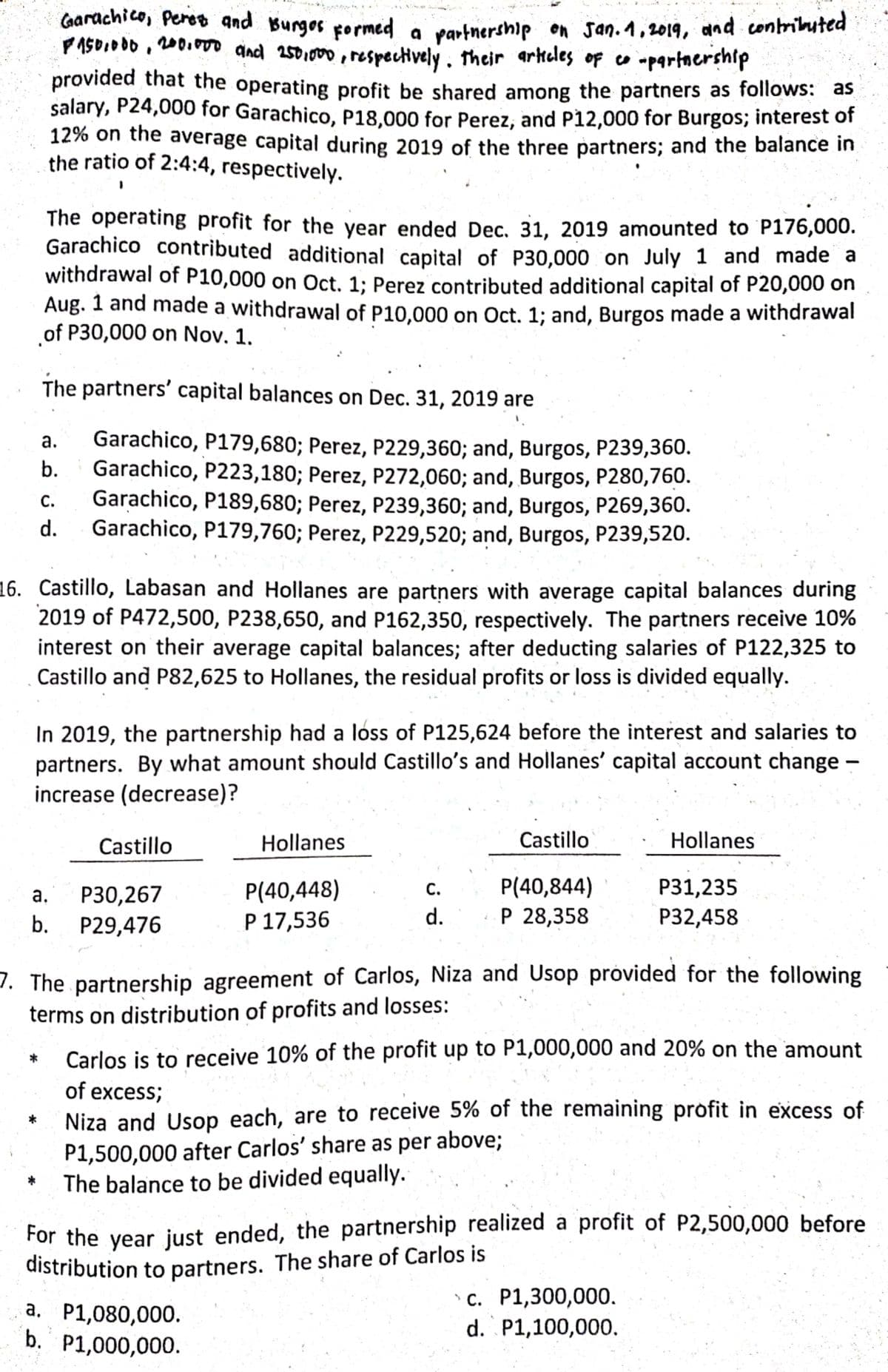

Garachico, Peres and Burges formed a partnershp on Jan. 1,2019, and contributed PASD.O00, 200.00 aind 250,000, respectively . their arkeles of co apartnership provided that the operating profit be shared among the partners as follows: as salary, P24,000 for Garachico, P18,000 for Perez, and P12,000 for Burgos; interest of 12% on the average capital during 2019 of the three partners; and the balance in the ratio of 2:4:4, respectively. The operating profit for the year ended Dec, 31, 2019 amounted to P176,000. Garachico contributed additional capital of P30,000 on July 1 and made a withdrawal of P10,000 on Oct. 1; Perez contributed additional capital of P20,000 on Aug. 1 and made a withdrawal of P10,000 on Oct. 1; and, Burgos made a withdrawal of P30,000 on Nov. 1. The partners' capital balances on Dec. 31, 2019 are Garachico, P179,680; Perez, P229,360; and, Burgos, P239,360. Garachico, P223,180; Perez, P272,060; and, Burgos, P280,760. Garachico, P189,680; Perez, P239,360; and, Burgos, P269,360. Garachico, P179,760; Perez, P229,520; and, Burgos, P239,520. а. b. C. d.

Garachico, Peres and Burges formed a partnershp on Jan. 1,2019, and contributed PASD.O00, 200.00 aind 250,000, respectively . their arkeles of co apartnership provided that the operating profit be shared among the partners as follows: as salary, P24,000 for Garachico, P18,000 for Perez, and P12,000 for Burgos; interest of 12% on the average capital during 2019 of the three partners; and the balance in the ratio of 2:4:4, respectively. The operating profit for the year ended Dec, 31, 2019 amounted to P176,000. Garachico contributed additional capital of P30,000 on July 1 and made a withdrawal of P10,000 on Oct. 1; Perez contributed additional capital of P20,000 on Aug. 1 and made a withdrawal of P10,000 on Oct. 1; and, Burgos made a withdrawal of P30,000 on Nov. 1. The partners' capital balances on Dec. 31, 2019 are Garachico, P179,680; Perez, P229,360; and, Burgos, P239,360. Garachico, P223,180; Perez, P272,060; and, Burgos, P280,760. Garachico, P189,680; Perez, P239,360; and, Burgos, P269,360. Garachico, P179,760; Perez, P229,520; and, Burgos, P239,520. а. b. C. d.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter14: Partnerships And Limited Liability Entities

Section: Chapter Questions

Problem 2BD

Related questions

Question

Transcribed Image Text:Carachico, Peros and Burges pormed a

PASO.000 , 200.00 and 2501000, respectively . their arkeles of co -partnership

partnership on san.1,2019, and contriluted

provided that the operating profit be shared among the partners as follows: as

salary, P24,000 for Garachico, P18,000 for Perez, and P12,000 for Burgos; interest of

12% on the average capital during 2019 of the three partners; and the balance in

the ratio of 2:4:4, respectively.

The operating profit for the year ended Dec, 31, 2019 amounted to P176,000.

Garachico contributed additional capital of P30,000 on July 1 and made a

withdrawal of P10,000 on Oct. 1; Perez contributed additional capital of P20,000 on

Aug. 1 and made a withdrawal of P10.000 on Oct. 1; and, Burgos made a withdrawal

of P30,000 on Nov. 1.

The partners' capital balances on Dec. 31, 2019 are

Garachico, P179,680; Perez, P229,360; and, Burgos, P239,360.

Garachico, P223,180; Perez, P272,060; and, Burgos, P280,760.

Garachico, P189,680; Perez, P239,360; and, Burgos, P269,360.

Garachico, P179,760; Perez, P229,520; and, Burgos, P239,520.

а.

b.

С.

d.

16. Castillo, Labasan and Hollanes are partners with average capital balances during

2019 of P472,500, P238,650, and P162,350, respectively. The partners receive 10%

interest on their average capital balances; after deducting salaries of P122,325 to

Castillo and P82,625 to Hollanes, the residual profits or loss is divided equally.

In 2019, the partnership had a loss of P125,624 before the interest and salaries to

partners. By what amount should Castillo's and Hollanes' capital account change –

increase (decrease)?

Castillo

Hollanes

Castillo

Hollanes

P(40,448)

Р 17,536

P(40,844)

Р 28,358

С.

Р31,235

Р30,267

b. P29,476

а.

d.

P32,458

7. The partnership agreement of Carlos, Niza and Usop próvided for the following

terms on distribution of profits and losses:

Carlos is to receive 10% of the profit up to P1,000,000 and 20% on the amount

*

of excess;

Niza and Usop each, are to receive 5% of the remaining profit in excess of

P1,500,000 after Carlos' share as per above;

The balance to be divided equally.

For the year just ended, the partnership realized a profit of P2,500,000 before

distribution to partners. The share of Carlos is

a, P1,080,000.

b. P1,000,000.

с. Р1,300,000.

d. P1,100,000.

а.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT