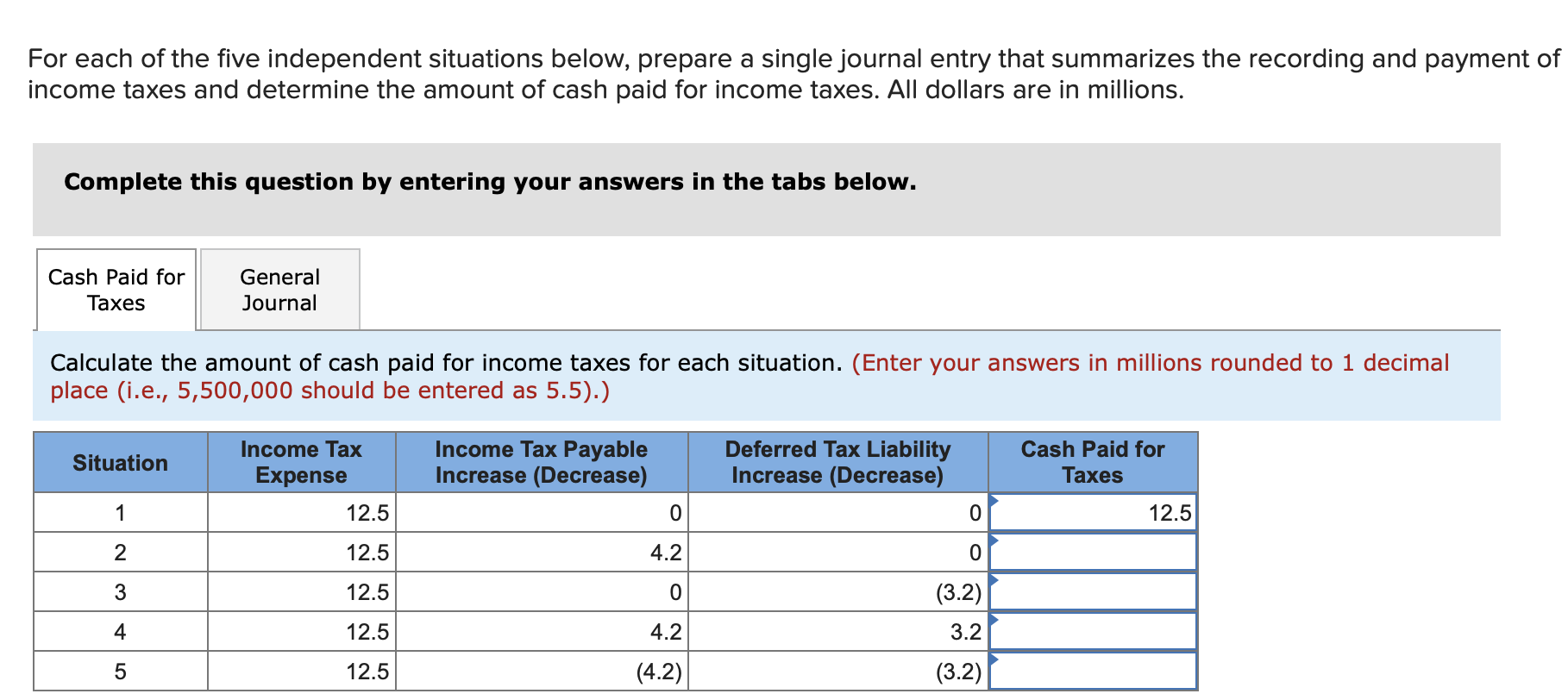

For each of the five independent situations below, prepare a single journal entry that summarizes the recording and payment of income taxes and determine the amount of cash paid for income taxes. All dollars are in millions. Complete this question by entering your answers in the tabs below. Cash Paid for General Таxes Journal Calculate the amount of cash paid for income taxes for each situation. (Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) Income Tax Payable Increase (Decrease) Deferred Tax Liability Increase (Decrease) Income Tax Cash Paid for Situation Expense Taxes 1 12.5 12.5 12.5 4.2 12.5 (3.2) 4 12.5 4.2 3.2 12.5 (4.2) (3.2) 5

For each of the five independent situations below, prepare a single journal entry that summarizes the recording and payment of income taxes and determine the amount of cash paid for income taxes. All dollars are in millions. Complete this question by entering your answers in the tabs below. Cash Paid for General Таxes Journal Calculate the amount of cash paid for income taxes for each situation. (Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) Income Tax Payable Increase (Decrease) Deferred Tax Liability Increase (Decrease) Income Tax Cash Paid for Situation Expense Taxes 1 12.5 12.5 12.5 4.2 12.5 (3.2) 4 12.5 4.2 3.2 12.5 (4.2) (3.2) 5

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 46P: Blue Company, an architectural firm, has a bookkeeper who maintains a cash receipts and...

Related questions

Question

Transcribed Image Text:For each of the five independent situations below, prepare a single journal entry that summarizes the recording and payment of

income taxes and determine the amount of cash paid for income taxes. All dollars are in millions.

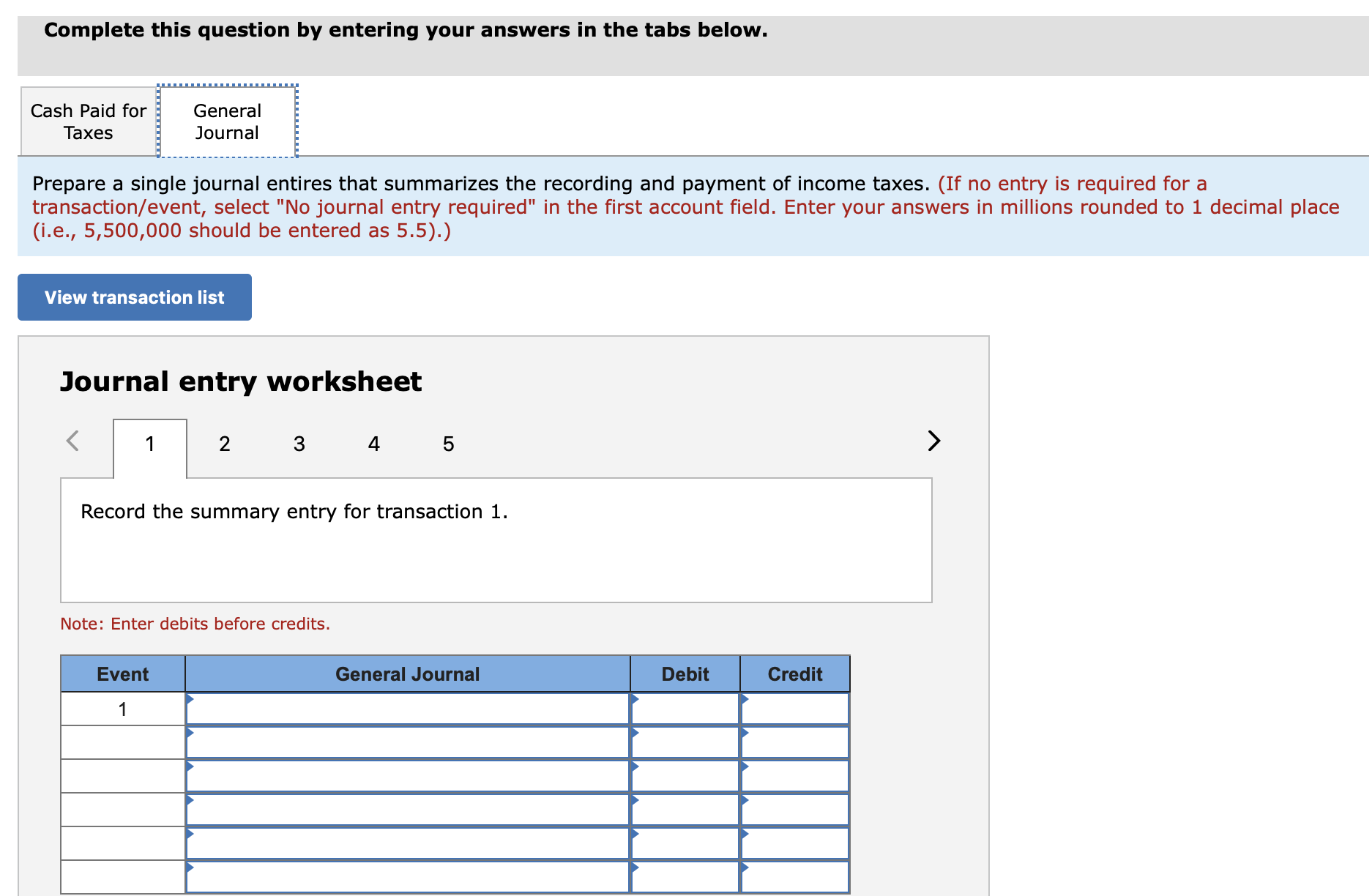

Complete this question by entering your answers in the tabs below.

Cash Paid for

General

Таxes

Journal

Calculate the amount of cash paid for income taxes for each situation. (Enter your answers in millions rounded to 1 decimal

place (i.e., 5,500,000 should be entered as 5.5).)

Income Tax Payable

Increase (Decrease)

Deferred Tax Liability

Increase (Decrease)

Income Tax

Cash Paid for

Situation

Expense

Taxes

1

12.5

12.5

12.5

4.2

12.5

(3.2)

4

12.5

4.2

3.2

12.5

(4.2)

(3.2)

5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College