he auditors of Final Victory Ltd (FVL) have conducted an annual audit of the company after 31 December 2020, the accounting year end of the company. Up to 31 January 2021 (before the authorization date of the financial statements), two errors are discovered: i) inventories to the value of $9,750 that had been recognized as sold during 2019 was incorrectly included in inventories as at 31 December 2019. ii) money receipt from a customer with a value of $5,250 on 31 December 2019 for service to be delivered on 2 January 2020 was recognized as a revenue in 2019. The following financial statements of FVL for 2019 (as reported) and 2020 (draft) are available: Statements of Profit or Loss and Other Comprehensive Income for the year ended 31 December (Picture Following) The tax rate was 30% for 2019 and 2020. No dividends have been declared or paid. FVL has no items of other comprehensive income since the date of incorporation. Required: Prepare the extracts on statement of changes in equity for 31 December 2020 of FVL to capture the adjustment of two errors.

The auditors of Final Victory Ltd (FVL) have conducted an annual audit of the company after 31 December 2020, the accounting year end of the company. Up to 31 January 2021 (before the authorization date of the financial statements), two errors are discovered:

- i) inventories to the value of $9,750 that had been recognized as sold during 2019 was incorrectly included in inventories as at 31 December 2019.

- ii) money receipt from a customer with a value of $5,250 on 31 December 2019 for service to be delivered on 2 January 2020 was recognized as a revenue in 2019.

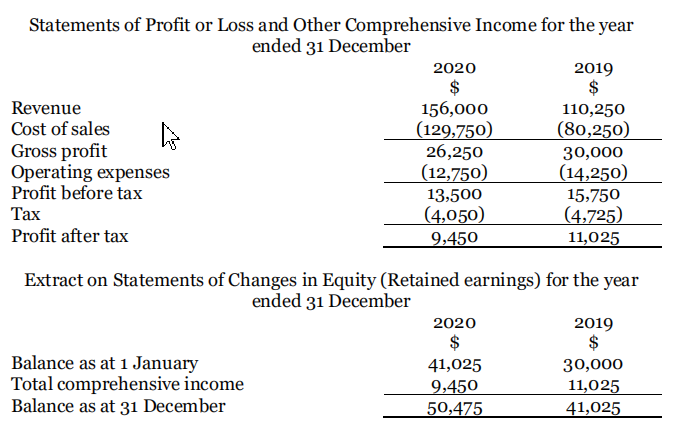

The following financial statements of FVL for 2019 (as reported) and 2020 (draft) are available:

Statements of Profit or Loss and Other Comprehensive Income for the year ended 31 December

(Picture Following)

The tax rate was 30% for 2019 and 2020. No dividends have been declared or paid.

FVL has no items of other comprehensive income since the date of incorporation.

Required: Prepare the extracts on statement of changes in equity for 31 December 2020 of FVL to capture the adjustment of two errors.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps