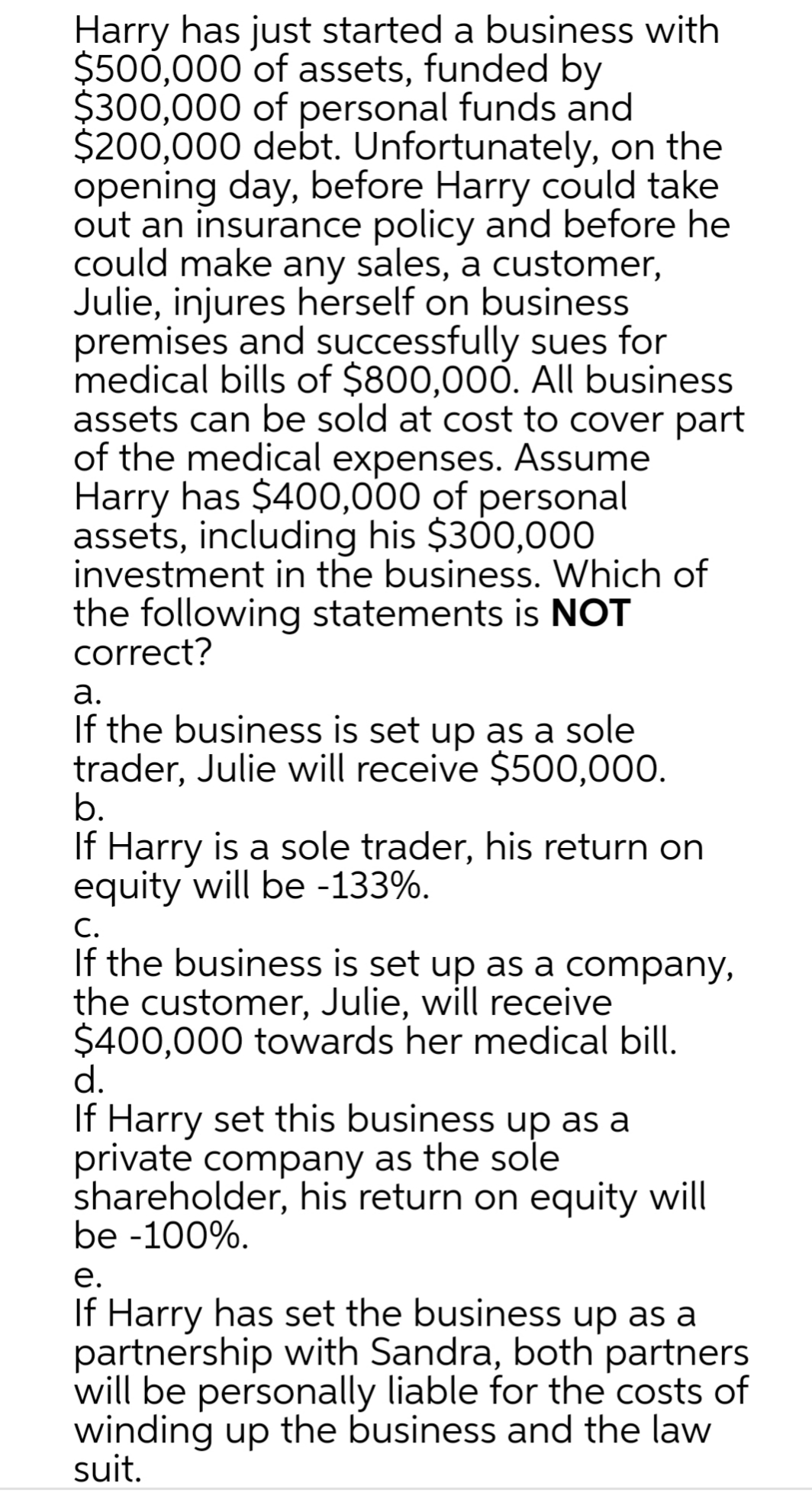

Harry has just started a business with $500,000 of assets, funded by $300,000 of personal funds and $200,000 debt. Unfortunately, on the opening day, before Harry could take out an insurance policy and before he could make any sales, a customer, Julie, injures herself on business premises and successfully sues for medical bills of $800,000. All business assets can be sold at cost to cover part of the medical expenses. Assume Harry has $400,000 of personal assets, including his $30,000 investment in the business. Which of the following statements is NOT correct? а. If the business is set up as a sole trader, Julie will receive $500,000. b. If Harry is a sole trader, his return on equity will be -133%. С. If the business is set up as a company, the customer, Julie, will receive $400,000 towards her medical bill. d. If Harry set this business up as a private company as the sole shareholder, his return on equity will be -100%. е. If Harry has set the business up as a partnership with Sandra, both partners will be personally liable for the costs of winding up the business and the law suit.

Harry has just started a business with $500,000 of assets, funded by $300,000 of personal funds and $200,000 debt. Unfortunately, on the opening day, before Harry could take out an insurance policy and before he could make any sales, a customer, Julie, injures herself on business premises and successfully sues for medical bills of $800,000. All business assets can be sold at cost to cover part of the medical expenses. Assume Harry has $400,000 of personal assets, including his $30,000 investment in the business. Which of the following statements is NOT correct? а. If the business is set up as a sole trader, Julie will receive $500,000. b. If Harry is a sole trader, his return on equity will be -133%. С. If the business is set up as a company, the customer, Julie, will receive $400,000 towards her medical bill. d. If Harry set this business up as a private company as the sole shareholder, his return on equity will be -100%. е. If Harry has set the business up as a partnership with Sandra, both partners will be personally liable for the costs of winding up the business and the law suit.

Chapter11: Investor Losses

Section: Chapter Questions

Problem 54P

Related questions

Question

Transcribed Image Text:Harry has just started a business with

$500,000 of assets, funded by

$300,000 of personal funds and

$200,000 debt. Unfortunately, on the

opening day, before Harry could take

out an insurance policy and before he

could make any sales, a customer,

Julie, injures herself on business

premises and successfully sues for

medical bills of $800,000. All business

assets can be sold at cost to cover part

of the medical expenses. Assume

Harry has $400,000 of personal

assets, including his $300,000

investment in the business. Which of

the following statements is NOT

correct?

а.

If the business is set up as a sole

trader, Julie will receive $500,000.

b.

If Harry is a sole trader, his return on

equity will be -133%.

C.

If the business is set up as a company,

the customer, Julie, will receive

$400,000 towards her medical bill.

d.

If Harry set this business up as a

private company as the sole

shareholder, his return on equity will

be -100%.

е.

If Harry has set the business up as a

partnership with Sandra, both partners

will be personally liable for the costs of

winding up the business and the law

suit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT