If Growth Industries is operating at only 75% of capacity, how much can sales grow before the firm will need to raise any external funds? Assume that once fixed assets are operating at capacity, they will need to grow thereafter in direct proportion to sales. (Do not round Intermediate calculations. Round your final answers to the nearest whole dollar amount.)

If Growth Industries is operating at only 75% of capacity, how much can sales grow before the firm will need to raise any external funds? Assume that once fixed assets are operating at capacity, they will need to grow thereafter in direct proportion to sales. (Do not round Intermediate calculations. Round your final answers to the nearest whole dollar amount.)

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 103.4C

Related questions

Question

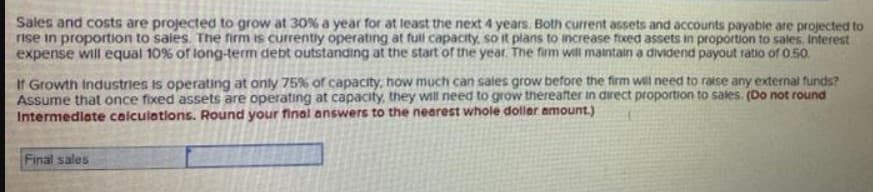

Transcribed Image Text:Sales and costs are projected to grow at 30% a year for at least the next 4 years. Both current assets and accounts payable are projected to

rise in proportion to sales. The firm is currently operating at full capacity, so it plans to increase fixed assets in proportion to sales. Interest

expense will equal 10% of long-term debt outstanding at the start of the year. The firm will maintain a dividend payout ratio of 0.50.

If Growth Industries is operating at only 75% of capacity, how much can sales grow before the firm will need to raise any external funds?

Assume that once fixed assets are operating at capacity, they will need to grow thereafter in direct proportion to sales. (Do not round

Intermediate calculations. Round your final answers to the nearest whole dollar amount.)

Final sales

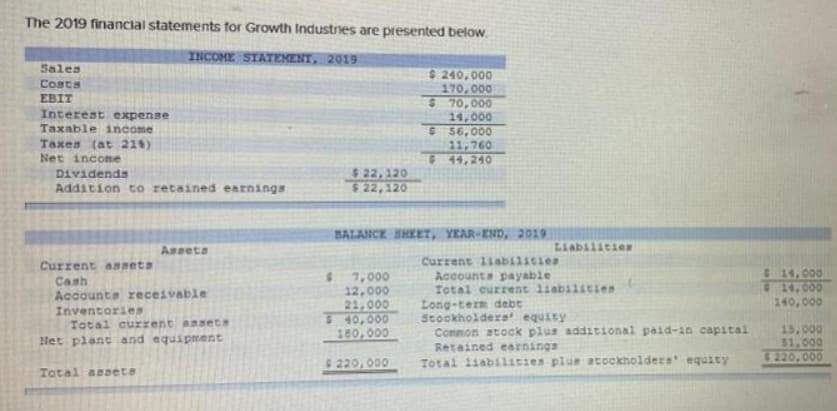

Transcribed Image Text:The 2019 financial statements for Growth Industries are presented below.

INCOME STATEMENT, 2019

Sales

Costs

EBIT

Interest expense

Taxable income

Taxes (at 216)

Net income

Dividends

Addition to retained earnings

Current assets

Cash

Assets

Accounts receivable

Inventories

Total current assets

Net plant and equipment

Total assets

$22,120

$22,120

$ 240,000

170,000

$70,000

14,000

$ 56,000

11,760

G44,240

BALANCE SHEET, YEAR-END, 2019

7,000

12,000

21,000

$ 40,000

180,000

220,000

Liabilities

Current liabilities

Accounts payable

Total current liabilities

Long-term debt

Stockholders' equity

Common stock plus additional paid-in capital

Retained earnings

Total liabilities plus stockholders' equity

14,000

14,000

140,000

15,000

$1,000

$220,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning