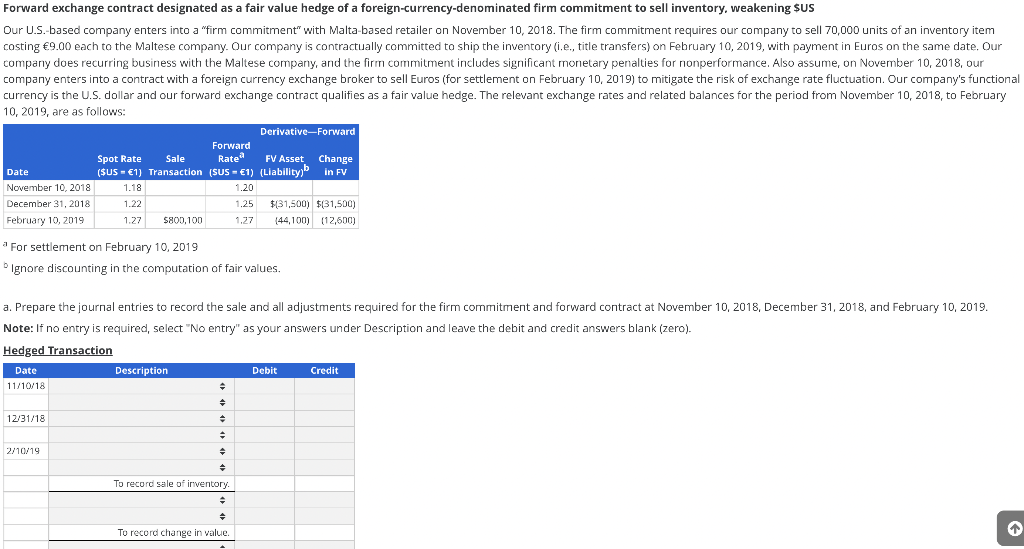

Forward exchange contract designated as a fair value hedge of a foreign-currency-denominated firm commitment to sell inventory, weakening SUS Dur U.S.-based company enters into a "firm commitment" with Malta-based retailer on November 10, 2018. The firm commitment requires our company to sell 70,000 units of an inventory item costing €9.00 each to the Maltese company. Our company is contractually committed to ship the inventory (i.e., title transfers) on February 10, 2019, with payment in Euros on the same date. Our company does recurring business with the Maltese company, and the firm commitment includes significant monetary penalties for nonperformance. Also assume, on November 10, 2018, our company enters into a contract with a foreign currency exchange broker to sell Euros (for settlement on February 10, 2019) to mitigate the risk of exchange rate fluctuation. Our company's functional currency is the U.S. dollar and our forward exchange contract qualifies as a fair value hedge. The relevant exchange rates and related balances for the period from November 10, 2018, to February 10, 2019, are as follows: Derivative-Forward Forward Spot Rate Sale Rate FV Asset Change (SUS - €1) Transaction (SUS - €1) (Liability)b in FV Date November 10, 2018 1.18 1.20 December 31, 2018 1.22 1.25 $(31,500) $(31,500) February 10, 2019 1.27 S800,100 1,27 (44,100) (12,600) 'For settlement on February 10, 2019 Ignore discounting in the computation of fair values. a. Prepare the journal entries to record the sale and all adjustments required for the firm commitment and forward contract at November 10, 2018, December 31, 2018, and February 10, 2019. Note: If no entry is required, select "No entry" as your answers under Description and leave the debit and credit answers blank (zero). Hedged Transaction Date Description Debit Credit 11/10/18

Forward exchange contract designated as a fair value hedge of a foreign-currency-denominated firm commitment to sell inventory, weakening SUS Dur U.S.-based company enters into a "firm commitment" with Malta-based retailer on November 10, 2018. The firm commitment requires our company to sell 70,000 units of an inventory item costing €9.00 each to the Maltese company. Our company is contractually committed to ship the inventory (i.e., title transfers) on February 10, 2019, with payment in Euros on the same date. Our company does recurring business with the Maltese company, and the firm commitment includes significant monetary penalties for nonperformance. Also assume, on November 10, 2018, our company enters into a contract with a foreign currency exchange broker to sell Euros (for settlement on February 10, 2019) to mitigate the risk of exchange rate fluctuation. Our company's functional currency is the U.S. dollar and our forward exchange contract qualifies as a fair value hedge. The relevant exchange rates and related balances for the period from November 10, 2018, to February 10, 2019, are as follows: Derivative-Forward Forward Spot Rate Sale Rate FV Asset Change (SUS - €1) Transaction (SUS - €1) (Liability)b in FV Date November 10, 2018 1.18 1.20 December 31, 2018 1.22 1.25 $(31,500) $(31,500) February 10, 2019 1.27 S800,100 1,27 (44,100) (12,600) 'For settlement on February 10, 2019 Ignore discounting in the computation of fair values. a. Prepare the journal entries to record the sale and all adjustments required for the firm commitment and forward contract at November 10, 2018, December 31, 2018, and February 10, 2019. Note: If no entry is required, select "No entry" as your answers under Description and leave the debit and credit answers blank (zero). Hedged Transaction Date Description Debit Credit 11/10/18

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter9: Operating Activities

Section: Chapter Questions

Problem 22PC

Related questions

Question

Transcribed Image Text:Forward exchange contract designated as a fair value hedge of a foreign-currency-denominated firm commitment to sell inventory, weakening SUS

Our U.S.-based company enters into a "firm commitment" with Malta-based retailer on November 10, 2018. The firm commitment requires our company to sell 70,000 units of an inventory item

costing €9.00 each to the Maltese company. Our company is contractually committed to ship the inventory (i.e., title transfers) on February 10, 2019, with payment in Euros on the same date. Our

company does recurring business with the Maltese company, and the firm commitment includes significant monetary penalties for nonperformance. Also assume, on November 10, 2018, our

company enters into a contract with a foreign currency exchange broker to sell Euros (for settlement on February 10, 2019) to mitigate the risk of exchange rate fluctuation. Our company's functional

currency is the U.S. dollar and our forward exchange contract qualifies as a fair value hedge. The relevant exchange rates and related balances for the period from November 10, 2018, to February

10, 2019, are as follows:

Derivative-Forward

Forward

Spot Rate

Sale

Rate

FV Asset Change

in FV

Date

($US - €1) Transaction (SUS - €1) (Liability)"

November 10, 2018

1.18

1.20

December 31, 2018

1.22

1.25

$(31,500) $(31,500)

February 10, 2019

1.27

S800,100

1.27

(44,100) (12,600)

a For settlement on February 10, 2019

Ignore discounting in the computation of fair values.

a. Prepare the journal entries to record the sale and all adjustments required for the firm commitment and forward contract at November 10, 2018, December 31, 2018, and February 10, 2019.

Note: If no entry is required, select "No entry" as your answers under Description and leave the debit and credit answers blank (zero).

Hedged Transaction

Date

Description

Debit

Credit

11/10/18

12/31/18

2/10/19

수

To record sale of inventory.

To record change in value.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning