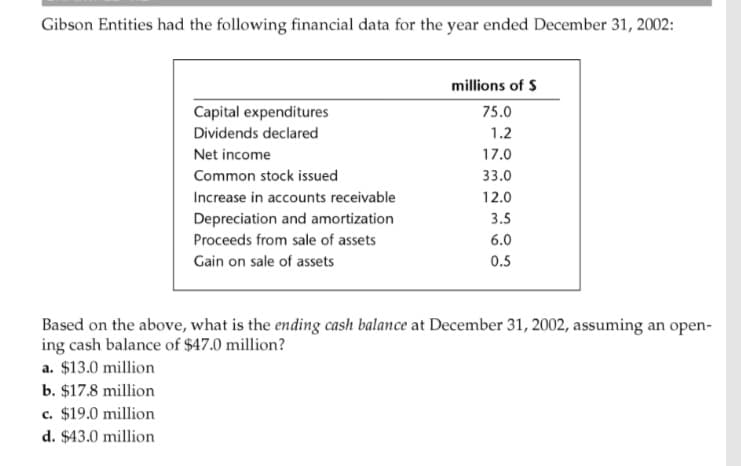

Gibson Entities had the following financial data for the year ended December 31, 2002: millions of $ Capital expenditures 75.0 Dividends declared 1.2 Net income 17.0 Common stock issued 33.0 Increase in accounts receivable 12.0 Depreciation and amortization 3.5 Proceeds from sale of assets 6.0 Gain on sale of assets 0.5 Based on the above, what is the ending cash balance at December 31, 2002, assuming an open- ing cash balance of $47.0 million? a. $13.0 million b. $17.8 million c. $19.0 million d. $43.0 million

Gibson Entities had the following financial data for the year ended December 31, 2002: millions of $ Capital expenditures 75.0 Dividends declared 1.2 Net income 17.0 Common stock issued 33.0 Increase in accounts receivable 12.0 Depreciation and amortization 3.5 Proceeds from sale of assets 6.0 Gain on sale of assets 0.5 Based on the above, what is the ending cash balance at December 31, 2002, assuming an open- ing cash balance of $47.0 million? a. $13.0 million b. $17.8 million c. $19.0 million d. $43.0 million

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 7MC

Related questions

Question

100%

Show explanation also

Transcribed Image Text:Gibson Entities had the following financial data for the year ended December 31, 2002:

millions of $

Capital expenditures

75.0

Dividends declared

1.2

Net income

17.0

Common stock issued

33.0

Increase in accounts receivable

12.0

Depreciation and amortization

3.5

Proceeds from sale of assets

6.0

Gain on sale of assets

0.5

Based on the above, what is the ending cash balance at December 31, 2002, assuming an open-

ing cash balance of $47.0 million?

a. $13.0 million

b. $17.8 million

c. $19.0 million

d. $43.0 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub