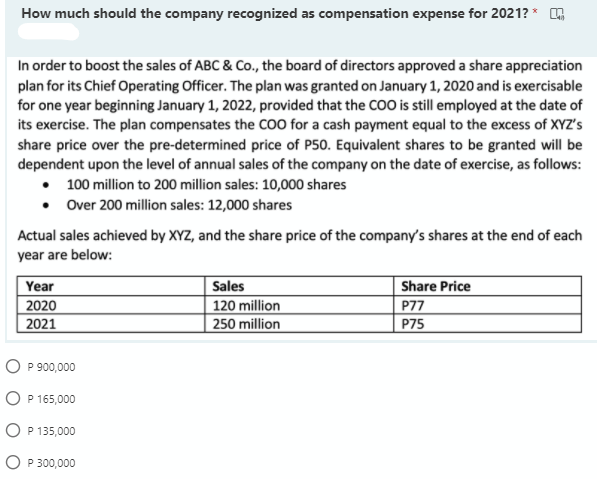

How much should the company recognized as compensation expense for 2021? * In order to boost the sales of ABC & Co., the board of directors approved a share appreciation plan for its Chief Operating Officer. The plan was granted on January 1, 2020 and is exercisable for one year beginning January 1, 2022, provided that the COO is still employed at the date of its exercise. The plan compensates the COO for a cash payment equal to the excess of XYZ's share price over the pre-determined price of P50. Equivalent shares to be granted will be dependent upon the level of annual sales of the company on the date of exercise, as follows: • 100 million to 200 million sales: 10,000 shares • Over 200 million sales: 12,000 shares Actual sales achieved by XYZ, and the share price of the company's shares at the end of each year are below: Share Price Sales | 120 million 250 million Year 2020 2021 P77 P75 O P 900,000 O P 165,000 O P 135,000 O P 300,000

How much should the company recognized as compensation expense for 2021? * In order to boost the sales of ABC & Co., the board of directors approved a share appreciation plan for its Chief Operating Officer. The plan was granted on January 1, 2020 and is exercisable for one year beginning January 1, 2022, provided that the COO is still employed at the date of its exercise. The plan compensates the COO for a cash payment equal to the excess of XYZ's share price over the pre-determined price of P50. Equivalent shares to be granted will be dependent upon the level of annual sales of the company on the date of exercise, as follows: • 100 million to 200 million sales: 10,000 shares • Over 200 million sales: 12,000 shares Actual sales achieved by XYZ, and the share price of the company's shares at the end of each year are below: Share Price Sales | 120 million 250 million Year 2020 2021 P77 P75 O P 900,000 O P 165,000 O P 135,000 O P 300,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter19: Accounting For Post Retirement Benefits

Section: Chapter Questions

Problem 7P

Related questions

Question

26

Transcribed Image Text:How much should the company recognized as compensation expense for 2021? * G

In order to boost the sales of ABC & Co., the board of directors approved a share appreciation

plan for its Chief Operating Officer. The plan was granted on January 1, 2020 and is exercisable

for one year beginning January 1, 2022, provided that the COO is still employed at the date of

its exercise. The plan compensates the COO for a cash payment equal to the excess of XYZ's

share price over the pre-determined price of P50. Equivalent shares to be granted will be

dependent upon the level of annual sales of the company on the date of exercise, as follows:

• 100 million to 200 million sales: 10,000 shares

• Over 200 million sales: 12,000 shares

Actual sales achieved by XYZ, and the share price of the company's shares at the end of each

year are below:

Year

Share Price

P77

Sales

120 million

250 million

2020

2021

P75

O P 900,000

O P 165,000

O P 135,000

O P 300,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT