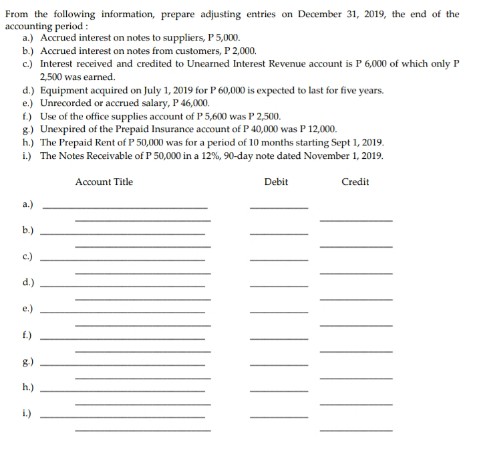

From the following information, prepare adjusting entries on December 31, 2019, the end of the accounting period: a.) Accrued interest on notes to suppliers, P 5,000. b.) Accrued interest on notes from customers, P2,000. c) Interest received and credited to Unearned Interest Revenue account is P 6,000 of which only P 2,500 was earned. d.) Equipment acquired on July 1, 2019 for P 60,000 is expected to last for five years. e.) Unrecorded or accrued salary, P 46,000. f) Use of the office supplies account of P 5,600 was P 2,500. g) Unexpired of the Prepaid Insurance account of P 40,000 was P 12,000. h.) The Prepaid Rent of P 50,000 was for a period of 10 months starting Sept 1, 2019. i.) The Notes Receivable of P 50,000 in a 12%, 90-day note dated November 1, 2019.

From the following information, prepare adjusting entries on December 31, 2019, the end of the accounting period: a.) Accrued interest on notes to suppliers, P 5,000. b.) Accrued interest on notes from customers, P2,000. c) Interest received and credited to Unearned Interest Revenue account is P 6,000 of which only P 2,500 was earned. d.) Equipment acquired on July 1, 2019 for P 60,000 is expected to last for five years. e.) Unrecorded or accrued salary, P 46,000. f) Use of the office supplies account of P 5,600 was P 2,500. g) Unexpired of the Prepaid Insurance account of P 40,000 was P 12,000. h.) The Prepaid Rent of P 50,000 was for a period of 10 months starting Sept 1, 2019. i.) The Notes Receivable of P 50,000 in a 12%, 90-day note dated November 1, 2019.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 6MC: Prior to adjustments, Barrett Companys account balances at December 31, 2019, for Accounts...

Related questions

Question

100%

Transcribed Image Text:From the following information, prepare adjusting entries on December 31, 2019, the end of the

accounting period:

a.) Accrued interest on notes to suppliers, P5,000.

b.) Accrued interest on notes from customers, P2,000.

c.) Interest received and credited to Unearned Interest Revenue account is P 6,000 of which only P

2,500 was earned.

d.) Equipment acquired on July 1, 2019 for P 60,000 is expected to last for five years.

e.) Unrecorded or accrued salary, P 46,000.

f) Use of the office supplies account of P 5,600 was P 2,500.

g) Unexpired of the Prepaid Insurance account of P 4O,000 was P 12,000.

h.) The Prepaid Rent of P 50,000 was for a period of 10 months starting Sept 1, 2019.

i.) The Notes Receivable of P 50,000 in a 12%, 90-day note dated November 1, 2019.

Account Title

Debit

Credit

a.)

b.)

c.)

d.)

e.)

f.)

8)

h.)

i.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub