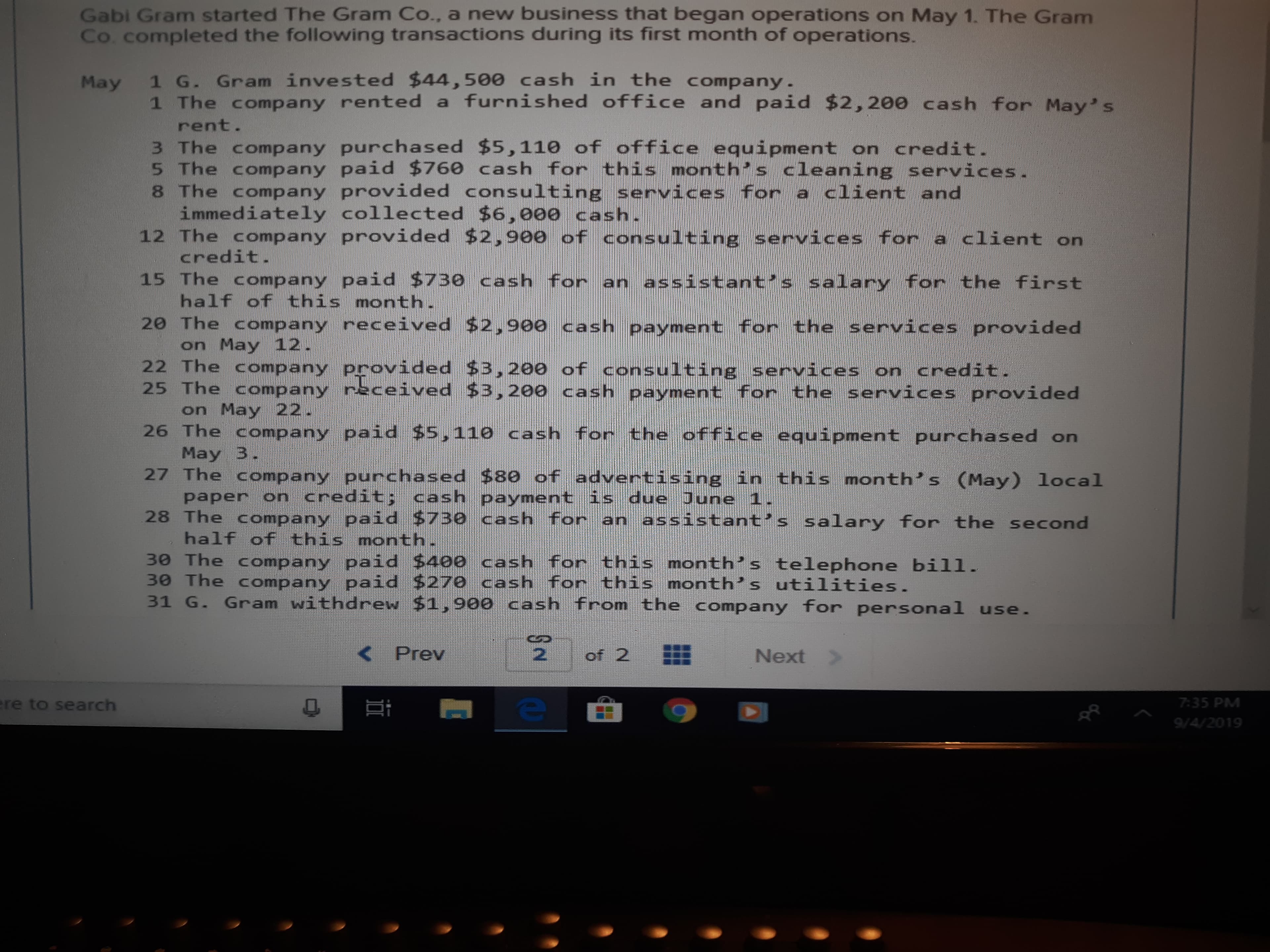

Gabi Gram started The Gram Co., a new business that began operations on May 1. The Gram Co. completed the following transactions during its first month of operations. G. Gram invested $44,500 cash in the company. 1 The company rented a rent. 3 The company purchased $5,110 of office equipment on credit. 5 The company paid $760 cash for this month's cleaning services. 8 The company provided consulting services for a client and immediately collected $6,000 cash. 12 The company provided $2,90e of consulting services for a client on credit. May furnished office and paid $2,200 cash for May's 15 The company paid $730 cash for an assistant's salary for the first half of this month. 20 The company received $2,900 cash payment for the services provided May 12. on 22 The company provided $3,200 of consulting serMices 25 The company rsceived $3,200 cash payment for the services provided on May 22. 26 The company paid $5,110 cash for the office equipment purchased on May 3 27 The company purchased $80 of advertising in this months paper on credit cash paymentis due June 28 The company paid $730 cashfor anassistant s half of this month. 30 The company paid $400 cash for this month's telephone bill. 30 The company paid $27e cash for this month's utilities. 31 G. Gram withdrew $1,900 cashfrom the company for personal use. on credit. (May) local salary for the second

Gabi Gram started The Gram Co., a new business that began operations on May 1. The Gram Co. completed the following transactions during its first month of operations. G. Gram invested $44,500 cash in the company. 1 The company rented a rent. 3 The company purchased $5,110 of office equipment on credit. 5 The company paid $760 cash for this month's cleaning services. 8 The company provided consulting services for a client and immediately collected $6,000 cash. 12 The company provided $2,90e of consulting services for a client on credit. May furnished office and paid $2,200 cash for May's 15 The company paid $730 cash for an assistant's salary for the first half of this month. 20 The company received $2,900 cash payment for the services provided May 12. on 22 The company provided $3,200 of consulting serMices 25 The company rsceived $3,200 cash payment for the services provided on May 22. 26 The company paid $5,110 cash for the office equipment purchased on May 3 27 The company purchased $80 of advertising in this months paper on credit cash paymentis due June 28 The company paid $730 cashfor anassistant s half of this month. 30 The company paid $400 cash for this month's telephone bill. 30 The company paid $27e cash for this month's utilities. 31 G. Gram withdrew $1,900 cashfrom the company for personal use. on credit. (May) local salary for the second

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter1: Business Transactions (ptrans)

Section: Chapter Questions

Problem 3R: On June 1 of the current year, Wilson Wood opened Woodys Web Services. This sole proprietorship had...

Related questions

Question

100%

Here's the chart for statement of cash flow

Transcribed Image Text:Gabi Gram started The Gram Co., a new business that began operations on May 1. The Gram

Co. completed the following transactions during its first month of operations.

G. Gram invested $44,500 cash in the company.

1 The company rented a

rent.

3 The company purchased $5,110 of office equipment on credit.

5 The company paid $760 cash for this month's cleaning services.

8 The company provided consulting services for a client and

immediately collected $6,000 cash.

12 The company provided $2,90e of consulting services for a client on

credit.

May

furnished office and paid $2,200 cash for May's

15 The company paid $730 cash for an assistant's salary for the first

half of this month.

20 The company received $2,900 cash payment for the services provided

May 12.

on

22 The company provided $3,200 of consulting serMices

25 The company rsceived $3,200 cash payment for the services provided

on May 22.

26 The company paid $5,110 cash for the office equipment purchased on

May 3

27 The company purchased $80 of advertising in this months

paper on credit cash paymentis due June

28 The company paid $730 cashfor anassistant s

half of this month.

30 The company paid $400 cash for this month's telephone bill.

30 The company paid $27e cash for this month's utilities.

31 G. Gram withdrew $1,900 cashfrom the company for personal use.

on credit.

(May) local

salary for the second

<Prev

2

of 2

Next

ere to search

e

7:35 PM

9/4/2019

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College