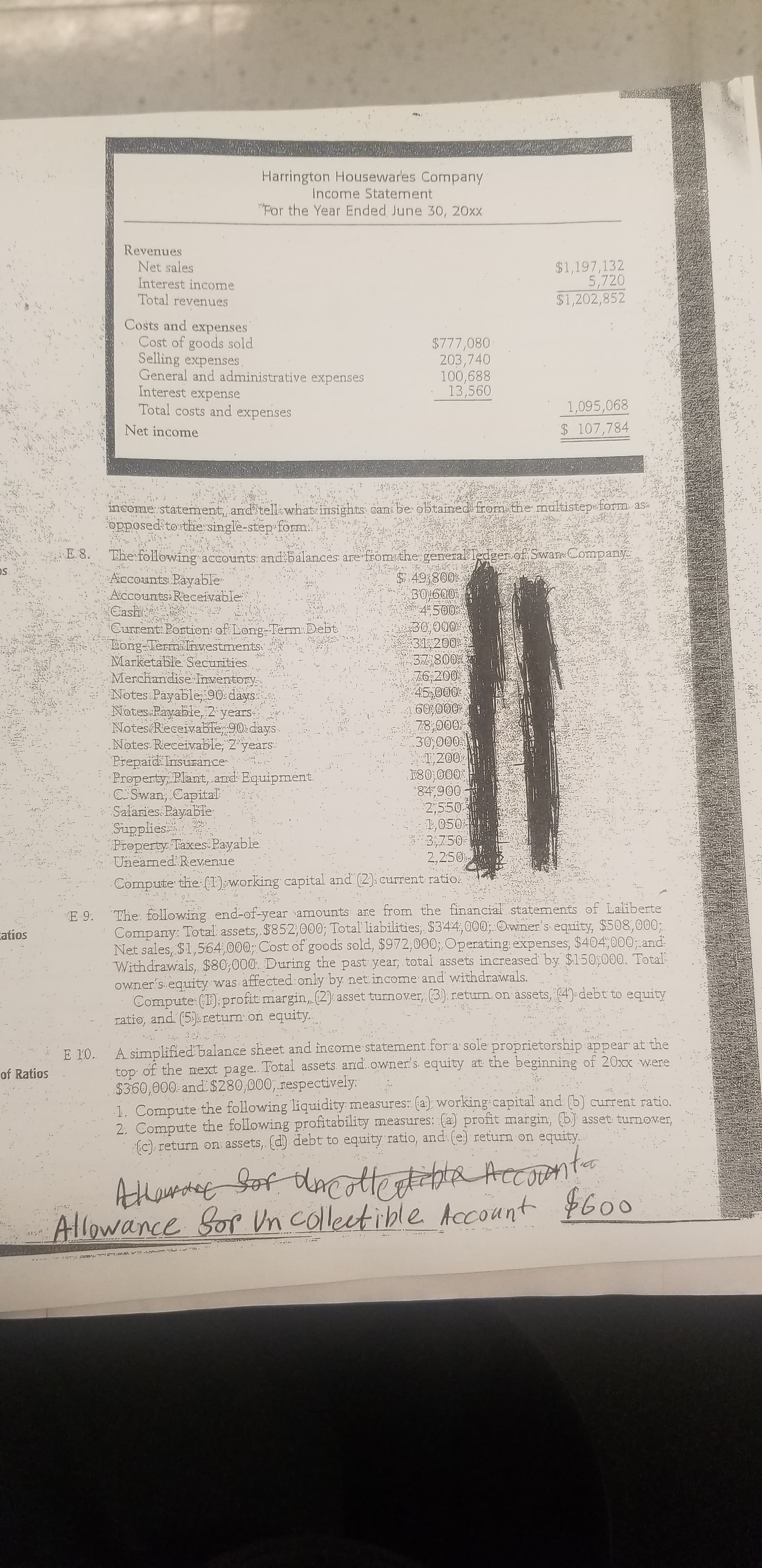

Harrington Housewares Company Income Statement For the Year Ended June 30, 20xx Revenues Net sales Interest income Total revenues $1,197,132 5,720 $1,202,852 Costs and expenses Cost of goods sold Selling expenses. General and administrative expenses Interest expense Total costs and expenses $777,080 203,740 100,688 13,560 1,095,068 $ 107,784 Net income nome statement and tell what insights canibe obtaired from the multistep form opposed torthe single-step form. as he following accounts: and balances are from the general ledger of SwaneCompany Aiccounts Payable Aiccounts Receivable Cash Current Portion: of Long-Term: Debt Eong-Term nvestments Marketable Securities Merchandise Inventory Notes Payable, 90: days Notes Payable,2 years Notes Receivable 90 days. Notes Rieceivable; 2 years Prepaid Insurance Property Plant, and Equipment. C Swan, Capital Salaries. Payable Supplies Property Taxes Payable Unearned Revenue E8. 1RLT1 S 49800 30%600 4500 30,000%! 31200 374800號 76200 45,000 60,000 78000 30;000 T,200 F80,000 84,900 2,550 ,050 3,750 2,250 .Compute the (1)working capital and (2) current ratio The following end-of-year amounts are from the financial statements of Laliberte Company: Total assets, $852,000; Total liabilities, $344,000; Owner's equity, $508,000; Net sales, $1,564,000; Cost of goods sold, $972,000, Operating expenses, $404,000;.and Withdrawals, $80;000. During the past year, total assets increased by $150 000. Total oWner's equity was affected: only by net income and withdrawals. Compute:(1) profit margin(2) asset turnover,(3). return on assets, (4)-debt to equity ratio, and. (5) return on equity E 9 atios A. simplified balance sheet and income statement for a sole proprietorship appear at the top of the next page. Total assets. andowner's equity at the beginning of 20xx were $360,000 and $280,000, respectively 1. Compute the following liquidity measures: (a): working capital and (b) current ratio. 2. Compute the following profitability measures: (a profit margin, (b) asset turnover, f). return on assets, (d) debt to equity ratio, and (e return on equity.. E 10 of Ratios AHawesee Sef Umattepte Aecovnt 6oo Vn collectible Account Allowance Sor

Harrington Housewares Company Income Statement For the Year Ended June 30, 20xx Revenues Net sales Interest income Total revenues $1,197,132 5,720 $1,202,852 Costs and expenses Cost of goods sold Selling expenses. General and administrative expenses Interest expense Total costs and expenses $777,080 203,740 100,688 13,560 1,095,068 $ 107,784 Net income nome statement and tell what insights canibe obtaired from the multistep form opposed torthe single-step form. as he following accounts: and balances are from the general ledger of SwaneCompany Aiccounts Payable Aiccounts Receivable Cash Current Portion: of Long-Term: Debt Eong-Term nvestments Marketable Securities Merchandise Inventory Notes Payable, 90: days Notes Payable,2 years Notes Receivable 90 days. Notes Rieceivable; 2 years Prepaid Insurance Property Plant, and Equipment. C Swan, Capital Salaries. Payable Supplies Property Taxes Payable Unearned Revenue E8. 1RLT1 S 49800 30%600 4500 30,000%! 31200 374800號 76200 45,000 60,000 78000 30;000 T,200 F80,000 84,900 2,550 ,050 3,750 2,250 .Compute the (1)working capital and (2) current ratio The following end-of-year amounts are from the financial statements of Laliberte Company: Total assets, $852,000; Total liabilities, $344,000; Owner's equity, $508,000; Net sales, $1,564,000; Cost of goods sold, $972,000, Operating expenses, $404,000;.and Withdrawals, $80;000. During the past year, total assets increased by $150 000. Total oWner's equity was affected: only by net income and withdrawals. Compute:(1) profit margin(2) asset turnover,(3). return on assets, (4)-debt to equity ratio, and. (5) return on equity E 9 atios A. simplified balance sheet and income statement for a sole proprietorship appear at the top of the next page. Total assets. andowner's equity at the beginning of 20xx were $360,000 and $280,000, respectively 1. Compute the following liquidity measures: (a): working capital and (b) current ratio. 2. Compute the following profitability measures: (a profit margin, (b) asset turnover, f). return on assets, (d) debt to equity ratio, and (e return on equity.. E 10 of Ratios AHawesee Sef Umattepte Aecovnt 6oo Vn collectible Account Allowance Sor

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 2E: Cost of Goods Sold and Income Statement Schuch Company presents you with the following account...

Related questions

Question

Transcribed Image Text:Harrington Housewares Company

Income Statement

For the Year Ended June 30, 20xx

Revenues

Net sales

Interest income

Total revenues

$1,197,132

5,720

$1,202,852

Costs and expenses

Cost of goods sold

Selling expenses.

General and administrative expenses

Interest expense

Total costs and expenses

$777,080

203,740

100,688

13,560

1,095,068

$ 107,784

Net income

nome statement and tell what insights canibe obtaired from the multistep form

opposed torthe single-step form.

as

he following accounts: and balances are from the general ledger of SwaneCompany

Aiccounts Payable

Aiccounts Receivable

Cash

Current Portion: of Long-Term: Debt

Eong-Term nvestments

Marketable Securities

Merchandise Inventory

Notes Payable, 90: days

Notes Payable,2 years

Notes Receivable 90 days.

Notes Rieceivable; 2 years

Prepaid Insurance

Property Plant, and Equipment.

C Swan, Capital

Salaries. Payable

Supplies

Property Taxes Payable

Unearned Revenue

E8.

1RLT1

S

49800

30%600

4500

30,000%!

31200

374800號

76200

45,000

60,000

78000

30;000

T,200

F80,000

84,900

2,550

,050

3,750

2,250

.Compute the (1)working capital and (2) current ratio

The following end-of-year amounts are from the financial statements of Laliberte

Company: Total assets, $852,000; Total liabilities, $344,000; Owner's equity, $508,000;

Net sales, $1,564,000; Cost of goods sold, $972,000, Operating expenses, $404,000;.and

Withdrawals, $80;000. During the past year, total assets increased by $150 000. Total

oWner's equity was affected: only by net income and withdrawals.

Compute:(1) profit margin(2) asset turnover,(3). return on assets, (4)-debt to equity

ratio, and. (5) return on equity

E 9

atios

A. simplified balance sheet and income statement for a sole proprietorship appear at the

top of the next page. Total assets. andowner's equity at the beginning of 20xx were

$360,000 and $280,000, respectively

1. Compute the following liquidity measures: (a): working capital and (b) current ratio.

2. Compute the following profitability measures: (a profit margin, (b) asset turnover,

f). return on assets, (d) debt to equity ratio, and (e return on equity..

E 10

of Ratios

AHawesee Sef Umattepte Aecovnt

6oo

Vn collectible Account

Allowance Sor

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,