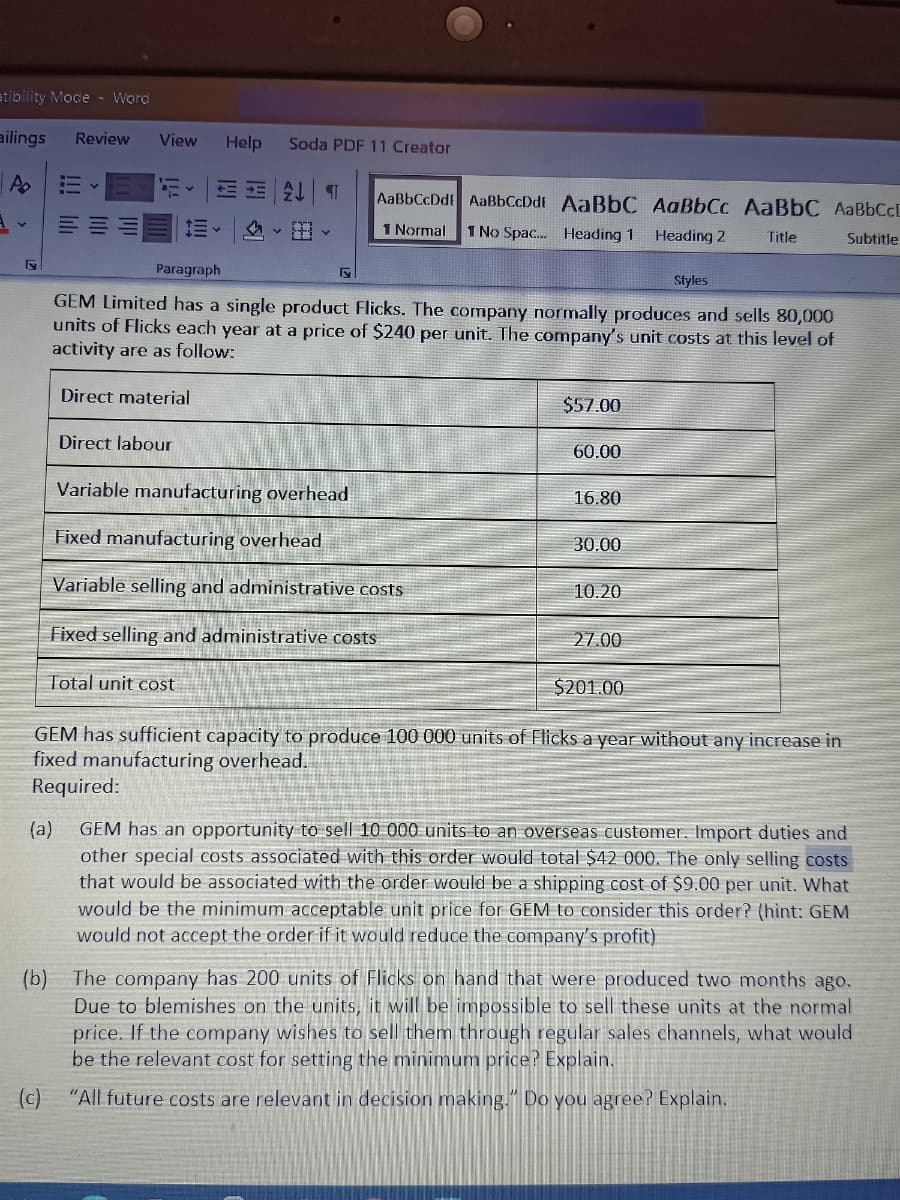

GEM Limited has a single product Flicks. The company normally produces and sells 80,000 units of Flicks each year at a price of $240 per unit. The company's unit costs at this level of activity are as follow: Direct material $57.00 Direct labour 60.00 Variable manufacturing overhead 16.80 Fixed manufacturing overhead 30.00 Variable selling and administrative costs 10.20 Fixed selling and administrative costs 27.00 Total unit cost $201.00 GEM has sufficient capacity to produce 100 000 units of Flicks a year without any increase in fixed manufacturing overhead. Required: GEM has an opportunity to sell 10 000 units to an overseas customer. Import duties and (a) other special costs associated with this order would total $42 000. The only selling costs that would be associated with the order would be a shipping cost of $9.00 per unit. What would be the minimum acceptable unit price for GEM to consider this order? (hìnt: GEM would not accept the order if it would reduce the company's profit) (b) The company has 200 units of Flicks on hand that were produced two months ago. Due to blemishes on the units, it will be impossible to sell these units at the normal price. If the company wishes to sell them through regular sales channels, what would be the relevant cost for setting the minimum price? Explain. (c) "All future costs are relevant in decision making." Do you agree? Explain.

GEM Limited has a single product Flicks. The company normally produces and sells 80,000 units of Flicks each year at a price of $240 per unit. The company's unit costs at this level of activity are as follow: Direct material $57.00 Direct labour 60.00 Variable manufacturing overhead 16.80 Fixed manufacturing overhead 30.00 Variable selling and administrative costs 10.20 Fixed selling and administrative costs 27.00 Total unit cost $201.00 GEM has sufficient capacity to produce 100 000 units of Flicks a year without any increase in fixed manufacturing overhead. Required: GEM has an opportunity to sell 10 000 units to an overseas customer. Import duties and (a) other special costs associated with this order would total $42 000. The only selling costs that would be associated with the order would be a shipping cost of $9.00 per unit. What would be the minimum acceptable unit price for GEM to consider this order? (hìnt: GEM would not accept the order if it would reduce the company's profit) (b) The company has 200 units of Flicks on hand that were produced two months ago. Due to blemishes on the units, it will be impossible to sell these units at the normal price. If the company wishes to sell them through regular sales channels, what would be the relevant cost for setting the minimum price? Explain. (c) "All future costs are relevant in decision making." Do you agree? Explain.

Pkg Acc Infor Systems MS VISIO CD

10th Edition

ISBN:9781133935940

Author:Ulric J. Gelinas

Publisher:Ulric J. Gelinas

Chapter17: Acquiring And Implementing Accounting Information Systems

Section: Chapter Questions

Problem 1SP

Related questions

Question

100%

Please provide answers of each.

Transcribed Image Text:atibility Mode -Word

ailings

Review

View

Help

Soda PDF 11 Creator

三 T

AaBbCcDdt AaBbCcDdE AaBbC AaBbCc AaBbC AABBCCD

1 Normal

1 No Spac. Heading 1

Heading 2

Title

Subtitle

Paragraph

Styles

GEM Limited has a single product Flicks. The company normally produces and sells 80,000

units of Flicks each year at a price of $240 per unit. The company's unit costs at this level of

activity are as follow:

Direct material

$57.00

Direct labour

60.00

Variable manufacturing overhead

16.80

Fixed manufacturing overhead

30.00

Variable selling and administrative costs

10.20

Fixed selling and administrative costs

27.00

Total unit cost

$201.00

GEM has sufficient capacity to produce 100 000 units of Flicks a year without any increase in

fixed manufacturing overhead.

Required:

GEM has an opportunity to sell 10 000 units to an overseas customer, Import duties and

(a)

other special costs associated with this order would total $42 000. The only selling costs

that would be associated with the order would be a shipping cost of $9.00 per unit. What

would be the minimum acceptable unit price for GEM to consider this order? (hìnt: GEM

would not accept the order if it would reduce the company's profit)

The company has 200 units of Flicks on hand that were produced two months ago.

(b)

Due to blemishes on the units, it will be impossible to sell these units at the normal

price. If the company wishes to sell them through regular sales channels, what would

be the relevant cost for setting the minimum price? Explain.

(c)

"All future costs are relevant in decision making." Do you agree? Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pkg Acc Infor Systems MS VISIO CD

Finance

ISBN:

9781133935940

Author:

Ulric J. Gelinas

Publisher:

CENGAGE L

Pkg Acc Infor Systems MS VISIO CD

Finance

ISBN:

9781133935940

Author:

Ulric J. Gelinas

Publisher:

CENGAGE L