How much in dividends were paid to shareholders during the year? Assume that In its most recent financial statements, Newhouse Inc. reported P50 million of net income and PS10 million of retained earnings. The previous retained earnings were P780 million. Required: all dividends declared were actually paid.

How much in dividends were paid to shareholders during the year? Assume that In its most recent financial statements, Newhouse Inc. reported P50 million of net income and PS10 million of retained earnings. The previous retained earnings were P780 million. Required: all dividends declared were actually paid.

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 1BCRQ

Related questions

Question

Help me answer this ty

Transcribed Image Text:How much in dividends were paid to shareholders during the year? Assume that

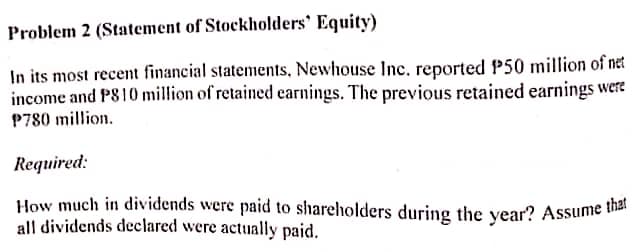

Problem 2 (Statement of Stockholders' Equity)

In its most recent financial statements, Newhouse Inc. reported P50 million of net

income and PS10 million of retained earnings. The previous retained earnings were

P780 million.

Required:

all dividends declared were actually paid.

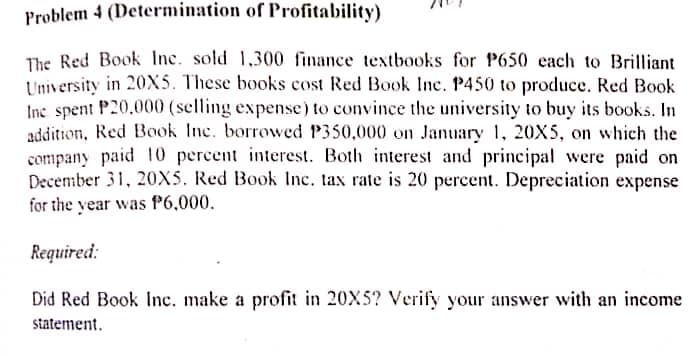

Transcribed Image Text:Problem 4 (Determination of Profitability)

The Red Book Inc. sold 1,300 finance textbooks for P650 each to Brilliant

University in 20X5. These books cost Red Book Inc. P450 to produce. Red Book

Inc spent P20,000 (selling expense) to convince the university to buy its books. In

addition, Red Book Inc. borrowed P350,000 on January 1, 20X5, on which the

company paid 10 percent interest. Both interest and principal were paid on

December 31, 20X5. Red Book Inc. tax rate is 20 percent. Depreciation expense

for the year was P6,000.

Required:

Did Red Book Inc. make a profit in 20X5? Verify your answer with an income

statement.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College