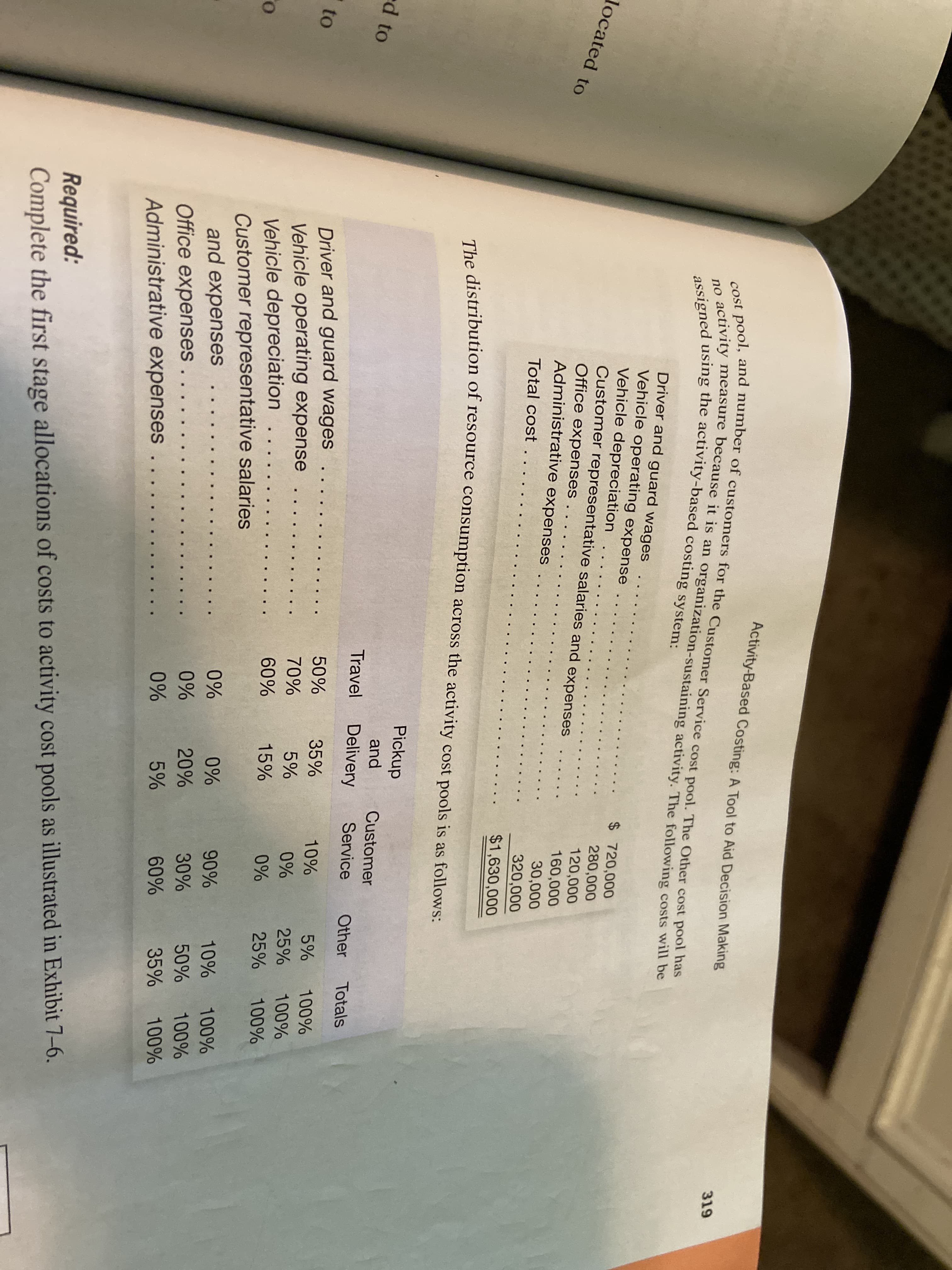

I, product-level. UuICn-ievel, Requiled! Classify each of the activities above as either à organization-sustaining activity. umt-1CVCI, , EXERCISE 7-2 First Stage Allocation [LO7-2] SecuriCorp operates a fleet of armored cars that make scheduled pickups and deliveriese :n Angeles area. The company is implementing an activity-based costing system that has four actin. ity cost pools: Travel, Pickup and Delivery, Customer Service, and Other. The activity measures are miles for the Travel cost pool, number of pickups and deliveries for the Pickup and Deliven Activity-Based Costing: A Tool to Aid Decision Making cost pool, and number of customers for the Customer Service cost pool. The Other cost pool has activity measure because it is an organization-sustaining activity. The following costs will be 319 assigned using the activity-based costing system: Driver and guard wages Vehicle operating expense Vehicle depreciation Customer representative salaries and expenses $ 720,000 280,000 120,000 160,000 30,000 located to Office expenses . . . . Administrative expenses Total cost .. 320,000 $1,630,000 The distribution of resource consumption across the activity cost pools is as follows: Pickup and Customer d to Travel Delivery Service Other Totals Driver and guard wages Vehicle operating expense Vehicle depreciation .. .. Customer representative salaries and expenses 50% 35% 10% 5% 100% to 70% 5% 0% 25% 100% 60% 15% 0% 25% 100% 0% 0% 90% 10% 100% 100% .. 0% 20% 30% 50% Office expenses .. Administrative expenses 0% 5% 60% 35% 100% Required: Complete the first stage allocations of costs to activity cost pools as illustrated in Exhibit 7-6.

I, product-level. UuICn-ievel, Requiled! Classify each of the activities above as either à organization-sustaining activity. umt-1CVCI, , EXERCISE 7-2 First Stage Allocation [LO7-2] SecuriCorp operates a fleet of armored cars that make scheduled pickups and deliveriese :n Angeles area. The company is implementing an activity-based costing system that has four actin. ity cost pools: Travel, Pickup and Delivery, Customer Service, and Other. The activity measures are miles for the Travel cost pool, number of pickups and deliveries for the Pickup and Deliven Activity-Based Costing: A Tool to Aid Decision Making cost pool, and number of customers for the Customer Service cost pool. The Other cost pool has activity measure because it is an organization-sustaining activity. The following costs will be 319 assigned using the activity-based costing system: Driver and guard wages Vehicle operating expense Vehicle depreciation Customer representative salaries and expenses $ 720,000 280,000 120,000 160,000 30,000 located to Office expenses . . . . Administrative expenses Total cost .. 320,000 $1,630,000 The distribution of resource consumption across the activity cost pools is as follows: Pickup and Customer d to Travel Delivery Service Other Totals Driver and guard wages Vehicle operating expense Vehicle depreciation .. .. Customer representative salaries and expenses 50% 35% 10% 5% 100% to 70% 5% 0% 25% 100% 60% 15% 0% 25% 100% 0% 0% 90% 10% 100% 100% .. 0% 20% 30% 50% Office expenses .. Administrative expenses 0% 5% 60% 35% 100% Required: Complete the first stage allocations of costs to activity cost pools as illustrated in Exhibit 7-6.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter7: Allocating Costs Of Support Departments And Joint Products

Section: Chapter Questions

Problem 23E: Refer to the data in Exercise 7.22. The company has decided to simplify its method of allocating...

Related questions

Question

7-2

![I, product-level.

UuICn-ievel,

Requiled!

Classify each of the activities above as either à

organization-sustaining activity.

umt-1CVCI,

,

EXERCISE 7-2 First Stage Allocation [LO7-2]

SecuriCorp operates a fleet of armored cars that make scheduled pickups and deliveriese :n

Angeles area. The company is implementing an activity-based costing system that has four actin.

ity cost pools: Travel, Pickup and Delivery, Customer Service, and Other. The activity measures

are miles for the Travel cost pool, number of pickups and deliveries for the Pickup and Deliven](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F85e39e9b-3b6a-4fb6-8406-b63a567ff03b%2F4a5c8e23-2af8-4620-a5aa-28421f979059%2Fq7all4b.jpeg&w=3840&q=75)

Transcribed Image Text:I, product-level.

UuICn-ievel,

Requiled!

Classify each of the activities above as either à

organization-sustaining activity.

umt-1CVCI,

,

EXERCISE 7-2 First Stage Allocation [LO7-2]

SecuriCorp operates a fleet of armored cars that make scheduled pickups and deliveriese :n

Angeles area. The company is implementing an activity-based costing system that has four actin.

ity cost pools: Travel, Pickup and Delivery, Customer Service, and Other. The activity measures

are miles for the Travel cost pool, number of pickups and deliveries for the Pickup and Deliven

Transcribed Image Text:Activity-Based Costing: A Tool to Aid Decision Making

cost pool, and number of customers for the Customer Service cost pool. The Other cost pool has

activity measure because it is an organization-sustaining activity. The following costs will be

319

assigned using the activity-based costing system:

Driver and guard wages

Vehicle operating expense

Vehicle depreciation

Customer representative salaries and expenses

$ 720,000

280,000

120,000

160,000

30,000

located to

Office expenses . . . .

Administrative expenses

Total cost ..

320,000

$1,630,000

The distribution of resource consumption across the activity cost pools is as follows:

Pickup

and

Customer

d to

Travel

Delivery

Service

Other

Totals

Driver and guard wages

Vehicle operating expense

Vehicle depreciation .. ..

Customer representative salaries

and expenses

50%

35%

10%

5%

100%

to

70%

5%

0%

25%

100%

60%

15%

0%

25%

100%

0%

0%

90%

10%

100%

100%

..

0%

20%

30%

50%

Office expenses ..

Administrative expenses

0%

5%

60%

35%

100%

Required:

Complete the first stage allocations of costs to activity cost pools as illustrated in Exhibit 7-6.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning