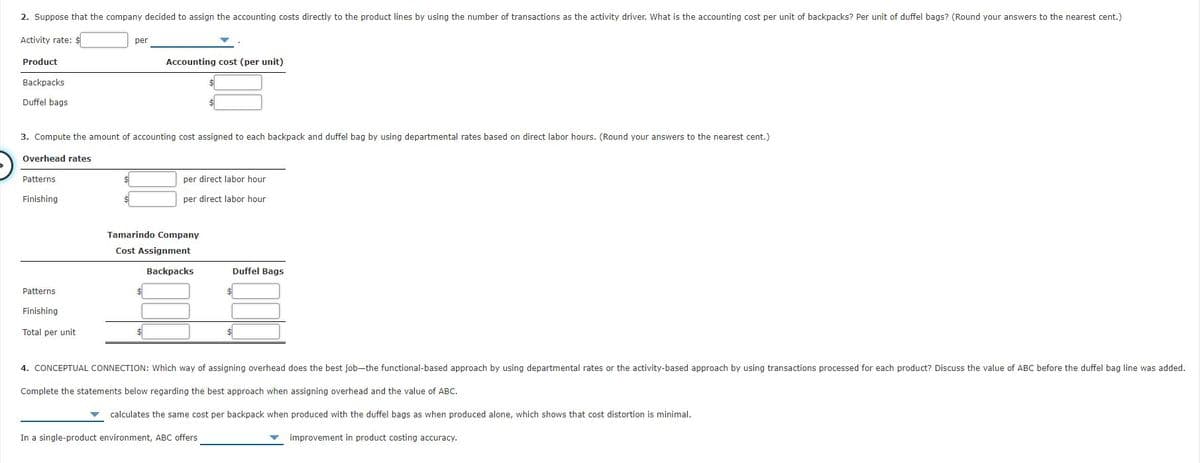

Functional-Based versus Activity-Based Costing For years, Tamarindo Company produced only one product: backpacks. Recently, Tamarindo added a line of duffel bags. With this addition, the company began assigning overhead costs by using departmental rates. (Prior to this, the company used a predetermined plantwide rate based on units produced.) Surprisingly, after the addition of the duffel-bag line and the switch to departmental rates, the costs to produce the backpacks increased, and their profitability dropped. Josie, the marketing manager, and Steve, the production manager, both complained about the increase in the production cost of backpacks. Josie was concerned because the increase in unit costs led to pressure to increase the unit price of backpacks. She was resisting this pressure because she was certain that the increase would harm the company's market share. Steve was receiving pressure to cut costs also, yet he was convinced that nothing different was being done in the way the backpacks were produced. After some discussion, the two managers decided that the problem had to be connected to the addition of the duffel-bag line. Upon investigation, they were informed that the only real change in product costing procedures was in the way overhead costs are assigned. A two-stage procedure was now in use. First, overhead costs are assigned to the two producing departments, Patterns and Finishing. Second, the costs accumulated in the producing departments are assigned to the two products by using direct labor hours as a driver (the rate in each department is based on direct labor hours). The managers were assured that great care was taken to associate overhead costs with individual products. So that they could construct their own example of overhead cost assignment, the controller provided them with the information necessary to show how accounting costs are assigned to products: Patterns Dept. Finishing Dept. Total Accounting cost $30,000 $90,000 $120,000 Transactions processed 20,000 60,000 80,000 Total direct labor hours 15,000 30,000 45,000 Direct labor hours per backpack* 0.10 0.20 0.30 Direct labor hours per duffel bag* 0.20 0.40 0.60 * Hours required to produce one unit of each product. The controller remarked that the cost of operating the accounting department had doubled with the addition of the new product line. The increase came because of the need to process additional transactions, which had also doubled in number. During the first year of producing duffel bags, the company produced and sold 100,000 backpacks and 25,000 duffel bags. The 100,000 backpacks matched the prior year’s output for that product. Required:

Process Costing

Process costing is a sort of operation costing which is employed to determine the value of a product at each process or stage of producing process, applicable where goods produced from a series of continuous operations or procedure.

Job Costing

Job costing is adhesive costs of each and every job involved in the production processes. It is an accounting measure. It is a method which determines the cost of specific jobs, which are performed according to the consumer’s specifications. Job costing is possible only in businesses where the production is done as per the customer’s requirement. For example, some customers order to manufacture furniture as per their needs.

ABC Costing

Cost Accounting is a form of managerial accounting that helps the company in assessing the total variable cost so as to compute the cost of production. Cost accounting is generally used by the management so as to ensure better decision-making. In comparison to financial accounting, cost accounting has to follow a set standard ad can be used flexibly by the management as per their needs. The types of Cost Accounting include – Lean Accounting, Standard Costing, Marginal Costing and Activity Based Costing.

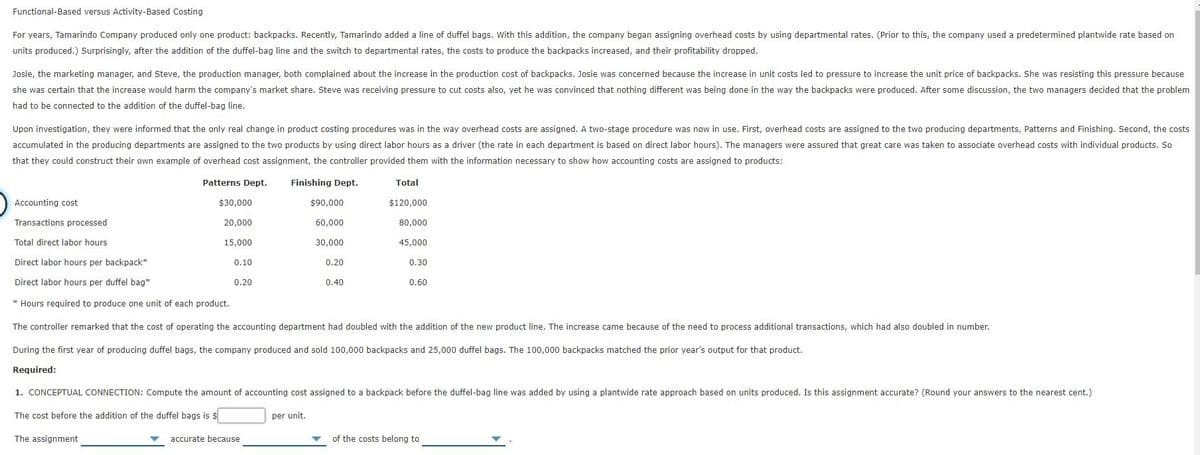

Functional-Based versus Activity-Based Costing

For years, Tamarindo Company produced only one product: backpacks. Recently, Tamarindo added a line of duffel bags. With this addition, the company began assigning overhead costs by using departmental rates. (Prior to this, the company used a predetermined plantwide rate based on units produced.) Surprisingly, after the addition of the duffel-bag line and the switch to departmental rates, the costs to produce the backpacks increased, and their profitability dropped.

Josie, the marketing manager, and Steve, the production manager, both complained about the increase in the production cost of backpacks. Josie was concerned because the increase in unit costs led to pressure to increase the unit price of backpacks. She was resisting this pressure because she was certain that the increase would harm the company's market share. Steve was receiving pressure to cut costs also, yet he was convinced that nothing different was being done in the way the backpacks were produced. After some discussion, the two managers decided that the problem had to be connected to the addition of the duffel-bag line.

Upon investigation, they were informed that the only real change in product costing procedures was in the way overhead costs are assigned. A two-stage procedure was now in use. First, overhead costs are assigned to the two producing departments, Patterns and Finishing. Second, the costs accumulated in the producing departments are assigned to the two products by using direct labor hours as a driver (the rate in each department is based on direct labor hours). The managers were assured that great care was taken to associate overhead costs with individual products. So that they could construct their own example of overhead cost assignment, the controller provided them with the information necessary to show how accounting costs are assigned to products:

| Patterns Dept. | Finishing Dept. | Total | |

| Accounting cost | $30,000 | $90,000 | $120,000 |

| Transactions processed | 20,000 | 60,000 | 80,000 |

| Total direct labor hours | 15,000 | 30,000 | 45,000 |

| Direct labor hours per backpack* | 0.10 | 0.20 | 0.30 |

| Direct labor hours per duffel bag* | 0.20 | 0.40 | 0.60 |

* Hours required to produce one unit of each product.

The controller remarked that the cost of operating the accounting department had doubled with the addition of the new product line. The increase came because of the need to process additional transactions, which had also doubled in number.

During the first year of producing duffel bags, the company produced and sold 100,000 backpacks and 25,000 duffel bags. The 100,000 backpacks matched the prior year’s output for that product.

Required:

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images