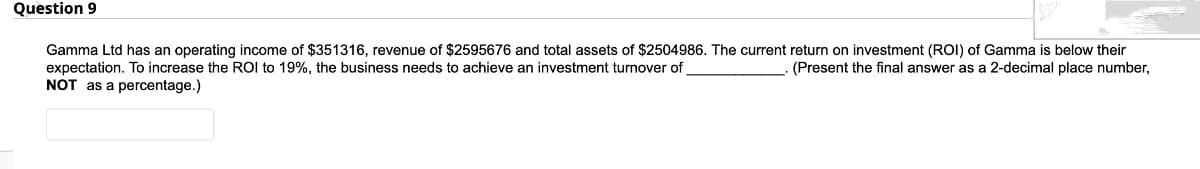

Gamma Ltd has an operating income of $351316, revenue of $2595676 and total assets of $2504986. The current return on investment (ROI) of Gamma is below their expectation. To increase the ROI to 19%, the business needs to achieve an investment turnover of (Present the final answer as a 2-decimal place number, NOT as a percentage.)

Q: Waterway Company uses a job order cost system. On May 1, the company has balances in Raw Materials…

A: Ending work in process = Beginning WIP + Direct materials + Direct Labor + Manufacturing overhead

Q: Splish Company's ledger shows the following balances on December 31, 2025. 7% Preferred stock-$10…

A: Dividends: The part of income that a company decides to distribute to their shareholders are termed…

Q: The outstanding capital stock of Concord Corporation consists of 2,000 shares of $100 par value, 7%…

A: A preferred dividend is a dividend that is allocated to and paid to company's preferred shares.

Q: Current Attempt in Progress Kingbird's currently manufactures art supplies, including markers. The…

A: The contribution margin is calculated as difference between sales and variable costs. The operating…

Q: Drilling Company uses activity-based costing and provides this information: Driver Rate $ 0.80 52.00…

A: Activity Based Costing: Overhead and indirect costs are divided across related goods and services…

Q: A generator costs ₱500,000 and whose salvage value is ₱10,000 after 20 years. How much is the…

A: Computation of the depreciable value of generator and sum of year digit: Cost of generator…

Q: Required information [The following information applies to the questions displayed below.] Ricky's…

A: Trial Balance :— It is the list of debit and credit balances of ledger accounts. Ledger accounts…

Q: Data Section: Work in process, beginning Units completed during the months Work in process, ending…

A: The total cost of producing a product, including raw materials and operating costs, is detailed in a…

Q: Phillip Morris reported the following information in its 2018 Form 10-K. $ millions Stockholders'…

A: The return on equity is the profitability ratio that is calculated by dividing the net earnings…

Q: Part I: Answer the question as following 1. What is capital and define the capital? 2. Explain the…

A: Capital refers to financial assets or the resources used to produce goods and services. In…

Q: Hi, I need help solving for the remaining values (cells highlighted red require input; white…

A: Computation of production budget is shown as below.

Q: 2. Johnstown Company granted 10 officers rights to buy 10,000 shares each of common stock $2 par, at…

A: Compensation is the total pay an employee receives when working. This includes a traditional salary,…

Q: The conceptual framework indicates the desired fundamental and enhancing qualitative characteristics…

A: A conceptual framework is a type of document that helps a company in drafting policies in the…

Q: TASK SIX Merchandising. Pharma help, Inc., a distributor of special pharmaceutical products,…

A: Hi student Since there are multiple subparts asked, we will answer only first three subparts.…

Q: 132) On May 1, a company purchased inventory costing $2,000 on account with terms 2/10, n/30. On May…

A: JOURNAL ENTRIES Journal Entry is the First stage of Accounting Process. Journal Entry is the…

Q: Accounting Information System Explain the flow of expenses flowchart of a bookstore business.

A: An expense flow chart of a bookstore business is a type of diagram representing a process using…

Q: AB Ltd. presents the following selected accounts, all balances are after adjusting journal entries.…

A: The transportation In costs are included in the cost of purchases. The interest expense is not…

Q: The balance sheet of Adams Pharmacy after the revenue, expense, and partner’s drawing accounts have…

A: The process of retiring a partner involves several steps, including the revaluation of the…

Q: If a company, sold 42,000 units, total sales were $168,000, total variable expenses were $117,600,…

A: Formula, Contribution Margin Ratio = Contribution Margin / Sales Revenue = [(Sales Revenue -…

Q: Lily Wyatt is unable to reconcile the bank balance at January 31. Lily's reconciliation is as…

A: The balance of the cash book occasionally does not match the balance of the bank account due to…

Q: What is the liability for the outstanding premiums at year-end?* a. 2,000,000 b. 562,500 c.…

A: Warranty is a form of assurance being provided by seller to the buyer that in case product will have…

Q: Quick Computing installed its previous generation of computer chip manufacturing equipment 3 years…

A: DEPRECIATION EXPENSE Depreciation means gradual decrease in the value of an asset due to normal wear…

Q: List the accounts names for the following transaction and determine which is a debit or credit: 1.…

A: INTEREST ON NOTES PAYABLE ACCRUED IS A PART OF CURRENT LIABILITY AND EVERY LIABILITY EITHER CURRENT…

Q: Assets Cash Receivables (net) Inventory PP & E (net) Patents&Licenses Goodwill Total assets…

A: Accounting Ratios: Accounting ratios are the mathematical relation between two financial figures to…

Q: The Westlake Company uses the percent of sales method of accounting for uncollectible accounts…

A: Provision for uncollectible amounts - also known as provision for doubtful debts or reserve for bad…

Q: DIRECTIONS: Read and analyze the following problems and supply what is required and support it with…

A: Solution: In the above given question IZZY plans to issue 7.8% P1000 Face value bonds amount to…

Q: The following information pertains to the inventory Parvin Company. Jan. 1 Apr. 1 Oct. 1 400 units…

A: Inventory valuation method includes: FIFO Method LIFO Method Weighted average cost method FIFO…

Q: Eastern Manufacturing is involved with several situations that possible involve contingencies. Each…

A: The date, the sum that will also be credited and debited, a brief description of the transaction,…

Q: In its first year of operations, Roma Company reports the following. Earned revenues of $48,000…

A: In this question, we need to compute net income under both: Cash Basis and, Accrual Basis Under…

Q: DIRECTIONS: Match the two columns by writing the letter assigned to your answer from the right…

A: A business is defined as an entity formed to carry out commercial activities in order to achieve a…

Q: Tuscan Incorporated had a retained earnings balance of $96,000 at December 31 of the prior year. In…

A: The statement of Retained earnings is prepared to record the changes in cumulative profits of the…

Q: O Ratio Calculations Select the images below to enlarge. Balance Sheet Murawski Company Balance…

A: RETURN ON ASSETS RATIO : = (NET INCOME / AVERAGE TOTAL ASSET) X 100

Q: Sales 60,000 ACquestion Variable Overheads. 36,0000 Contribution 1,15,000 Fixed Overheads…

A: Lets understand the basics. Profit volume ratio is also known as contribution margin ratio. It is a…

Q: R. L. Ybarra employs John Ince at a salary of $53,000 a year. Ybarra is subject to employer Social…

A: Cost of employment includes all expenses paid by employer. Payroll taxes also part of employment…

Q: Murawski Company Balance Sheet December 31 Current Assets Investments Cash and cash equivalents…

A: Current ratio is the liquidity ratio that shows the ability of the company to pay off its current…

Q: Siberia. The cost of the musk oil is $1.50 per gram. Budgeted production of Mink Caress is given…

A: Direct materials purchase budget is based on production needs and is prepared to predict the…

Q: Accounting Information System Provide an analysis/explanation of the flow of the expenses flowchart…

A: A business expenses flowchart is a visual representation of the flow of expenditures in a business.…

Q: On January 2, 20X1, Gold Sor Lesting Company leases equipment to Brick Co. with 5 equal annual…

A: Solution: Lease receivables at the beginning of lease = Present value of minimum lease payment and…

Q: ABA Ltd. Has collected the following data and asks you to prepare the Balance Sheet at 12/31/20X2:…

A: The balance sheet is the important financial statement of the business. It represents the business's…

Q: Business revenue Business expenses Rental revenue Rental expenses, excl. CCA Rental-maximum CCA…

A: INTRODUCTION: Operating income is defined as the profit of the firm after subtracting operating…

Q: A Corporation is working on its direct labor budget for the next two months. Each unit of output…

A: Direct labor budget shows the number of labor hours required to produce the units budgeted and the…

Q: Question 6 Graham's average P/E is 17.663, and its EPS is $41.00. If its current price is $609.75,…

A: PE RATIO IS CALCULATED : MARKET PRICE PER SHARE/EARNINGS PER SHARE, HENCE, THE AVERAGE PRICE SHOULD…

Q: Post the transactions to T accounts .(post entries in the order (cash,account receivable,equipment,…

A: Cash Date Particulars Amount Date Particulars Amount 1-Sep-18 Capital $…

Q: 1. How long will it take for P4,300 to to P5,250 at 9.4% semi-annually? accumulate compounded

A: Future value is a value received in the future by the investor, The interest amount is included in…

Q: The income statement for the Cheyenne Golf Club Inc. for the month ended July 31 shows Service…

A: The following entry occur during the closing process: 1. Journal entries are made to return the…

Q: VitalSom ance as x blank. ter's Cli al Balan y 31, 20 DE

A: Lets understand the basics. Trial balance preparation is a third stage of preparing statement of…

Q: s CON1-1 Part 2 2. Prepare a statement of stockholders' equity for the current year. PENNY'S POOL…

A: STATEMENT OF SHAREHOLDERS EQUITY Statement of Shareholders Equity is also Known as Changes in…

Q: Pharoah Company adopts acceptable accounting for its defined benefit pension plan on January 1,…

A: The worksheet should include the following sections: Beginning Balances: This should include the…

Q: Revenue Cost of Sales Gross Profit Expenses Operating Profit Interest Payable Profit Before Tax Tax…

A: Gross profit margin ratio is the ratio which shows the percentage gross profit earned on the sales…

Q: 不 Becky would like to be a millionaire in 20 years. How much would she need to invest quarterly in a…

A: Time value of money :— According to this concept, value of money in present day is greater than the…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- The income statement comparison for Rush Delivery Company shows the income statement for the current and prior year. A. Determine the operating income (loss) (dollars) for each year. B. Determine the operating income (percentage) for each year. C. The company made a strategic decision to invest in additional assets in the current year. These amounts are provided. Using the total assets amounts as the investment base, calculate the ROI. Was the decision to invest additional assets in the company successful? Explain. D. Assuming an 8% cost of capital, calculate the RI for each year. Explain how this compares to your findings in part C.14. Briggs Company has operating income of $33,516, invested assets of $133,000, and sales of $478,800. Use the DuPont formula to compute the return on investment. If required, round your answers to two decimal places. a. Profit margin ____ % b. Investment turnover ____ c. Return on investment ____ %6. bottlebrush company has operating income of $225,675 , invested assets of $295,000 and sales of $1,327,500. using the DuPont formula to compute the return of investment, and show (a) profit margin, (b) the investment turnover, and (c) the return on investment. round answers to the one decimal place

- Grove Corp. has revenues of $1,531,000 resulting in an operating income of $183,000. Average invested assets total $801,000. If sales increase by 10% and the investment level remains constant, what is the investment turnover?A.) 2.10B.) 12.65%C.) 1.91D.) 11.95%Why are Old Men so Daggum Stubborn (OMDS) had the following information for the previous calendar year: Operating income: $66,880 Invested assets: $167,200 Sales: $836,000 What is OMDS' investment turnover? For percentages, please enter your answer as a decimal (i.e., 20% is 0.20). For dollar amounts, please provide your answer to two decimal places (i.e. $3.00 is 3.00)11. Briton Company has operating income of $36,000, invested assets of $180,000, and sales of $720,000. Use the DuPont formula to compute the return on investment and show (a) the profit margin, (b) the investment turnover, and (c) the return on investment.

- DuPont Analysis Gardial & Son has an ROA of 12%, a 4% profit margin, and a return on equity equal to 20%. What is the company's total assets turnover? What is the firm's equity multiplier? Do not round intermediate calculations. Round your answers to two decimal places. Total assets turnover: Equity multiplier:Please I need step 4 Gibson Corporation’s balance sheet indicates that the company has $580,000 invested in operating assets. During the year, Gibson earned operating income of $67,280 on $1,160,000 of sales. Required Compute Gibson’s profit margin for the year. Compute Gibson’s turnover for the year. Compute Gibson’s return on investment for the year. Recompute Gibson’s ROI under each of the following independent assumptions:(1) Sales increase from $1,160,000 to $1,392,000, thereby resulting in an increase in operating income from $67,280 to $76,560.(2) Sales remain constant, but Gibson reduces expenses, resulting in an increase in operating income from $67,280 to $69,600.(3) Gibson is able to reduce its invested capital from $580,000 to $464,000 without affecting operating income.Margin, Turnover, Return on Investment Pelak Company had sales of $4,974,000, expenses of $4,566,000, and average operating assets of $4,380,000. Required: 1. Compute the operating income.$fill in the blank 1 2. Compute the margin (as a percent) and turnover ratio. If required, round your answers to one decimal place. Margin fill in the blank 2 % Turnover fill in the blank 3 3. Compute the ROI as a percent. Use the part 2 final answers in these calculations and round the final answer to two decimal places.fill in the blank 4 %

- Margin, Turnover, Return on Investment Pelak Company had sales of $5,003,000, expenses of $4,607,000, and average operating assets of $4,840,000. Required: 1. Compute the operating income.$ 2. Compute the margin (as a percent) and turnover ratio. If required, round your answers to one decimal place. Margin % Turnover 3. Compute the ROI as a percent. Use the part 2 final answers in these calculations and round the final answer to two decimal places.%Profit Margin, Investment Turnover, and ROI Snodgrass Company has income from operations of $232,800, invested assets of $970,000, and sales of $3,880,000. Use the DuPont formula to compute the return on investment and show (a) the profit margin, (b) the investment turnover, and (c) the return on investment. Round your answers to one decimal place. a. Profit margin b. Investment turnover c. Return on investment %For the most recent year, Robin Company reports operating income of $660,000. Robin's sales margin is 7%, and capital turnover is 2.0.What is Robin's return on investment (ROI)? Question 15 options: 2% 7% 4% 14%