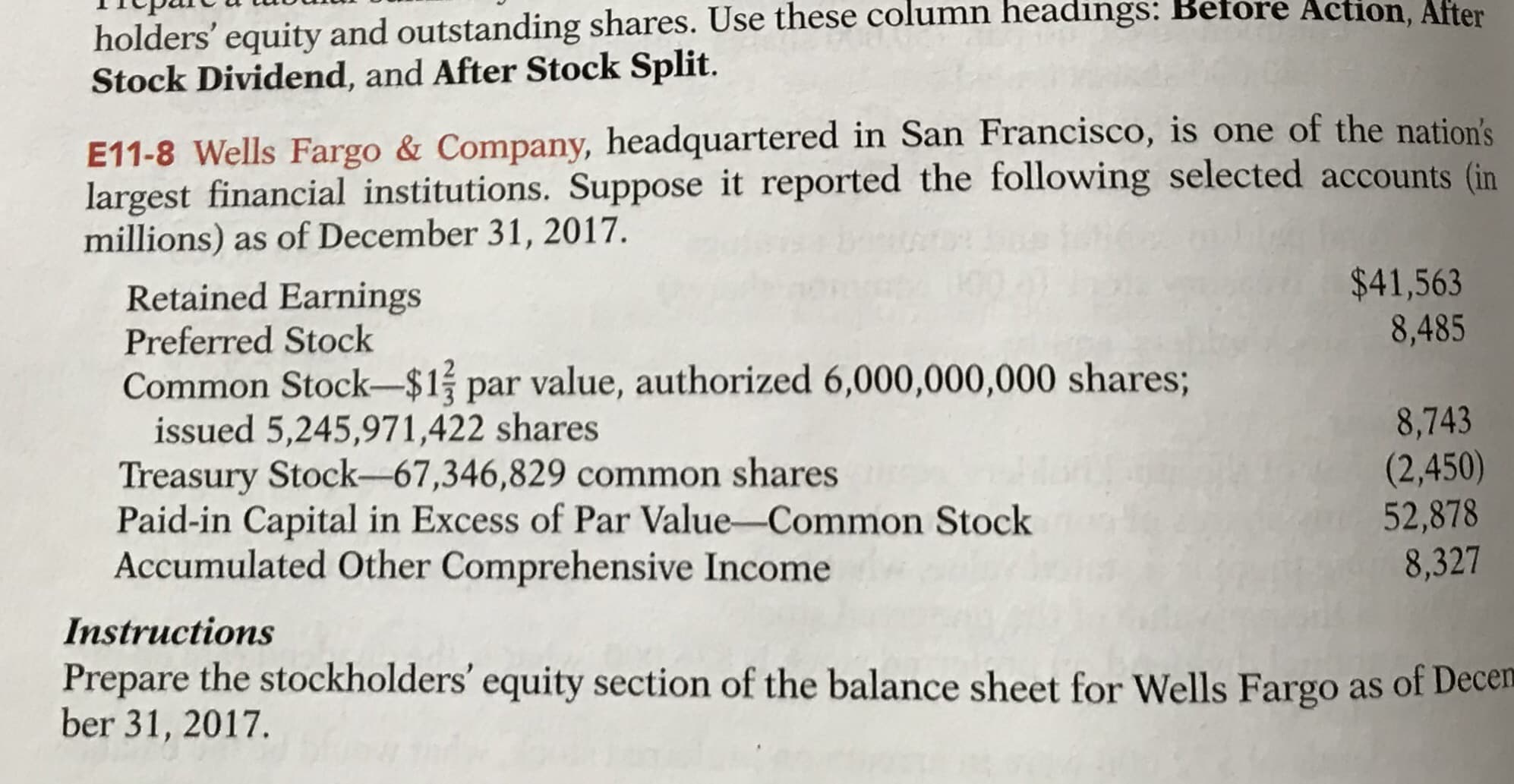

holders' equity and outstanding shares. Use these column headings: Before Action, After Stock Dividend, and After Stock Split. E11-8 Wells Fargo & Company, headquartered in San Francisco, is one of the nation's largest financial institutions. Suppose it reported the following selected accounts (in millions) as of December 31, 2017. $41,563 8,485 Retained Earnings Preferred Stock Common Stock-$1 par value, authorized 6,000,000,000 shares; issued 5,245,971,422 shares Treasury Stock-67,346,829 common shares Paid-in Capital in Excess of Par Value-Common Stock Accumulated Other Comprehensive Income 8,743 (2,450) 52,878 8,327 Instructions Prepare the stockholders' equity section of the balance sheet for Wells Fargo as of Decen ber 31, 2017.

holders' equity and outstanding shares. Use these column headings: Before Action, After Stock Dividend, and After Stock Split. E11-8 Wells Fargo & Company, headquartered in San Francisco, is one of the nation's largest financial institutions. Suppose it reported the following selected accounts (in millions) as of December 31, 2017. $41,563 8,485 Retained Earnings Preferred Stock Common Stock-$1 par value, authorized 6,000,000,000 shares; issued 5,245,971,422 shares Treasury Stock-67,346,829 common shares Paid-in Capital in Excess of Par Value-Common Stock Accumulated Other Comprehensive Income 8,743 (2,450) 52,878 8,327 Instructions Prepare the stockholders' equity section of the balance sheet for Wells Fargo as of Decen ber 31, 2017.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter11: Stockholders' Equity

Section: Chapter Questions

Problem 11.13E

Related questions

Question

E11-8

Transcribed Image Text:holders' equity and outstanding shares. Use these column headings: Before Action, After

Stock Dividend, and After Stock Split.

E11-8 Wells Fargo & Company, headquartered in San Francisco, is one of the nation's

largest financial institutions. Suppose it reported the following selected accounts (in

millions) as of December 31, 2017.

$41,563

8,485

Retained Earnings

Preferred Stock

Common Stock-$1 par value, authorized 6,000,000,000 shares;

issued 5,245,971,422 shares

Treasury Stock-67,346,829 common shares

Paid-in Capital in Excess of Par Value-Common Stock

Accumulated Other Comprehensive Income

8,743

(2,450)

52,878

8,327

Instructions

Prepare the stockholders' equity section of the balance sheet for Wells Fargo as of Decen

ber 31, 2017.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning