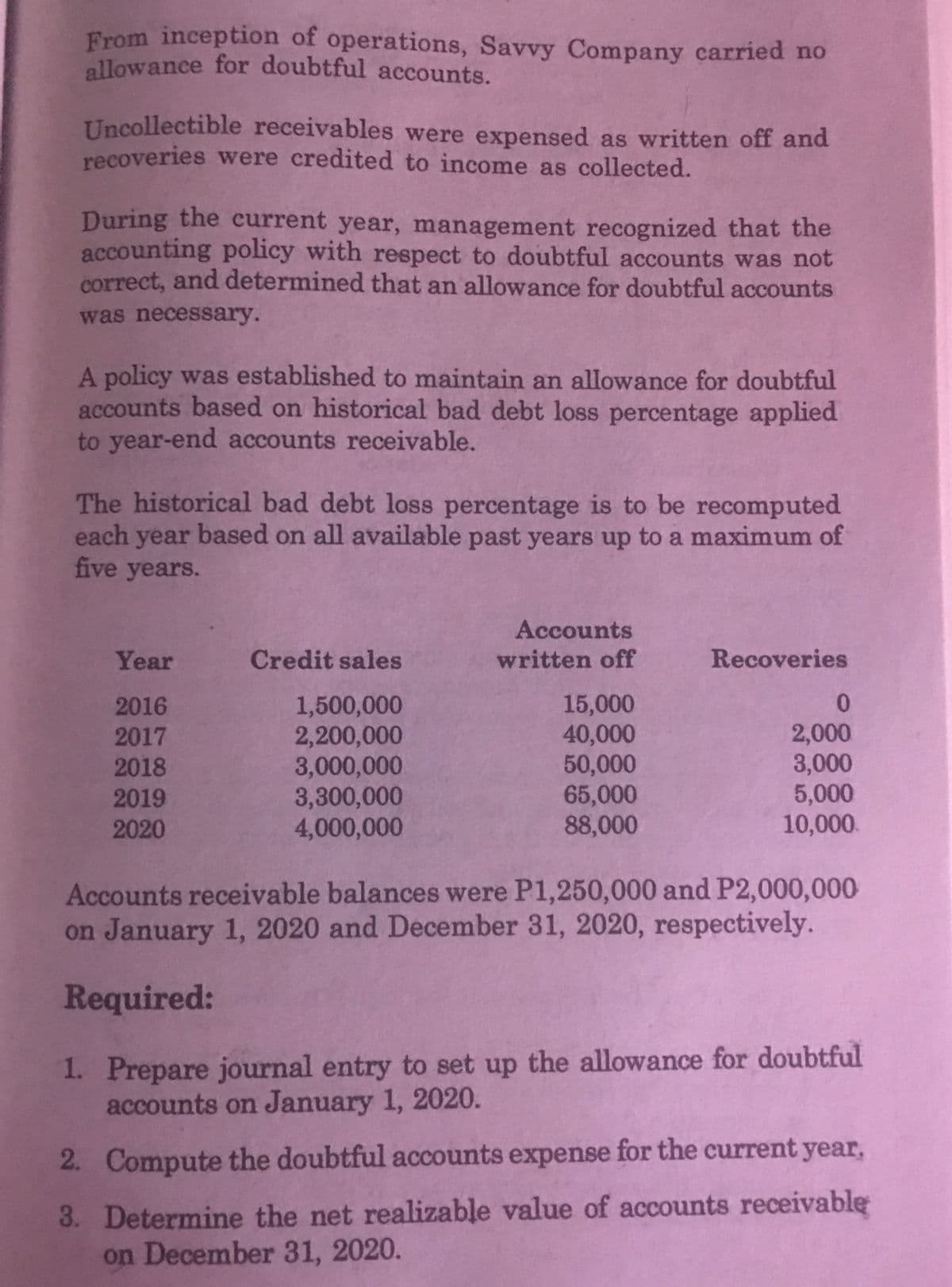

From inception of operations, Savvy Company carried no allowance for doubtful accounts. Uncollectible receivables were expensed as written off and recoveries were credited to income as collected. During the current year, management recognized that the accounting policy with respect to doubtful accounts was not correct, and determined that an allowance for doubtful accounts was necessary. A policy was established to maintain an allowance for doubtful accounts based on historical bad debt loss percentage applied to year-end accounts receivable. The historical bad debt loss percentage is to be recomputed each year based on all available past years up to a maximum of five years. Accounts Year Credit sales written off Recoveries 15,000 40,000 50,000 65,000 88,000 0. 1,500,000 2,200,000 3,000,000 3,300,000 4,000,000 2016 2,000 3,000 5,000 10,000. 2017 2018 2019 2020 Accounts receivable balances were P1,250,000 and P2,000,000 on January 1, 2020 and December 31, 2020, respectively. Required: 1. Prepare journal entry to set up the allowance for doubtful accounts on January 1, 2020. 2. Compute the doubtful accounts expense for the current year, 3. Determine the net realizable value of accounts receivable on December 31, 2020.

From inception of operations, Savvy Company carried no allowance for doubtful accounts. Uncollectible receivables were expensed as written off and recoveries were credited to income as collected. During the current year, management recognized that the accounting policy with respect to doubtful accounts was not correct, and determined that an allowance for doubtful accounts was necessary. A policy was established to maintain an allowance for doubtful accounts based on historical bad debt loss percentage applied to year-end accounts receivable. The historical bad debt loss percentage is to be recomputed each year based on all available past years up to a maximum of five years. Accounts Year Credit sales written off Recoveries 15,000 40,000 50,000 65,000 88,000 0. 1,500,000 2,200,000 3,000,000 3,300,000 4,000,000 2016 2,000 3,000 5,000 10,000. 2017 2018 2019 2020 Accounts receivable balances were P1,250,000 and P2,000,000 on January 1, 2020 and December 31, 2020, respectively. Required: 1. Prepare journal entry to set up the allowance for doubtful accounts on January 1, 2020. 2. Compute the doubtful accounts expense for the current year, 3. Determine the net realizable value of accounts receivable on December 31, 2020.

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 5PA: The following accounts receivable information pertains to Luxury Cruises. A. Determine the estimated...

Related questions

Question

100%

Transcribed Image Text:allowance for doubtful accounts.

From inception of operations, Savvy Company carried no

Uncollectible receivables were expensed as written off and

recoveries were credited to income as collected.

During the current year, management recognized that the

accounting policy with respect to doubtful accounts was not

correct, and determined that an allowance for doubtful accounts

was necessary.

A policy was established to maintain an allowance for doubtful

accounts based on historical bad debt loss percentage applied

to year-end accounts receivable.

The historical bad debt loss percentage is to be recomputed

each year based on all available past years up to a maximum of

five years.

Accounts

Year

Credit sales

written off

Recoveries

15,000

40,000

50,000

65,000

88,000

0.

1,500,000

2,200,000

3,000,000

3,300,000

4,000,000

2016

2,000

3,000

5,000

10,000.

2017

2018

2019

2020

Accounts receivable balances were P1,250,000 and P2,000,000

on January 1, 2020 and December 31, 2020, respectively.

Required:

1. Prepare journal entry to set up the allowance for doubtful

accounts on January 1, 2020.

2. Compute the doubtful accounts expense for the current year,

3. Determine the net realizable value of accounts receivable

on December 31, 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,