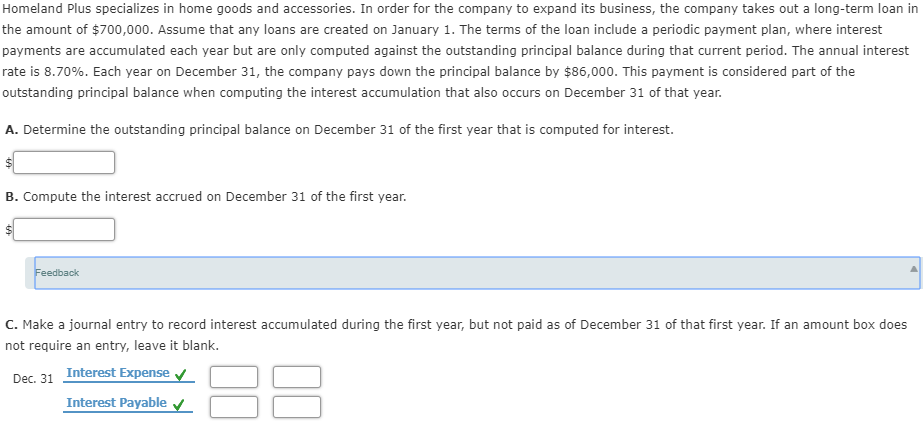

Homeland Plus specializes in home goods and accessories. In order for the company to expand its business, the company takes out a long-term loan in the amount of $700,000. Assume that any loans are created on January 1. The terms of the loan include a periodic payment plan, where interest payments are accumulated each year but are only computed against the outstanding principal balance during that current period. The annual interest rate is 8.70%. Each year on December 31, the company pays down the principal balance by $86,000. This payment is considered part of the outstanding principal balance when computing the interest accumulation that also occurs on December 31 of that year. A. Determine the outstanding principal balance on December 31 of the first year that is computed for interest. $1 B. Compute the interest accrued on December 31 of the first year. Feedback C. Make a journal entry to record interest accumulated during the first year, but not paid as of December 31 of that first year. If an amount box does not require an entry, leave it blank. Interest Expense v Interest Payable v Dec. 31

Homeland Plus specializes in home goods and accessories. In order for the company to expand its business, the company takes out a long-term loan in the amount of $700,000. Assume that any loans are created on January 1. The terms of the loan include a periodic payment plan, where interest payments are accumulated each year but are only computed against the outstanding principal balance during that current period. The annual interest rate is 8.70%. Each year on December 31, the company pays down the principal balance by $86,000. This payment is considered part of the outstanding principal balance when computing the interest accumulation that also occurs on December 31 of that year. A. Determine the outstanding principal balance on December 31 of the first year that is computed for interest. $1 B. Compute the interest accrued on December 31 of the first year. Feedback C. Make a journal entry to record interest accumulated during the first year, but not paid as of December 31 of that first year. If an amount box does not require an entry, leave it blank. Interest Expense v Interest Payable v Dec. 31

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 7EA: Homeland Plus specializes in home goods and accessories. In order for the company to expand its...

Related questions

Question

Transcribed Image Text:Homeland Plus specializes in home goods and accessories. In order for the company to expand its business, the company takes out a long-term loan in

the amount of $700,000. Assume that any loans are created on January 1. The terms of the loan include a periodic payment plan, where interest

payments are accumulated each year but are only computed against the outstanding principal balance during that current period. The annual interest

rate is 8.70%. Each year on December 31, the company pays down the principal balance by $86,000. This payment is considered part of the

outstanding principal balance when computing the interest accumulation that also occurs on December 31 of that year.

A. Determine the outstanding principal balance on December 31 of the first year that is computed for interest.

$1

B. Compute the interest accrued on December 31 of the first year.

Feedback

C. Make a journal entry to record interest accumulated during the first year, but not paid as of December 31 of that first year. If an amount box does

not require an entry, leave it blank.

Interest Expense v

Interest Payable v

Dec. 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning