical returns is

If investors expect the average realized return from 2012 to 2016 on CCC's stock to continue into the future, its

coefficient of variation (CV) will be

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning