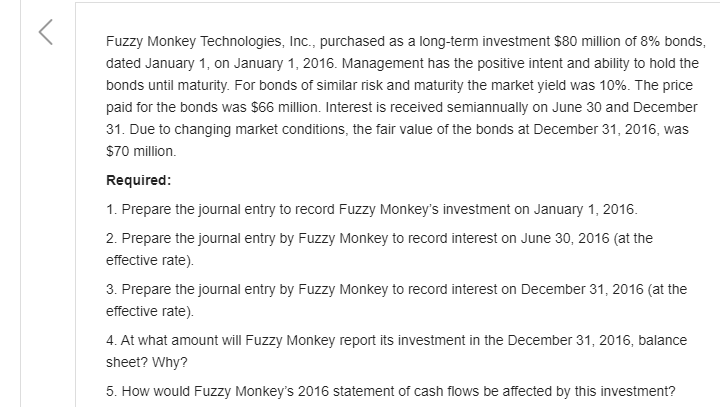

Fuzzy Monkey Technologies, Inc., purchased as a long-term investment $80 million of 8% bonds, dated January 1, on January 1, 2016. Management has the positive intent and ability to hold the bonds until maturity. For bonds of similar risk and maturity the market yield was 10%. The price paid for the bonds was $66 million. Interest is received semiannually on June 30 and December 31. Due to changing market conditions, the fair value of the bonds at December 31, 2016, was $70 million. Required: 1. Prepare the journal entry to record Fuzzy Monkey's investment on January 1, 2016. 2. Prepare the journal entry by Fuzzy Monkey to record interest on June 30, 2016 (at the effective rate). 3. Prepare the journal entry by Fuzzy Monkey to record interest on December 31, 2016 (at the effective rate). 4. At what amount will Fuzzy Monkey report its investment in the December 31, 2016, balance sheet? Why? 5. How would Fuzzy Monkey's 2016 statement of cash flows be affected by this investment?

Fuzzy Monkey Technologies, Inc., purchased as a long-term investment $80 million of 8% bonds, dated January 1, on January 1, 2016. Management has the positive intent and ability to hold the bonds until maturity. For bonds of similar risk and maturity the market yield was 10%. The price paid for the bonds was $66 million. Interest is received semiannually on June 30 and December 31. Due to changing market conditions, the fair value of the bonds at December 31, 2016, was $70 million. Required: 1. Prepare the journal entry to record Fuzzy Monkey's investment on January 1, 2016. 2. Prepare the journal entry by Fuzzy Monkey to record interest on June 30, 2016 (at the effective rate). 3. Prepare the journal entry by Fuzzy Monkey to record interest on December 31, 2016 (at the effective rate). 4. At what amount will Fuzzy Monkey report its investment in the December 31, 2016, balance sheet? Why? 5. How would Fuzzy Monkey's 2016 statement of cash flows be affected by this investment?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 3C

Related questions

Question

please, assist me with solving the problem attached, I am particularly interested in solving 3 and 4.

Thank you,

Milena

Transcribed Image Text:Fuzzy Monkey Technologies, Inc., purchased as a long-term investment $80 million of 8% bonds,

dated January 1, on January 1, 2016. Management has the positive intent and ability to hold the

bonds until maturity. For bonds of similar risk and maturity the market yield was 10%. The price

paid for the bonds was $66 million. Interest is received semiannually on June 30 and December

31. Due to changing market conditions, the fair value of the bonds at December 31, 2016, was

$70 million.

Required:

1. Prepare the journal entry to record Fuzzy Monkey's investment on January 1, 2016.

2. Prepare the journal entry by Fuzzy Monkey to record interest on June 30, 2016 (at the

effective rate).

3. Prepare the journal entry by Fuzzy Monkey to record interest on December 31, 2016 (at the

effective rate).

4. At what amount will Fuzzy Monkey report its investment in the December 31, 2016, balance

sheet? Why?

5. How would Fuzzy Monkey's 2016 statement of cash flows be affected by this investment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning