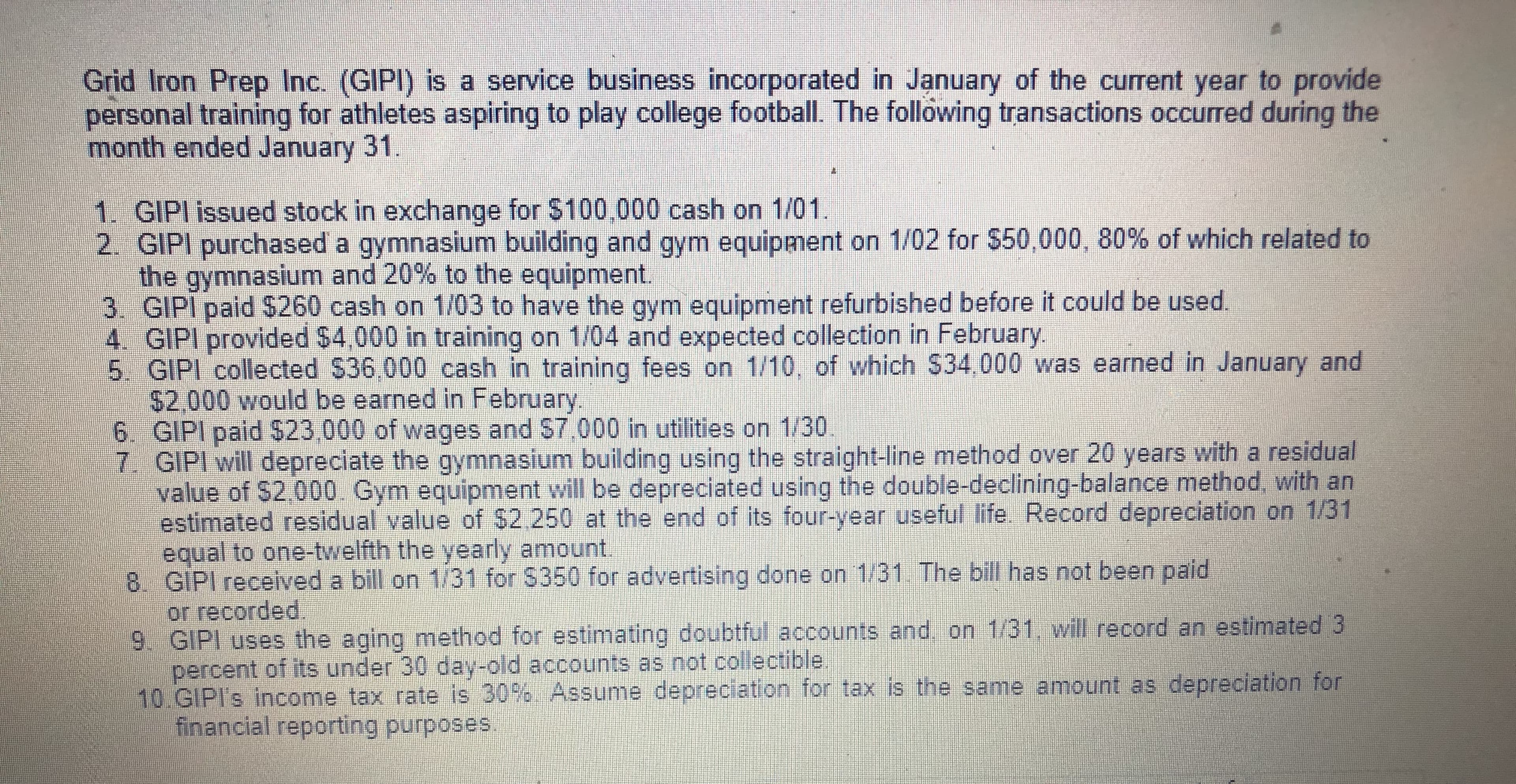

Grid Iron Prep Inc. (GIPI) is a service business incorporated in January of the current year to provide personal training for athletes aspiring to play college football. The following transactions occurred during the month ended January 31. 1. GIPI issued stock in exchange for $100,000 cash on 1/01 2. GIPI purchased a gymnasium building and gym equipment on 1/02 for $50,000, 80% of which related to the gymnasium and 20% to the equipment. 3. GIPI paid $260 cash on 1/03 to have the gym equipment refurbished before it could be used 4. GIPI provided $4,000 in training on 1/04 and expected collection in February 5. GIPI collected $36 000 cash in training fees on 1/10, of which $34,000 was earned in January and $2,000 would be earned in February 6. GIPI paid S23 000 of wages and $7,000 in utilities on 1/30 7. GIPI will depreciate the gymnasium building using the straight-line method over 20 years with a residual value of $2,000. Gym equipment will be depreciated using the double-declining-balance method, with an estimated residual value of $2 250 at the end of its four-year useful life. Record depreciation on 1/31 equal to one-twelfth the yearly amount. 8 GIPI received a bill on 1/31 for $350 for advertising done on 1/31 The bill has not been paid or recorded 9 GIPI uses the aging method for estimating doubtful accounts and on 1/31. will record an estimated 3 percent of its under 30 day-old accounts as not collectible. 10.GIPI's income tax rate is 30% Assunme depreciation for tax is the same amount as depreciation for financial reporting purposes GRID IRON PREP INC. Balance Sheet As of January 31

Grid Iron Prep Inc. (GIPI) is a service business incorporated in January of the current year to provide personal training for athletes aspiring to play college football. The following transactions occurred during the month ended January 31. 1. GIPI issued stock in exchange for $100,000 cash on 1/01 2. GIPI purchased a gymnasium building and gym equipment on 1/02 for $50,000, 80% of which related to the gymnasium and 20% to the equipment. 3. GIPI paid $260 cash on 1/03 to have the gym equipment refurbished before it could be used 4. GIPI provided $4,000 in training on 1/04 and expected collection in February 5. GIPI collected $36 000 cash in training fees on 1/10, of which $34,000 was earned in January and $2,000 would be earned in February 6. GIPI paid S23 000 of wages and $7,000 in utilities on 1/30 7. GIPI will depreciate the gymnasium building using the straight-line method over 20 years with a residual value of $2,000. Gym equipment will be depreciated using the double-declining-balance method, with an estimated residual value of $2 250 at the end of its four-year useful life. Record depreciation on 1/31 equal to one-twelfth the yearly amount. 8 GIPI received a bill on 1/31 for $350 for advertising done on 1/31 The bill has not been paid or recorded 9 GIPI uses the aging method for estimating doubtful accounts and on 1/31. will record an estimated 3 percent of its under 30 day-old accounts as not collectible. 10.GIPI's income tax rate is 30% Assunme depreciation for tax is the same amount as depreciation for financial reporting purposes GRID IRON PREP INC. Balance Sheet As of January 31

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter3: Processing Accounting Information

Section: Chapter Questions

Problem 3.2AP

Related questions

Question

Prepare a balance sheet

Transcribed Image Text:Grid Iron Prep Inc. (GIPI) is a service business incorporated in January of the current year to provide

personal training for athletes aspiring to play college football. The following transactions occurred during the

month ended January 31.

1. GIPI issued stock in exchange for $100,000 cash on 1/01

2. GIPI purchased a gymnasium building and gym equipment on 1/02 for $50,000, 80% of which related to

the gymnasium and 20% to the equipment.

3. GIPI paid $260 cash on 1/03 to have the gym equipment refurbished before it could be used

4. GIPI provided $4,000 in training on 1/04 and expected collection in February

5. GIPI collected $36 000 cash in training fees on 1/10, of which $34,000 was earned in January and

$2,000 would be earned in February

6. GIPI paid S23 000 of wages and $7,000 in utilities on 1/30

7. GIPI will depreciate the gymnasium building using the straight-line method over 20 years with a residual

value of $2,000. Gym equipment will be depreciated using the double-declining-balance method, with an

estimated residual value of $2 250 at the end of its four-year useful life. Record depreciation on 1/31

equal to one-twelfth the yearly amount.

8 GIPI received a bill on 1/31 for $350 for advertising done on 1/31 The bill has not been paid

or recorded

9 GIPI uses the aging method for estimating doubtful accounts and on 1/31. will record an estimated 3

percent of its under 30 day-old accounts as not collectible.

10.GIPI's income tax rate is 30% Assunme depreciation for tax is the same amount as depreciation for

financial reporting purposes

Transcribed Image Text:GRID IRON PREP INC.

Balance Sheet

As of January 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning