Het income of the investment for each year. b. Compute the incremental cash flows of the investment for each year. c. Suppose the appropriate discount rate is 12 percent. What is the NPV of the project? 3. Calculating Project NPV Down Under Boomerang, Inc., is considering a new three- year expansion project that requires an initial fixed asset investment of $1.65 million. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which it will be worthless. The project is estimated to generate $1.24 million in annual sales, with costs of $485,000. The tax rate is 35 percent and the required return is 12 percent. What is the project's NPV? Calculating Project Cash Flow from Assets In the previous problem, suppose the project requires an initial investment in net working capital of $285,000 and the fixed asset will have a market value of $225,000 at the end of the project. What is the project's 4. Year O net cash flow? Year 1? Year 2? Year 3? What is the new NPV? NPV and Modified ACRS In the previous problem, suppose the fixed asset actually falls into the three-year MACRS class. All the other facts are the same. What is the project's Year 1 net cash flow now? Year 2? Year 3? What is the new NPV? 5. Project Evaluation computer-based order entry system. The system will be depreciated straight-line to zero over its five-year life. It will be worth $50,000 at the end of that time. You will save $186,000 before taxes per year in order processing costs, and you will be able to reduce working capital by $85,000 (this is a one-time reduction). If the tax rate is 35 percent, what is the IRR for this project? 6. Your firm is contemplating the purchase of a new $530,000 7. Project Evaluation Dog Up! Franks is looking at a new sausage system with an

Het income of the investment for each year. b. Compute the incremental cash flows of the investment for each year. c. Suppose the appropriate discount rate is 12 percent. What is the NPV of the project? 3. Calculating Project NPV Down Under Boomerang, Inc., is considering a new three- year expansion project that requires an initial fixed asset investment of $1.65 million. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which it will be worthless. The project is estimated to generate $1.24 million in annual sales, with costs of $485,000. The tax rate is 35 percent and the required return is 12 percent. What is the project's NPV? Calculating Project Cash Flow from Assets In the previous problem, suppose the project requires an initial investment in net working capital of $285,000 and the fixed asset will have a market value of $225,000 at the end of the project. What is the project's 4. Year O net cash flow? Year 1? Year 2? Year 3? What is the new NPV? NPV and Modified ACRS In the previous problem, suppose the fixed asset actually falls into the three-year MACRS class. All the other facts are the same. What is the project's Year 1 net cash flow now? Year 2? Year 3? What is the new NPV? 5. Project Evaluation computer-based order entry system. The system will be depreciated straight-line to zero over its five-year life. It will be worth $50,000 at the end of that time. You will save $186,000 before taxes per year in order processing costs, and you will be able to reduce working capital by $85,000 (this is a one-time reduction). If the tax rate is 35 percent, what is the IRR for this project? 6. Your firm is contemplating the purchase of a new $530,000 7. Project Evaluation Dog Up! Franks is looking at a new sausage system with an

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 13E: Buena Vision Clinic is considering an investment that requires an outlay of 600,000 and promises a...

Related questions

Question

100%

Hello, It is a three part question. However, I would like to know how the amount of 122, 265, was calculated in the solution provided for the book.

See attachment

Transcribed Image Text:Het income of the investment for each year.

b. Compute the incremental cash flows of the investment for each year.

c. Suppose the appropriate discount rate is 12 percent. What is the NPV of the

project?

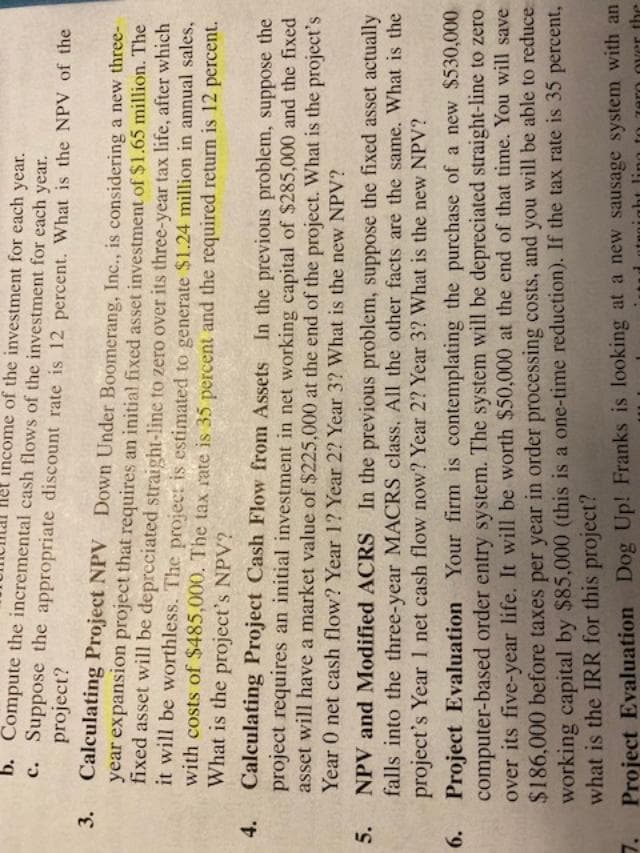

3. Calculating Project NPV

Down Under Boomerang, Inc., is considering a new three-

year expansion project that requires an initial fixed asset investment of $1.65 million. The

fixed asset will be depreciated straight-line to zero over its three-year tax life, after which

it will be worthless. The project is estimated to generate $1.24 million in annual sales,

with costs of $485,000. The tax rate is 35 percent and the required return is 12 percent.

What is the project's NPV?

Calculating Project Cash Flow from Assets In the previous problem, suppose the

project requires an initial investment in net working capital of $285,000 and the fixed

asset will have a market value of $225,000 at the end of the project. What is the project's

4.

Year O net cash flow? Year 1? Year 2? Year 3? What is the new NPV?

NPV and Modified ACRS In the previous problem, suppose the fixed asset actually

falls into the three-year MACRS class. All the other facts are the same. What is the

project's Year 1 net cash flow now? Year 2? Year 3? What is the new NPV?

5.

Project Evaluation

computer-based order entry system. The system will be depreciated straight-line to zero

over its five-year life. It will be worth $50,000 at the end of that time. You will save

$186,000 before taxes per year in order processing costs, and you will be able to reduce

working capital by $85,000 (this is a one-time reduction). If the tax rate is 35 percent,

what is the IRR for this project?

6.

Your firm is contemplating the purchase of a new $530,000

7.

Project Evaluation Dog Up! Franks is looking at a new sausage system with an

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning