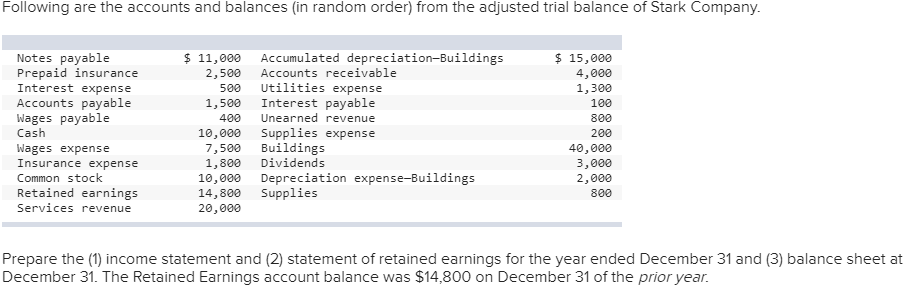

Following are the accounts and balances (in random order) from the adjusted trial balance of Stark Company. Notes payable Prepaid insurance Interest expense Accounts payable Wages payable Cash Accumulated depreciation-Buildings Accounts receivable 15,000 11,000 2,500 500 4,000 1,300 Utilities expense Interest payable Unearned revenue Supplies expense Buildings Dividends 1,500 100 400 800 10,000 200 Wages expense Insurance expense 7,500 1,800 10,000 14,800 20,000 40,000 3,000 2,000 800 Common stock Depreciation expense-Buildings Supplies Retained earnings Services revenue Prepare the (1) income statement and (2) statement of retained earnings for the year ended December 31 and (3) balance sheet at December 31. The Retained Earnings account balance was $14,800 on December 31 of the prior year. STARK COMPANY Balance Sheet December 31 Assets Accounts receivable Cash Prepaid insurance 4,000 10,000 2,500 Supplies 800 0 $ 17,300 Total assets Liabilities |Accounts payable Wages payable Interest payable Notes payable 1,500 400 100 11,000 Total liabilities 13,000 Equity Retained earnings Common stock Total equity Total liabilities and equity 0 $ 13,000

Following are the accounts and balances (in random order) from the adjusted trial balance of Stark Company. Notes payable Prepaid insurance Interest expense Accounts payable Wages payable Cash Accumulated depreciation-Buildings Accounts receivable 15,000 11,000 2,500 500 4,000 1,300 Utilities expense Interest payable Unearned revenue Supplies expense Buildings Dividends 1,500 100 400 800 10,000 200 Wages expense Insurance expense 7,500 1,800 10,000 14,800 20,000 40,000 3,000 2,000 800 Common stock Depreciation expense-Buildings Supplies Retained earnings Services revenue Prepare the (1) income statement and (2) statement of retained earnings for the year ended December 31 and (3) balance sheet at December 31. The Retained Earnings account balance was $14,800 on December 31 of the prior year. STARK COMPANY Balance Sheet December 31 Assets Accounts receivable Cash Prepaid insurance 4,000 10,000 2,500 Supplies 800 0 $ 17,300 Total assets Liabilities |Accounts payable Wages payable Interest payable Notes payable 1,500 400 100 11,000 Total liabilities 13,000 Equity Retained earnings Common stock Total equity Total liabilities and equity 0 $ 13,000

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter22: End-of-fiscal-period Work For A Corporation

Section: Chapter Questions

Problem 1AP

Related questions

Question

Transcribed Image Text:Following are the accounts and balances (in random order) from the adjusted trial balance of Stark Company.

Notes payable

Prepaid insurance

Interest expense

Accounts payable

Wages payable

Cash

Accumulated depreciation-Buildings

Accounts receivable

15,000

11,000

2,500

500

4,000

1,300

Utilities expense

Interest payable

Unearned revenue

Supplies expense

Buildings

Dividends

1,500

100

400

800

10,000

200

Wages expense

Insurance expense

7,500

1,800

10,000

14,800

20,000

40,000

3,000

2,000

800

Common stock

Depreciation expense-Buildings

Supplies

Retained earnings

Services revenue

Prepare the (1) income statement and (2) statement of retained earnings for the year ended December 31 and (3) balance sheet at

December 31. The Retained Earnings account balance was $14,800 on December 31 of the prior year.

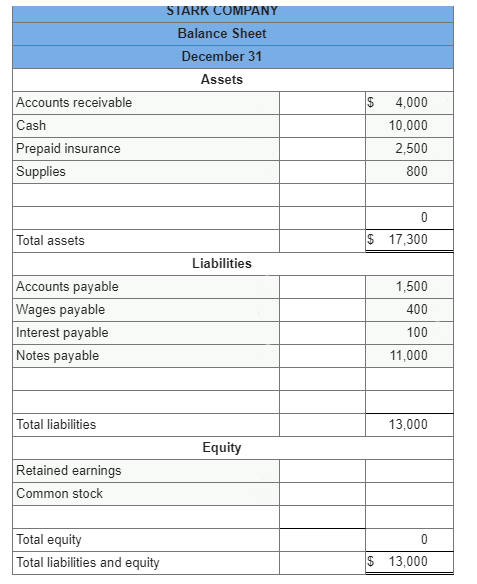

Transcribed Image Text:STARK COMPANY

Balance Sheet

December 31

Assets

Accounts receivable

Cash

Prepaid insurance

4,000

10,000

2,500

Supplies

800

0

$ 17,300

Total assets

Liabilities

|Accounts payable

Wages payable

Interest payable

Notes payable

1,500

400

100

11,000

Total liabilities

13,000

Equity

Retained earnings

Common stock

Total equity

Total liabilities and equity

0

$ 13,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Expert Answers to Latest Homework Questions

Q: An accounting firm has 780 hours of staff time and 272 hours of reviewing time available each week.…

Q: O Macmillan Learning

The graph represents consumption (C) as a function of

disposable income (DI).…

Q: Bode Plot: Example 3

Draw the Bode Diagram for the transfer function:

H(s) = 10-

S+10

S² + 3s

Q: NAME q, Snake Food Department, and the Bird Food Department. The following Budgeted cosis of on per…

Q: Dave's mother is calling at

11:30 pm while he is on

vacation.

yes

After 11pm

Does not answer

phone…

Q: A reaction with an enthalpy of -16.9 kJ and and entropy of -265 J/K is being run

at -115°C. What is…

Q: The following month-end information is from the adjusted trial balance and other records of Roget…

Q: dont provide handwriting solution.....

Q: Am. 131.

Q: Chemistry

Q: None

Q: dont provide handwritinhg solutiin...............

Q: dont provide handwriting solutio......

Q: Am. 130.

Q: The following information as to earnings and deductions for the two-week pay period ended March 26,…

Q: Am. 129.

Q: Am. 128.

Q: Draw the structure of the major organic product(s) of the reaction.

о

NaOH

H₂O

• You do not have to…

Q: Submitted

What is the most likely mechanism for the reaction below?

Br

H3C-N-CH3

Multiple Choice

О…

Q: Draw structural formulas for organic products A and B in the window below.

-Br

Li

pentane

Cul

A

B…

Q: A family friend has asked your help in analyzing the operations of three anonymous companies…