H31 H31 Waren oofing Income tatement NJA Waen Ring Fer the Month tnded Mach , 017 Generaljutingentries wet forThe Mt Revenu Accounts eandeplanion Debit Credi Aed Serviceevee T lne Amet blnce nce heet Supplienepene $ 1520 A T Expen Supglies S LS0 Salariandwm epe erecordatjutment entry for pplies epene $ 2.00 S LS20 2000 11.000 Supplie 2000540 Mllane pen Depreciation Depreciation expense 250 1.000 400 Accumulated depreciation tapene 250 ereced depreition pen 250 Uneamed Senve even wners Capta Totapen Unearned servicerevenue 260 12.300 LINE Net income fon Servicerenene 260 perecord the ervice mpen 20 Mlanet Salaries andwagnpene 700 Ownerseutyement 700 Salariesandwan payable pe recend salari and mpmse payabie 22 14 23 Fer the Month tnded March 1, 2017 Ownerseuitybeginng $ 12.00 24 25 26 Net income Service renanue SAN S 590 incomeummary berecordtraner of servicereenuete incomeummary Tata Drawing Owners Capital, March 3 S100 S 14.220 28 Incommesummary $ 4I0 $ 2,000 Salaries and wagepene Melaneosepene Supplinpene Deprecition berecerd traner ofepetincomeummany 400 S LS20 250 dance Sheet Forthe ManthndedMarch L, 2017 34 Ca $4.500 S 00 incomemmary Onercapit tereordtraner ofincometenerscapta $ RA0 Account paye Suppies tipment Acumulated depreciation Tetal Ats S 1.00 S 8.500 00 $1740 Ownercapital S L100 S L100 Ounerdring Terecord dringptom ownerscapita L esand harehalderseuity Accounts payable $ 2.500 20 700 Unearned service Salindwn Totacurrentablite Ownereuity Ownerscapit Tota and harholdernquity $ 3.40 $ 14.20 5 1740

H31 H31 Waren oofing Income tatement NJA Waen Ring Fer the Month tnded Mach , 017 Generaljutingentries wet forThe Mt Revenu Accounts eandeplanion Debit Credi Aed Serviceevee T lne Amet blnce nce heet Supplienepene $ 1520 A T Expen Supglies S LS0 Salariandwm epe erecordatjutment entry for pplies epene $ 2.00 S LS20 2000 11.000 Supplie 2000540 Mllane pen Depreciation Depreciation expense 250 1.000 400 Accumulated depreciation tapene 250 ereced depreition pen 250 Uneamed Senve even wners Capta Totapen Unearned servicerevenue 260 12.300 LINE Net income fon Servicerenene 260 perecord the ervice mpen 20 Mlanet Salaries andwagnpene 700 Ownerseutyement 700 Salariesandwan payable pe recend salari and mpmse payabie 22 14 23 Fer the Month tnded March 1, 2017 Ownerseuitybeginng $ 12.00 24 25 26 Net income Service renanue SAN S 590 incomeummary berecordtraner of servicereenuete incomeummary Tata Drawing Owners Capital, March 3 S100 S 14.220 28 Incommesummary $ 4I0 $ 2,000 Salaries and wagepene Melaneosepene Supplinpene Deprecition berecerd traner ofepetincomeummany 400 S LS20 250 dance Sheet Forthe ManthndedMarch L, 2017 34 Ca $4.500 S 00 incomemmary Onercapit tereordtraner ofincometenerscapta $ RA0 Account paye Suppies tipment Acumulated depreciation Tetal Ats S 1.00 S 8.500 00 $1740 Ownercapital S L100 S L100 Ounerdring Terecord dringptom ownerscapita L esand harehalderseuity Accounts payable $ 2.500 20 700 Unearned service Salindwn Totacurrentablite Ownereuity Ownerscapit Tota and harholdernquity $ 3.40 $ 14.20 5 1740

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter2: Basic Accounting Systems: Cash Basis

Section: Chapter Questions

Problem 2.5P: Missing amounts from Financial statements The financial statements at the end of Network Realty,...

Related questions

Question

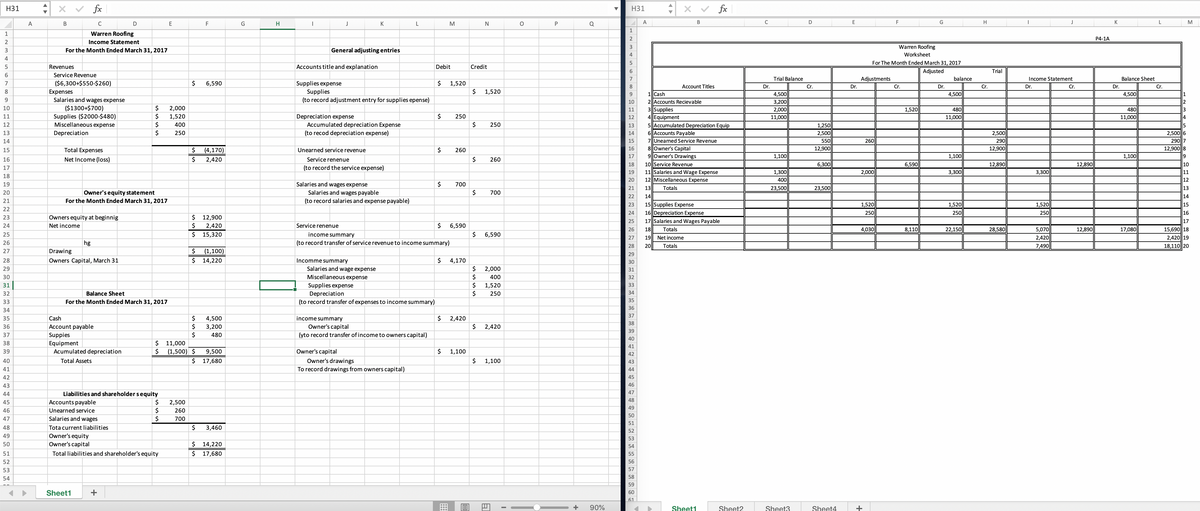

Can you help me complete the worksheet? I just so confused with the quantities. Thank you.

Transcribed Image Text:НЗ1

X v fx

H31

fx

A

В

C

E

G

H

K

M

Q

A

C

D

E

F

G

J

K

M

1

1

Warren Roofing

2

P4-1A

2

Income Statement

Warren Roofing

3

For the Month Ended March 31, 2017

General adjusting entries

4

Worksheet

4

For The Month Ended March 31, 2017

Revenues

Accounts title and explanation

Debit

Credit

Adjusted

Trial

Service Revenue

7

Trial Balance

Adjustments

balance

Income Statement

Balance Sheet

($6,300+$550-$260)

$

Supplies expense

Supplies

(to record adjustment entry for supplies epense)

7

6,590

1,520

8

Account Titles

Dr.

Cr.

Dr.

Cr.

Dr.

Cr.

Dr.

Cr.

Dr.

Cr.

8.

$

Expenses

Salaries and wages expense

1,520

1Cash

4,500

3,200

2,000

11,000

9

4,500

4,500

1

9.

10

2Accounts Recievable

2

($1300+$700)

Supplies ($2000-$480)

Miscellaneous expense

$

$

$

$

10

2,000

3 Supplies

4 Equipment

5 Accumulated Depreciation Equip

6 Accounts Payable

1,520

480

11,000

11

480

3

Depreciation expense

Accumulated depreciation Expense

(to recod depreciation expense)

11

1,520

250

12

11,000

4

12

1,250

2,500

400

250

13

5

2,500

290

2,500 6

290|7

12,900||8

13

Depreciation

250

14

14

15

7 Unearned Service Revenue

550

260

8Owner's Capital

9Owner's Drawings

15

Total Expenses

2$

(4,170)

Unearned service revenue

$

260

16

12,900

12,900

17

1,100

1,100

1,100

19

16

Net Income (Iloss)

$

2,420

Service renenue

$

260

18

10 Service Revenue

6,300

6,590

12,890

12,890

10

17

(to record the service expense)

2,000

3,300

3,300

11 Salaries and Wage Expense

12 Miscellaneous Expense

19

1,300

11

18

20

400

12

Salaries and wages expense

Salaries and wages payable

(to record salaries and expense payable)

19

$

700

21

13

Totals

23,500

23,500

13

20

Owner's equity statement

$

700

22

14

14

21

For the Month Ended March 31, 2017

23

15 Supplies Expense

1,520

1,520

1,520

15

22

24

16 Depreciation Expense

250

250

250

16

23

Owners equity at beginnig

12,900

25

17 Salaries and Wages Payable

|17

24

Net income

$

2,420

Service renenue

$

6,590

28,580

12,890

5,070

2,420

7,490

15,690| 18

2,420 19

26

18

Totals

4,030

8,110

22,150

17,080

25

$ 15,320

income summary

6,590

27

19

Net income

26

hg

(to record transfer of service revenue to income summary)

28

20

Totals

18,110||20

$

(1,100)

$ 14,220

27

Drawing

29

28

Owners Capital, March 31

Incomme summary

$

4,170

30

Salaries and wage expense

$

$

$

29

2,000

31

30

Miscellaneous expense

400

32

Supplies expense

Depreciation

(to record transfer of expenses to income summary)

31

1,520

33

32

Balance Sheet

250

34

33

For the Month Ended March 31, 2017

35

36

34

37

$

4,500

$

3,200

$

35

Cash

income summary

2,420

38

Owner's capital

(yto record transfer of income to owners capital)

36

Account payable

Suppies

Equipment

Acumulated depreciation

2,420

39

37

480

40

38

$ 11,000

41

39

$

(1,500) $

9,500

Owner's capital

$

1,100

42

40

Total Assets

$ 17,680

Owner's drawings

1,100

43

41

To record drawings from owners capital)

44

42

45

43

46

47

Liabilities and shareholder sequity

$

44

48

45

Accounts payable

2,500

49

$

$

46

Unearned service

260

50

47

Salaries and wages

700

51

48

Tota current liabilities

$

3,460

52

49

Owner's equity

53

$ 14,220

$ 17,680

50

Owner's capital

54

51

Total liabilities and shareholder's equity

55

52

56

53

57

54

58

59

Sheet1

+

60

61

+

90%

Sheet1

Sheet2

Sheet3

Sheet4

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning